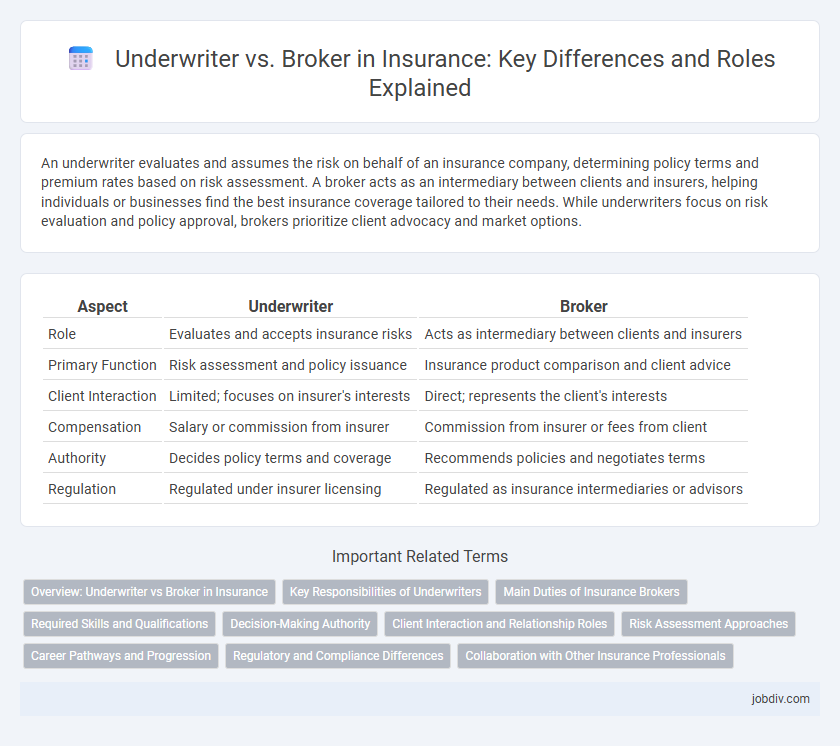

An underwriter evaluates and assumes the risk on behalf of an insurance company, determining policy terms and premium rates based on risk assessment. A broker acts as an intermediary between clients and insurers, helping individuals or businesses find the best insurance coverage tailored to their needs. While underwriters focus on risk evaluation and policy approval, brokers prioritize client advocacy and market options.

Table of Comparison

| Aspect | Underwriter | Broker |

|---|---|---|

| Role | Evaluates and accepts insurance risks | Acts as intermediary between clients and insurers |

| Primary Function | Risk assessment and policy issuance | Insurance product comparison and client advice |

| Client Interaction | Limited; focuses on insurer's interests | Direct; represents the client's interests |

| Compensation | Salary or commission from insurer | Commission from insurer or fees from client |

| Authority | Decides policy terms and coverage | Recommends policies and negotiates terms |

| Regulation | Regulated under insurer licensing | Regulated as insurance intermediaries or advisors |

Overview: Underwriter vs Broker in Insurance

Underwriters evaluate risks and determine the terms and premiums for insurance policies based on detailed assessments and actuarial data. Brokers act as intermediaries who represent clients, seeking the best coverage options from multiple insurers to meet specific needs. The distinction lies in underwriters setting policy conditions, while brokers facilitate client access to suitable insurance solutions.

Key Responsibilities of Underwriters

Underwriters in insurance assess risk by evaluating applications, medical records, and financial data to determine policy terms and premiums. They verify the accuracy of information provided, establish coverage limits, and decide policy acceptance or rejection based on risk analysis. Underwriters collaborate with actuaries and claims adjusters to ensure profitable underwriting and compliance with regulatory standards.

Main Duties of Insurance Brokers

Insurance brokers act as intermediaries between clients and insurance companies, analyzing clients' risks and advising on suitable coverage options tailored to individual needs. They negotiate policies on behalf of clients, ensuring competitive premiums and comprehensive protection. Brokers also assist with claims processing and provide ongoing support to maintain optimal insurance portfolios.

Required Skills and Qualifications

Underwriters require strong analytical skills, attention to detail, and expertise in risk assessment, often holding certifications such as CPCU or ARM. Brokers need excellent interpersonal communication, negotiation abilities, and comprehensive knowledge of insurance products, typically supported by licenses like the Insurance Producer License. Both roles demand proficiency in regulatory compliance and a deep understanding of industry-specific legal frameworks.

Decision-Making Authority

Underwriters possess decision-making authority to assess risk, set policy terms, and approve or deny insurance applications based on detailed analysis. Brokers act as intermediaries, advising clients and recommending policies but do not have the authority to make underwriting decisions or bind coverage. The distinction highlights underwriters' control over risk acceptance, while brokers focus on client representation and policy placement.

Client Interaction and Relationship Roles

Underwriters primarily evaluate risk and determine policy terms, engaging with clients indirectly through brokers rather than direct interaction. Brokers act as intermediaries who communicate client needs, provide personalized advice, and facilitate the acquisition of suitable insurance coverage. This client-facing role makes brokers essential in maintaining ongoing relationships, ensuring clear understanding and satisfaction.

Risk Assessment Approaches

Underwriters analyze risk by evaluating detailed data such as applicant history, claims records, and actuarial models to determine insurance premiums and policy terms. Brokers focus on assessing client-specific needs and market options, gathering risk-related information to find suitable coverage from multiple insurers. Both utilize risk assessment but underwriters emphasize quantifiable risk metrics while brokers prioritize personalized risk matching.

Career Pathways and Progression

Underwriters typically follow a career progression from junior analyst roles to senior underwriter and risk manager positions, emphasizing risk assessment and decision-making skills within insurance companies. Brokers advance by developing client relationships and sales expertise, moving from entry-level sales roles to senior broker or agency manager positions, often leveraging market knowledge to negotiate policies. Both career paths offer opportunities for specialization in areas like property, casualty, or life insurance, with continuous professional development driving advancement.

Regulatory and Compliance Differences

Underwriters operate under strict regulatory frameworks, ensuring risk assessment aligns with insurer guidelines and compliance mandates set by financial authorities such as the NAIC or FCA. Brokers, regulated as intermediaries, must adhere to regulatory requirements focused on transparency, disclosure, and fair client advice, governed by bodies like FINRA or the Prudential Regulation Authority. The regulatory distinction impacts liability, with underwriters accountable for policy terms and brokers responsible for accurate client representation and compliance with anti-money laundering (AML) and know-your-customer (KYC) laws.

Collaboration with Other Insurance Professionals

Underwriters and brokers collaborate closely to balance risk assessment with client needs, ensuring comprehensive insurance solutions. Brokers gather detailed client information and market insights, which underwriters use to evaluate and price risk accurately. This partnership enhances policy customization, strengthens risk management strategies, and improves overall claim handling efficiency.

Underwriter vs Broker Infographic

jobdiv.com

jobdiv.com