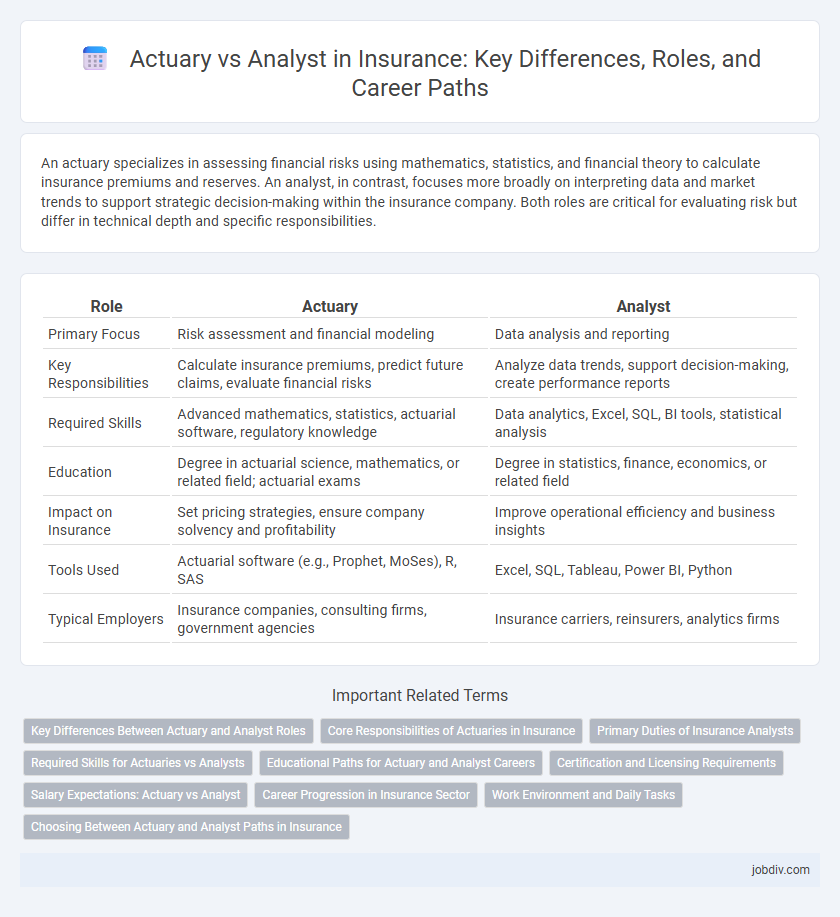

An actuary specializes in assessing financial risks using mathematics, statistics, and financial theory to calculate insurance premiums and reserves. An analyst, in contrast, focuses more broadly on interpreting data and market trends to support strategic decision-making within the insurance company. Both roles are critical for evaluating risk but differ in technical depth and specific responsibilities.

Table of Comparison

| Role | Actuary | Analyst |

|---|---|---|

| Primary Focus | Risk assessment and financial modeling | Data analysis and reporting |

| Key Responsibilities | Calculate insurance premiums, predict future claims, evaluate financial risks | Analyze data trends, support decision-making, create performance reports |

| Required Skills | Advanced mathematics, statistics, actuarial software, regulatory knowledge | Data analytics, Excel, SQL, BI tools, statistical analysis |

| Education | Degree in actuarial science, mathematics, or related field; actuarial exams | Degree in statistics, finance, economics, or related field |

| Impact on Insurance | Set pricing strategies, ensure company solvency and profitability | Improve operational efficiency and business insights |

| Tools Used | Actuarial software (e.g., Prophet, MoSes), R, SAS | Excel, SQL, Tableau, Power BI, Python |

| Typical Employers | Insurance companies, consulting firms, government agencies | Insurance carriers, reinsurers, analytics firms |

Key Differences Between Actuary and Analyst Roles

Actuaries specialize in risk assessment and financial modeling to determine insurance premiums and reserves, using advanced statistical methods and probability theory. Analysts focus on data collection, trend analysis, and reporting to support business decision-making, often using tools like Excel and SQL. The key difference lies in actuaries' emphasis on predictive modeling and regulatory compliance, while analysts prioritize data interpretation and operational efficiency.

Core Responsibilities of Actuaries in Insurance

Actuaries in insurance specialize in risk assessment by analyzing statistical data to calculate probabilities of events such as death, illness, or property loss. They develop pricing models, determine premium rates, and establish reserve funds to ensure the financial stability of insurance products. Their core responsibilities also include evaluating policyholder risks, forecasting future claims, and advising on risk management strategies to optimize profitability and solvency.

Primary Duties of Insurance Analysts

Insurance analysts primarily evaluate insurance policies, assess risk factors, and analyze data to guide underwriting decisions and pricing strategies. They collect and interpret quantitative data to forecast trends and financial outcomes, supporting the development of competitive insurance products. Unlike actuaries who focus on complex statistical modeling and risk prediction, analysts concentrate on operational efficiency and market analysis to optimize insurance portfolio performance.

Required Skills for Actuaries vs Analysts

Actuaries require strong expertise in mathematics, statistics, and financial theory to evaluate risk and model insurance scenarios accurately. Analysts typically need proficiency in data analysis, reporting tools, and business acumen to interpret data trends and support decision-making. Advanced programming skills, such as proficiency in R, Python, or SAS, are increasingly essential for both roles, but actuaries focus more on predictive modeling while analysts emphasize descriptive analytics.

Educational Paths for Actuary and Analyst Careers

Actuary careers typically require a strong foundation in mathematics, statistics, and actuarial science, often obtained through a bachelor's degree in actuarial science, mathematics, or economics, followed by passing a series of professional actuarial exams administered by institutions such as the Society of Actuaries (SOA) or Casualty Actuarial Society (CAS). Analyst roles in insurance commonly demand degrees in finance, business administration, economics, or data analytics, with an emphasis on developing skills in data interpretation, financial modeling, and statistical software. Continuous professional development is crucial for both paths, but actuaries follow a more rigorous exam-based certification process that directly impacts their career advancement and specialization in risk assessment.

Certification and Licensing Requirements

Actuaries typically require certification from professional bodies such as the Society of Actuaries (SOA) or the Casualty Actuarial Society (CAS), involving multiple rigorous exams and continuous professional development. Analysts in insurance often need relevant certifications like the Chartered Property Casualty Underwriter (CPCU) or Financial Risk Manager (FRM), though formal licensing is generally less stringent compared to actuaries. Licensing requirements for actuaries are stricter due to their role in risk assessment and financial modeling, where regulatory compliance and advanced expertise are mandatory.

Salary Expectations: Actuary vs Analyst

Actuaries typically earn a higher salary than analysts due to their specialized expertise in risk assessment, mathematical modeling, and certification requirements such as the Society of Actuaries (SOA) exams. According to industry data, the median annual salary for actuaries ranges from $100,000 to $150,000, while analysts in insurance generally earn between $60,000 and $90,000. Employer demand for credentialed actuaries, coupled with the critical role they play in pricing insurance products and managing financial risk, significantly boosts their earning potential compared to analysts.

Career Progression in Insurance Sector

Actuaries in the insurance sector typically follow a structured career progression involving rigorous exams and certifications, advancing from junior actuary roles to senior positions like Chief Actuary or Risk Manager. Analysts often start with data analysis and reporting tasks, moving up to positions such as Data Scientist or Business Analyst, with career growth influenced by expertise in statistical software and domain knowledge. Both career paths demand strong analytical skills, but actuaries generally experience a more defined trajectory due to professional credentialing requirements in insurance risk assessment.

Work Environment and Daily Tasks

Actuaries typically work in professional office settings within insurance companies, focusing on risk assessment by applying statistical models and financial theory to predict future events. Analysts in insurance firms often have a dynamic work environment involving data collection, market research, and financial reporting to support business decisions. Both roles require strong analytical skills but actuaries emphasize long-term risk evaluation while analysts handle immediate data interpretation and operational insights.

Choosing Between Actuary and Analyst Paths in Insurance

Choosing between actuary and analyst paths in insurance depends on one's proficiency with advanced mathematics, statistical modeling, and risk assessment. Actuaries specialize in calculating insurance premiums, reserves, and ensuring financial stability by applying probability theories, while analysts focus on data interpretation, market trends, and operational insights to support strategic decisions. Actuaries typically require professional certification such as the SOA or CAS, whereas analysts often hold degrees in economics, finance, or data science with strong analytical software skills.

Actuary vs Analyst Infographic

jobdiv.com

jobdiv.com