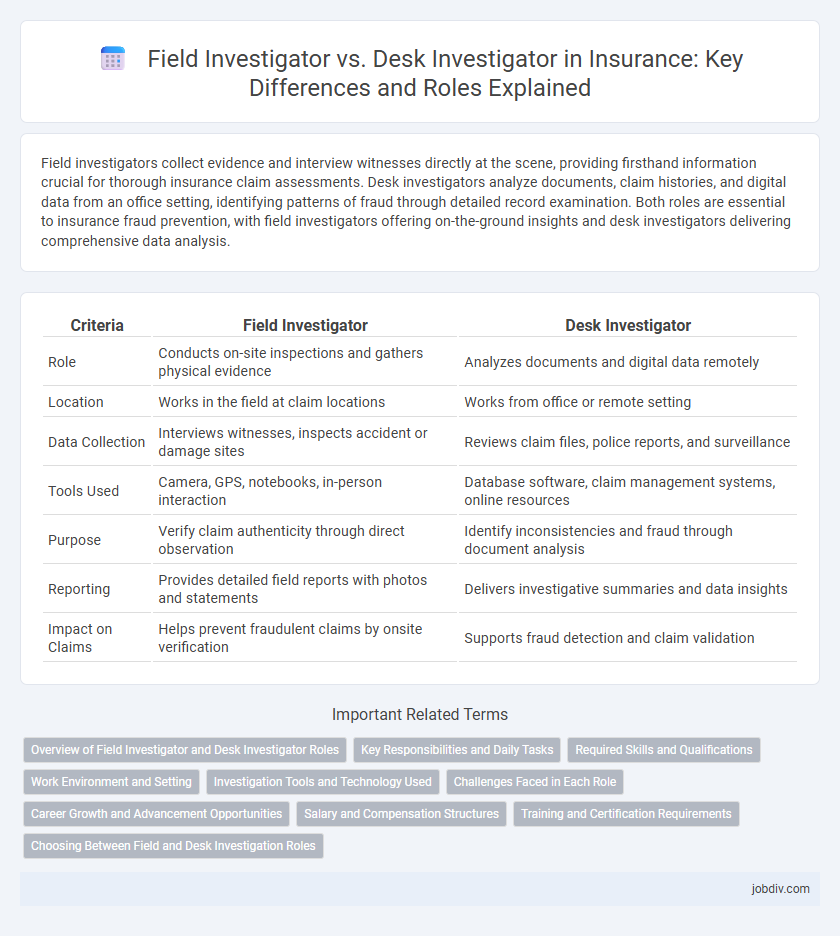

Field investigators collect evidence and interview witnesses directly at the scene, providing firsthand information crucial for thorough insurance claim assessments. Desk investigators analyze documents, claim histories, and digital data from an office setting, identifying patterns of fraud through detailed record examination. Both roles are essential to insurance fraud prevention, with field investigators offering on-the-ground insights and desk investigators delivering comprehensive data analysis.

Table of Comparison

| Criteria | Field Investigator | Desk Investigator |

|---|---|---|

| Role | Conducts on-site inspections and gathers physical evidence | Analyzes documents and digital data remotely |

| Location | Works in the field at claim locations | Works from office or remote setting |

| Data Collection | Interviews witnesses, inspects accident or damage sites | Reviews claim files, police reports, and surveillance |

| Tools Used | Camera, GPS, notebooks, in-person interaction | Database software, claim management systems, online resources |

| Purpose | Verify claim authenticity through direct observation | Identify inconsistencies and fraud through document analysis |

| Reporting | Provides detailed field reports with photos and statements | Delivers investigative summaries and data insights |

| Impact on Claims | Helps prevent fraudulent claims by onsite verification | Supports fraud detection and claim validation |

Overview of Field Investigator and Desk Investigator Roles

Field Investigators conduct on-site investigations, gather physical evidence, and interview witnesses to validate insurance claims, ensuring accurate risk assessment. Desk Investigators analyze documentation, telephonic interviews, and digital records to verify claims and detect potential fraud from the office. Both roles collaborate to enhance claim accuracy and reduce insurance fraud.

Key Responsibilities and Daily Tasks

Field Investigators conduct on-site inspections, verifications, and interviews to gather evidence and assess claim validity, often visiting accident scenes or claimant residences. Desk Investigators analyze documents, claims data, and medical records remotely to identify discrepancies, detect fraud, and support case resolutions. Both roles play a critical part in insurance fraud prevention and claims accuracy, with Field Investigators focusing on physical evidence and Desk Investigators emphasizing data analysis.

Required Skills and Qualifications

Field investigators require strong observational skills, excellent communication abilities, and a valid driver's license to conduct on-site investigations effectively. Desk investigators depend on analytical thinking, attention to detail, proficiency in research tools, and experience interpreting reports remotely. Both roles demand knowledge of insurance policies, claim procedures, and regulatory compliance to ensure accurate and ethical claim assessments.

Work Environment and Setting

Field investigators operate primarily on-site, conducting in-person inspections and interviews to gather firsthand evidence related to insurance claims, often navigating diverse and dynamic environments. Desk investigators work mainly in controlled office settings, analyzing documents, reviewing records, and conducting research remotely to detect fraud or verify claim authenticity. The field environment demands adaptability and travel, while the desk setting emphasizes detailed analytical skills and access to extensive databases.

Investigation Tools and Technology Used

Field investigators utilize advanced mobile devices, GPS tracking, and on-site surveillance cameras to collect real-time evidence and conduct thorough, in-person investigations. Desk investigators rely heavily on digital databases, computer forensic tools, and online public records to analyze claims and detect fraud remotely. Both roles leverage specialized software for data analysis, but field investigators emphasize physical evidence gathering, whereas desk investigators focus on virtual data integration and background checks.

Challenges Faced in Each Role

Field investigators in insurance often face challenges such as accessing difficult locations, verifying physical evidence, and managing unpredictable environments, which require strong observational skills and adaptability. Desk investigators primarily encounter challenges related to analyzing large volumes of data, interpreting complex documents, and conducting thorough background checks remotely, necessitating attention to detail and proficiency with digital tools. Both roles demand strong critical thinking to identify fraud and ensure accurate claim assessments despite their differing operational obstacles.

Career Growth and Advancement Opportunities

Field investigators in insurance often gain hands-on experience through on-site claim assessments, building practical skills valued for leadership roles and specialized investigations. Desk investigators primarily analyze claims data and conduct interviews remotely, developing expertise in fraud detection and report writing that can lead to roles in risk management or compliance. Career growth for field investigators typically involves advancement to senior field roles or supervisory positions, while desk investigators may progress toward analytical or managerial roles within the insurance fraud investigation domain.

Salary and Compensation Structures

Field investigators in insurance typically earn higher salaries than desk investigators due to the physical demands and travel requirements of their role, with average annual earnings ranging from $50,000 to $70,000. Desk investigators, who analyze claims primarily from an office setting, generally receive compensation between $40,000 and $60,000, often with fewer variable bonuses. Compensation structures for field investigators frequently include mileage reimbursement and performance bonuses tied to case resolution, whereas desk investigators may benefit from fixed salaries with incentives based on investigation accuracy and claim recovery rates.

Training and Certification Requirements

Field investigators in insurance require extensive on-site training to develop skills in claim assessment, evidence collection, and interviewing witnesses, often needing certification such as Certified Fraud Examiner (CFE) to validate investigative competencies. Desk investigators focus on analyzing documentation, conducting background checks, and reviewing claim histories, which necessitates training in data analysis and legal compliance with certifications like Adjuster Licensing or specialized insurance fraud detection courses. Both roles benefit from ongoing education in regulatory updates and technological tools to ensure accurate and compliant investigations.

Choosing Between Field and Desk Investigation Roles

Field investigators gather on-site evidence and conduct face-to-face interviews, providing direct insights into insurance claims that desk investigators cannot access remotely. Desk investigators analyze documents, digital data, and records from a centralized location, using advanced software tools to detect fraud efficiently. Selecting between these roles depends on factors like the complexity of the case, geographic reach, and the need for physical interaction versus data-driven analysis.

Field Investigator vs Desk Investigator Infographic

jobdiv.com

jobdiv.com