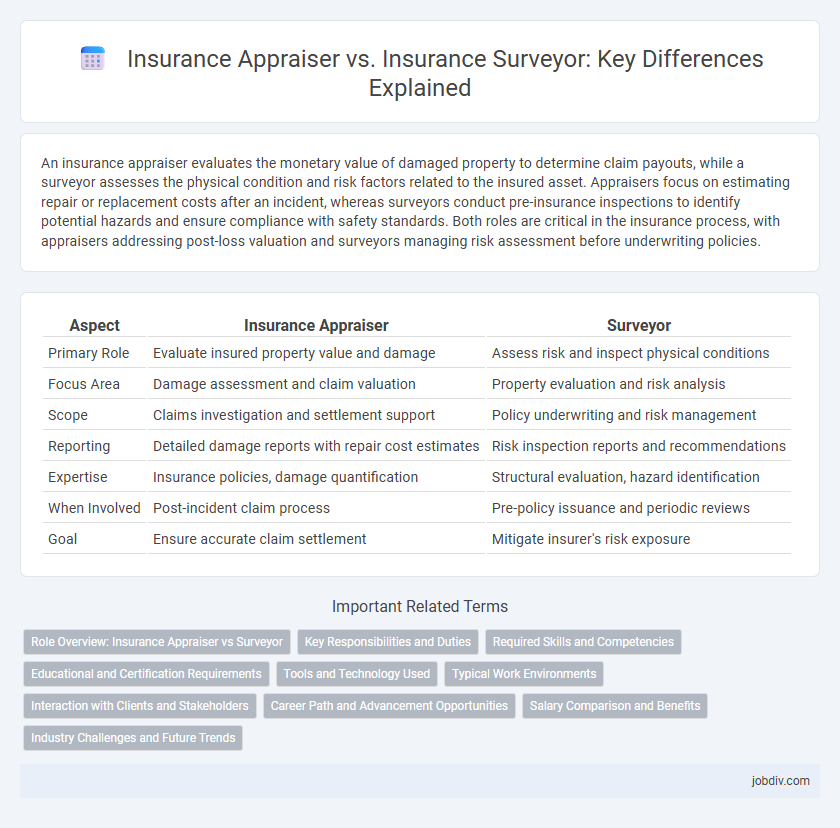

An insurance appraiser evaluates the monetary value of damaged property to determine claim payouts, while a surveyor assesses the physical condition and risk factors related to the insured asset. Appraisers focus on estimating repair or replacement costs after an incident, whereas surveyors conduct pre-insurance inspections to identify potential hazards and ensure compliance with safety standards. Both roles are critical in the insurance process, with appraisers addressing post-loss valuation and surveyors managing risk assessment before underwriting policies.

Table of Comparison

| Aspect | Insurance Appraiser | Surveyor |

|---|---|---|

| Primary Role | Evaluate insured property value and damage | Assess risk and inspect physical conditions |

| Focus Area | Damage assessment and claim valuation | Property evaluation and risk analysis |

| Scope | Claims investigation and settlement support | Policy underwriting and risk management |

| Reporting | Detailed damage reports with repair cost estimates | Risk inspection reports and recommendations |

| Expertise | Insurance policies, damage quantification | Structural evaluation, hazard identification |

| When Involved | Post-incident claim process | Pre-policy issuance and periodic reviews |

| Goal | Ensure accurate claim settlement | Mitigate insurer's risk exposure |

Role Overview: Insurance Appraiser vs Surveyor

An insurance appraiser evaluates the damage to insured property, determining repair costs and settlement amounts to aid claim processing. A surveyor inspects property conditions, assesses risks, and provides detailed reports used in underwriting and risk management decisions. Both roles are critical in the insurance industry for accurate valuation and risk assessment, but appraisers focus on post-loss evaluation while surveyors emphasize pre-insurance risk analysis.

Key Responsibilities and Duties

Insurance appraisers evaluate property damage and determine the value of claims to ensure accurate settlements. Surveyors inspect and assess risks related to property conditions, providing detailed reports that influence policy underwriting decisions. Both roles require expertise in damage assessment, but appraisers focus on claim valuation, while surveyors emphasize risk evaluation.

Required Skills and Competencies

Insurance appraisers require strong analytical skills to accurately assess damage costs and estimate claim values, along with expertise in property evaluation and negotiation. Surveyors must possess in-depth knowledge of property law, risk assessment, and regulatory compliance, supported by proficiency in data collection and report writing. Both roles demand excellent attention to detail, communication skills, and the ability to interpret technical documents for accurate insurance evaluations.

Educational and Certification Requirements

Insurance appraisers typically require a background in finance, insurance, or a related field, often holding certifications such as the Accredited Senior Appraiser (ASA) or Certified Insurance Appraiser (CIA). Surveyors in insurance usually possess technical training in engineering or property assessment, with certifications like the Chartered Property Casualty Underwriter (CPCU) or certifications from professional surveying bodies. Both roles demand ongoing education to stay current with industry regulations, valuation techniques, and insurance policies, ensuring accurate risk evaluation and claim settlements.

Tools and Technology Used

Insurance appraisers utilize advanced forensic software and mobile assessment apps to accurately evaluate vehicle or property damage, ensuring precise claim settlements. Surveyors employ geographic information systems (GIS), drones, and laser scanning technology for detailed land measurements, topographical analysis, and structural inspections. Both professionals integrate digital imaging tools and data analytics platforms to enhance accuracy and efficiency in risk assessment and valuation.

Typical Work Environments

Insurance appraisers typically work in office settings, examining claim details, assessing damages, and processing estimates for property or vehicle claims. Surveyors operate in the field, visiting sites to conduct inspections, measure land or property boundaries, and evaluate structural conditions to ensure accuracy in insurance policies. Both roles often collaborate with insurance companies, adjusters, and clients, but appraisers are more desk-focused while surveyors have extensive outdoor assignments.

Interaction with Clients and Stakeholders

Insurance appraisers focus on evaluating property or vehicle damage to determine claim values, interacting closely with clients and insurers to gather accurate information and explain assessment results. Surveyors primarily assess risks and property conditions prior to policy issuance, collaborating with underwriters, brokers, and clients to ensure comprehensive risk evaluation. Both professionals require strong communication skills to effectively coordinate with stakeholders and facilitate transparent decision-making in the insurance process.

Career Path and Advancement Opportunities

Insurance appraisers often begin their careers with a background in property inspection or claims adjustment, advancing by gaining certifications such as Certified Insurance Appraiser to handle complex damage assessments. Surveyors typically enter the field through education in civil engineering or land surveying, progressing by acquiring licenses like Professional Land Surveyor (PLS) to take on large-scale projects and regulatory compliance roles. Career advancement for appraisers centers on specialized damage evaluation and claim negotiation, while surveyors move toward leadership in project management and land development planning.

Salary Comparison and Benefits

Insurance appraisers typically earn a higher salary than surveyors due to their specialized role in assessing property damage and determining claim values, with average annual wages ranging from $50,000 to $70,000 compared to $40,000 to $60,000 for surveyors. Surveyors benefit from more consistent work schedules and opportunities in land assessment and mapping, while appraisers often receive variable pay linked to the volume of claims handled. Both roles include benefits such as health insurance, retirement plans, and opportunities for professional certification, but appraisers may have higher earning potential through bonuses and commissions.

Industry Challenges and Future Trends

Insurance appraisers face challenges in accurately assessing damages amid increasing claims complexity and fraud attempts, requiring advanced valuation techniques and technology integration. Surveyors encounter evolving regulatory standards and the need for comprehensive risk evaluations in diverse environments, pushing the adoption of digital tools and remote inspection methods. Future trends emphasize the use of AI-driven analysis, blockchain for transparent reporting, and enhanced collaboration between appraisers and surveyors to improve accuracy and efficiency in insurance claim processing.

Insurance Appraiser vs Surveyor Infographic

jobdiv.com

jobdiv.com