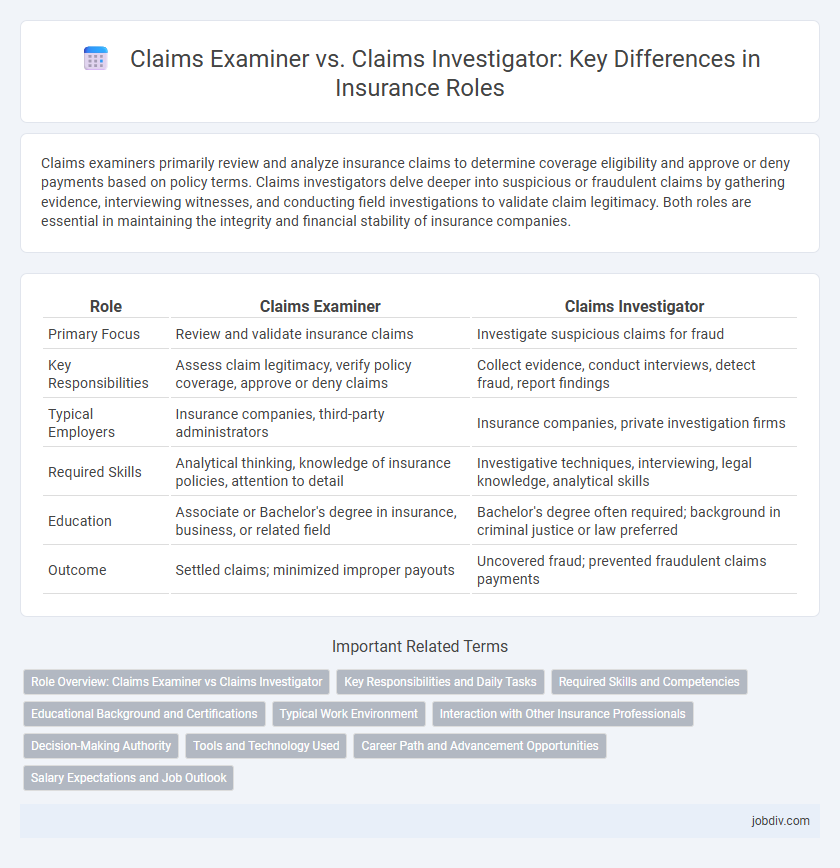

Claims examiners primarily review and analyze insurance claims to determine coverage eligibility and approve or deny payments based on policy terms. Claims investigators delve deeper into suspicious or fraudulent claims by gathering evidence, interviewing witnesses, and conducting field investigations to validate claim legitimacy. Both roles are essential in maintaining the integrity and financial stability of insurance companies.

Table of Comparison

| Role | Claims Examiner | Claims Investigator |

|---|---|---|

| Primary Focus | Review and validate insurance claims | Investigate suspicious claims for fraud |

| Key Responsibilities | Assess claim legitimacy, verify policy coverage, approve or deny claims | Collect evidence, conduct interviews, detect fraud, report findings |

| Typical Employers | Insurance companies, third-party administrators | Insurance companies, private investigation firms |

| Required Skills | Analytical thinking, knowledge of insurance policies, attention to detail | Investigative techniques, interviewing, legal knowledge, analytical skills |

| Education | Associate or Bachelor's degree in insurance, business, or related field | Bachelor's degree often required; background in criminal justice or law preferred |

| Outcome | Settled claims; minimized improper payouts | Uncovered fraud; prevented fraudulent claims payments |

Role Overview: Claims Examiner vs Claims Investigator

Claims Examiners analyze insurance claims to assess their validity, review policy coverage, and determine appropriate payouts based on contract terms and documentation. Claims Investigators focus on gathering detailed information, conducting interviews, and verifying facts to detect fraudulent claims or discrepancies in the reported incidents. Both roles are essential in managing risk and ensuring accurate, fair claim settlements within the insurance industry.

Key Responsibilities and Daily Tasks

Claims Examiners primarily review insurance claims to determine coverage validity and ensure compliance with policy terms by analyzing documents, medical records, and claim information. Claims Investigators conduct thorough investigations to detect fraud or misrepresentation, often performing interviews, site visits, and background checks. Both roles collaborate with adjusters and legal teams to resolve discrepancies and expedite claim settlements efficiently.

Required Skills and Competencies

Claims Examiners require strong analytical skills to evaluate insurance claims accurately, proficiency in medical and legal terminology, and attention to detail for verifying policy coverage and claim validity. Claims Investigators need investigative skills, including interviewing witnesses, gathering evidence, and assessing fraud risk, along with knowledge of insurance laws and strong critical thinking abilities. Both roles demand effective communication skills and the ability to work with complex documentation to ensure proper claims handling.

Educational Background and Certifications

Claims Examiners typically hold a bachelor's degree in fields such as insurance, business administration, or finance, with certifications like the Certified Claims Adjuster (CCA) enhancing their qualifications. Claims Investigators often possess a background in criminal justice or law enforcement, complemented by certifications such as the Associate Certified Fraud Examiner (ACFE) credential to specialize in fraud detection. Both roles require industry-specific knowledge, but the educational emphasis for Examiners leans towards insurance principles, while Investigators focus more on investigative techniques and legal compliance.

Typical Work Environment

Claims Examiners typically work in office settings within insurance companies, focusing on reviewing and evaluating insurance claims for accuracy and compliance. Claims Investigators often operate both in-office and on-site, visiting homes, accident scenes, or businesses to gather evidence and verify claim details. Both roles require strong analytical skills but differ in their balance of remote fieldwork versus desk-based tasks.

Interaction with Other Insurance Professionals

Claims Examiners collaborate closely with underwriters, adjusters, and medical professionals to evaluate policy coverage and validate claim legitimacy. Claims Investigators engage with law enforcement, legal experts, and surveillance teams to uncover fraud and gather detailed factual evidence. Both roles require effective communication skills to ensure accurate claim resolution and maintain coordination within the insurance claims process.

Decision-Making Authority

Claims Examiners possess decision-making authority to approve or deny insurance claims based on policy terms and evidence, facilitating efficient claims processing. Claims Investigators gather detailed information through interviews and research to uncover potential fraud or inconsistencies but typically do not have final approval powers. The collaboration between claims examiners and investigators ensures accurate claim evaluations and prevents fraudulent payouts.

Tools and Technology Used

Claims examiners primarily utilize claims management software, automated fraud detection systems, and database analytics tools to review and process insurance claims efficiently. Claims investigators employ advanced forensic technology, surveillance equipment, GPS tracking, and data mining software to verify the legitimacy of claims and identify potential fraud. Both roles leverage digital platforms and AI-driven algorithms to enhance accuracy and streamline claim evaluations within the insurance sector.

Career Path and Advancement Opportunities

Claims Examiners typically follow a structured career path within insurance companies, advancing through roles such as Senior Claims Examiner or Claims Manager by developing expertise in claims processing and policy interpretation. Claims Investigators often have specialized advancement opportunities, moving into roles like Senior Investigator or Fraud Specialist, leveraging skills in field investigations and evidence gathering. Both careers offer growth potential, but Claims Investigators may experience broader opportunities in fraud detection units or law enforcement collaboration.

Salary Expectations and Job Outlook

Claims Examiners typically earn an average salary ranging from $50,000 to $70,000 annually, while Claims Investigators can expect higher pay, often between $60,000 and $90,000 due to specialized investigative skills. The job outlook for Claims Examiners shows steady growth at around 5% through 2030, with demand driven by the need for efficient claims processing. Claims Investigators face a slightly faster growth rate near 7%, fueled by increasing fraud detection efforts and complex claim investigations in insurance companies.

Claims Examiner vs Claims Investigator Infographic

jobdiv.com

jobdiv.com