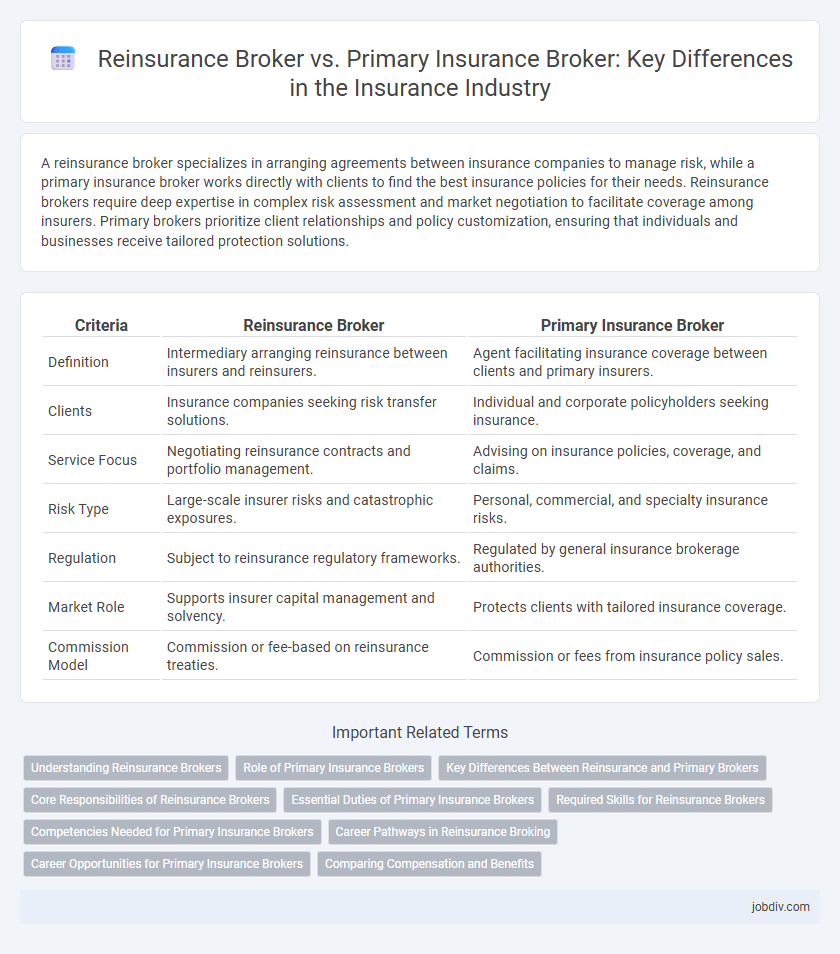

A reinsurance broker specializes in arranging agreements between insurance companies to manage risk, while a primary insurance broker works directly with clients to find the best insurance policies for their needs. Reinsurance brokers require deep expertise in complex risk assessment and market negotiation to facilitate coverage among insurers. Primary brokers prioritize client relationships and policy customization, ensuring that individuals and businesses receive tailored protection solutions.

Table of Comparison

| Criteria | Reinsurance Broker | Primary Insurance Broker |

|---|---|---|

| Definition | Intermediary arranging reinsurance between insurers and reinsurers. | Agent facilitating insurance coverage between clients and primary insurers. |

| Clients | Insurance companies seeking risk transfer solutions. | Individual and corporate policyholders seeking insurance. |

| Service Focus | Negotiating reinsurance contracts and portfolio management. | Advising on insurance policies, coverage, and claims. |

| Risk Type | Large-scale insurer risks and catastrophic exposures. | Personal, commercial, and specialty insurance risks. |

| Regulation | Subject to reinsurance regulatory frameworks. | Regulated by general insurance brokerage authorities. |

| Market Role | Supports insurer capital management and solvency. | Protects clients with tailored insurance coverage. |

| Commission Model | Commission or fee-based on reinsurance treaties. | Commission or fees from insurance policy sales. |

Understanding Reinsurance Brokers

Reinsurance brokers specialize in placing insurance risks from primary insurers with reinsurers, facilitating risk diversification and capital management. They possess expert knowledge of reinsurance markets, contract structures, and pricing strategies, ensuring optimal coverage for insurers' portfolios. Unlike primary insurance brokers who work directly with policyholders, reinsurance brokers operate between insurance companies, coordinating complex risk transfers.

Role of Primary Insurance Brokers

Primary insurance brokers act as intermediaries between clients and insurance companies, securing coverage tailored to individual or business risks. They assess client needs, explain policy options, and facilitate premium negotiations to ensure optimal protection. Their role centers on client relationship management, risk analysis, and delivering personalized insurance solutions without direct engagement in risk transfer like reinsurance brokers.

Key Differences Between Reinsurance and Primary Brokers

Reinsurance brokers specialize in placing risk coverage between primary insurers and reinsurance companies, focusing on large-scale risk transfer and financial stability for insurers. Primary insurance brokers work directly with policyholders to secure the best coverage options and pricing for personal or commercial insurance needs. The key differences lie in their client base, with reinsurance brokers operating between insurers and reinsurers, while primary brokers serve individual or business policyholders.

Core Responsibilities of Reinsurance Brokers

Reinsurance brokers specialize in facilitating risk transfer between primary insurers and reinsurers, ensuring optimal coverage and terms for complex or large-scale risks. They analyze insurance portfolios, negotiate treaty and facultative reinsurance contracts, and provide market insights to improve risk management strategies. Their core responsibilities include risk placement, claims advocacy, and maintaining strong relationships across global reinsurance markets.

Essential Duties of Primary Insurance Brokers

Primary insurance brokers play a crucial role in assessing clients' insurance needs, identifying suitable policies from various insurers, and providing expert advice to ensure optimal coverage. They facilitate policy placement, manage renewals, and assist with claims processing to ensure clients receive appropriate financial protection. Primary brokers maintain ongoing client relationships, monitor market trends, and help negotiate terms to achieve cost-effective insurance solutions.

Required Skills for Reinsurance Brokers

Reinsurance brokers require advanced analytical skills and deep expertise in risk assessment to structure complex reinsurance treaties effectively. Proficiency in market knowledge, negotiation, and regulatory compliance is essential for navigating global reinsurance markets and securing optimal terms. Strong communication and relationship management skills enable reinsurance brokers to liaise between insurers and reinsurers, ensuring seamless risk transfer and portfolio management.

Competencies Needed for Primary Insurance Brokers

Primary insurance brokers require strong competencies in risk assessment, regulatory compliance, and client relationship management to effectively tailor insurance policies to individual client needs. Proficiency in underwriting processes and a deep understanding of insurance products enable primary brokers to advise clients accurately and secure optimal coverage. Effective communication skills and market knowledge are essential for negotiating terms and ensuring policy clarity between clients and insurers.

Career Pathways in Reinsurance Broking

Career pathways in reinsurance broking typically involve specialized knowledge of risk transfer, treaty structuring, and global market dynamics, offering professionals opportunities to work with large-scale clients and complex portfolios. Compared to primary insurance brokers who focus on retail or commercial risks directly with policyholders, reinsurance brokers negotiate between insurance companies and reinsurers, requiring deep analytical skills and expertise in the reinsurance market. Progression in reinsurance broking can lead to roles such as senior placement broker, underwriting advisor, or client relationship manager, emphasizing strategic risk management and international business acumen.

Career Opportunities for Primary Insurance Brokers

Career opportunities for primary insurance brokers are expanding rapidly as they specialize in client risk assessment, policy placement, and claims management in diverse sectors such as health, property, and commercial insurance. These brokers develop strong relationships with individual and corporate clients, utilizing in-depth knowledge of insurance products to tailor coverage solutions that address specific client needs and regulatory requirements. Expertise in market trends, customer service, and negotiation skills positions primary insurance brokers for advancement into senior sales roles, underwriting collaboration, and leadership within insurance firms.

Comparing Compensation and Benefits

Reinsurance brokers typically earn commissions based on the volume and complexity of reinsurance treaties negotiated, often enjoying higher compensation due to specialized expertise and large transaction values. Primary insurance brokers receive commissions linked to policy premiums sold to individual or corporate clients, with benefits structured around sales targets and client retention. Compensation for reinsurance brokers includes performance bonuses and profit-sharing tied to risk management success, whereas primary brokers may focus more on volume-driven incentives and client service rewards.

Reinsurance Broker vs Primary Insurance Broker Infographic

jobdiv.com

jobdiv.com