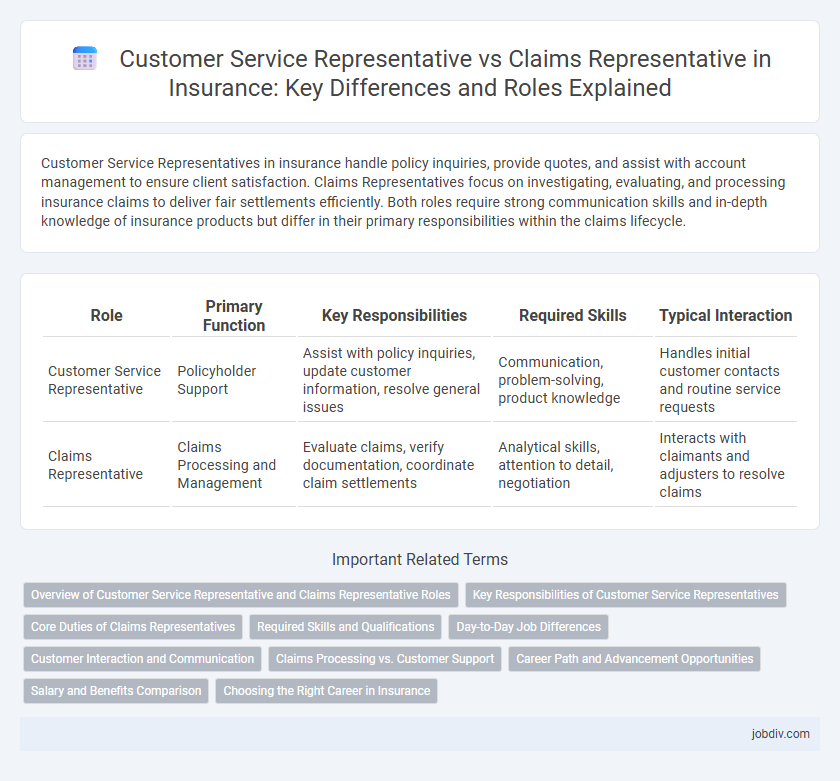

Customer Service Representatives in insurance handle policy inquiries, provide quotes, and assist with account management to ensure client satisfaction. Claims Representatives focus on investigating, evaluating, and processing insurance claims to deliver fair settlements efficiently. Both roles require strong communication skills and in-depth knowledge of insurance products but differ in their primary responsibilities within the claims lifecycle.

Table of Comparison

| Role | Primary Function | Key Responsibilities | Required Skills | Typical Interaction |

|---|---|---|---|---|

| Customer Service Representative | Policyholder Support | Assist with policy inquiries, update customer information, resolve general issues | Communication, problem-solving, product knowledge | Handles initial customer contacts and routine service requests |

| Claims Representative | Claims Processing and Management | Evaluate claims, verify documentation, coordinate claim settlements | Analytical skills, attention to detail, negotiation | Interacts with claimants and adjusters to resolve claims |

Overview of Customer Service Representative and Claims Representative Roles

Customer Service Representatives in insurance primarily handle policy inquiries, provide information on coverage options, and assist with billing and account management, ensuring customer satisfaction and retention. Claims Representatives focus on evaluating, processing, and settling insurance claims by investigating incidents, verifying policy coverage, and negotiating settlements to facilitate timely claim resolution. Both roles require strong communication skills, attention to detail, and knowledge of insurance products and regulations, but Customer Service Representatives emphasize client engagement while Claims Representatives concentrate on claims assessment and management.

Key Responsibilities of Customer Service Representatives

Customer Service Representatives in insurance manage client inquiries, provide policy information, and assist with billing or account updates, ensuring a positive customer experience. They handle routine transactions and direct complex issues to specialized departments, optimizing workflow efficiency. Their role requires excellent communication skills and extensive knowledge of insurance products to resolve problems promptly and maintain client satisfaction.

Core Duties of Claims Representatives

Claims Representatives handle claim investigations, evaluate policy coverage, and determine claim validity to ensure accurate settlements. They analyze documentation, communicate with claimants and adjusters, and negotiate claim resolutions to minimize company losses. Their core duties emphasize risk assessment, fraud detection, and compliance with insurance regulations.

Required Skills and Qualifications

Customer Service Representatives in insurance require strong communication skills, empathy, and proficiency in handling policy inquiries and account management. Claims Representatives need expertise in investigating claims, assessing policy coverage, and negotiating settlements, along with analytical abilities and attention to detail. Both roles benefit from knowledge of insurance regulations, customer relationship management software, and problem-solving capabilities.

Day-to-Day Job Differences

Customer Service Representatives in insurance primarily handle policy inquiries, process payments, and assist with general account management, ensuring customer satisfaction through direct interaction. Claims Representatives focus on investigating, evaluating, and processing insurance claims, coordinating with adjusters and policyholders to determine claim validity and settlement amounts. The day-to-day tasks differ significantly, with Customer Service Representatives emphasizing client communication and account support, while Claims Representatives concentrate on claim assessment and resolution.

Customer Interaction and Communication

Customer Service Representatives in insurance primarily manage policy inquiries, billing questions, and general account updates, requiring strong interpersonal and communication skills to ensure clear and empathetic customer interactions. Claims Representatives focus on handling claim filings, investigations, and status updates, necessitating detailed and precise communication to explain complex claim processes and resolve issues effectively. Both roles demand excellent customer interaction abilities, but Customer Service Representatives emphasize proactive support, while Claims Representatives concentrate on detailed claim-related communication.

Claims Processing vs. Customer Support

Claims Representatives specialize in claims processing by verifying policy coverage, assessing damages, and facilitating timely settlements to ensure efficient resolution of insurance claims. Customer Service Representatives focus on customer support by addressing policy inquiries, providing product information, and assisting with account management to enhance client satisfaction. The claims processing role demands analytical skills and decision-making under regulatory guidelines, while customer support emphasizes communication and problem-solving abilities.

Career Path and Advancement Opportunities

Customer Service Representatives in insurance often begin by handling client inquiries and policy information, developing strong communication skills essential for advancement into supervisory or sales roles within the company. Claims Representatives specialize in evaluating, investigating, and settling insurance claims, which can lead to career paths in claims management or risk assessment positions. Both roles offer distinct advancement opportunities, with Claims Representatives typically progressing into more technical or specialized roles, while Customer Service Representatives may transition into broader client-focused or administrative careers.

Salary and Benefits Comparison

Customer Service Representatives in insurance typically earn between $35,000 and $50,000 annually, with benefits including health insurance, retirement plans, and paid time off, reflecting their role in client interactions and support. Claims Representatives often receive higher salaries ranging from $45,000 to $65,000 due to their specialized skills in claims processing and adjudication, along with comprehensive benefits packages that may include bonuses and enhanced professional development opportunities. Salary and benefits for both positions vary depending on company size, location, and experience level, with Claims Representatives generally enjoying greater financial and career advancement potential.

Choosing the Right Career in Insurance

Customer Service Representatives in insurance focus on assisting clients with policy inquiries, billing, and general support, requiring strong communication skills and customer-centric attitudes. Claims Representatives specialize in evaluating and processing insurance claims, often demanding analytical abilities and knowledge of policy terms to ensure accurate settlements. Choosing between these roles depends on whether you prefer client interaction and support or detailed claims assessment and investigation within the insurance industry.

Customer Service Representative vs Claims Representative Infographic

jobdiv.com

jobdiv.com