Reinsurance brokers act as intermediaries between insurance companies and reinsurers, facilitating negotiations and securing optimal coverage terms to transfer risk effectively. Reinsurance underwriters evaluate and assess the risks presented by insurance portfolios, determining appropriate premiums and coverage limits to ensure profitability and risk management for the reinsurer. The distinct roles of brokers and underwriters are crucial in balancing market access and risk assessment within the reinsurance industry.

Table of Comparison

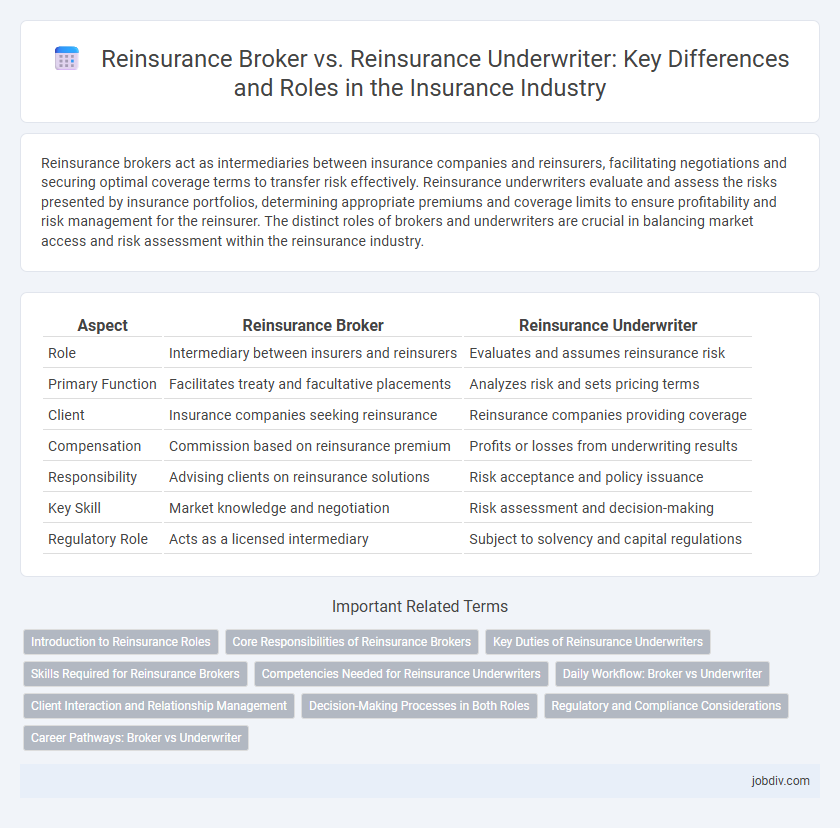

| Aspect | Reinsurance Broker | Reinsurance Underwriter |

|---|---|---|

| Role | Intermediary between insurers and reinsurers | Evaluates and assumes reinsurance risk |

| Primary Function | Facilitates treaty and facultative placements | Analyzes risk and sets pricing terms |

| Client | Insurance companies seeking reinsurance | Reinsurance companies providing coverage |

| Compensation | Commission based on reinsurance premium | Profits or losses from underwriting results |

| Responsibility | Advising clients on reinsurance solutions | Risk acceptance and policy issuance |

| Key Skill | Market knowledge and negotiation | Risk assessment and decision-making |

| Regulatory Role | Acts as a licensed intermediary | Subject to solvency and capital regulations |

Introduction to Reinsurance Roles

Reinsurance brokers act as intermediaries between insurance companies and reinsurers, facilitating negotiations and securing optimal reinsurance contracts to manage risk exposure. Reinsurance underwriters assess the risks presented by cedents and determine appropriate terms, conditions, and pricing for reinsurance coverage. Understanding these distinct roles is essential for efficient risk transfer and capital management within the insurance industry.

Core Responsibilities of Reinsurance Brokers

Reinsurance brokers act as intermediaries who facilitate negotiations between insurance companies and reinsurers, ensuring optimal coverage terms and pricing. They analyze risk portfolios, provide market insights, and tailor reinsurance solutions to meet the specific needs of insurance clients. Their core responsibilities include advising on treaty structures, managing relationships, and securing reinsurance agreements to enhance risk management strategies.

Key Duties of Reinsurance Underwriters

Reinsurance underwriters assess risk by analyzing the insurance portfolios submitted by ceding companies, determining appropriate terms, and setting premium rates to ensure profitability and risk mitigation. Their key duties include evaluating the financial stability and claim history of insurers, negotiating contract conditions, and maintaining compliance with regulatory standards. Accurate risk assessment and strategic decision-making by reinsurance underwriters directly impact the insurer's risk exposure and overall market stability.

Skills Required for Reinsurance Brokers

Reinsurance brokers require strong negotiation skills, in-depth knowledge of insurance markets, and the ability to analyze complex risk data. Expertise in contract structuring and regulatory compliance ensures optimal placement of reinsurance coverage for clients. Effective communication and relationship management are essential to bridge insurers and reinsurers successfully.

Competencies Needed for Reinsurance Underwriters

Reinsurance underwriters require strong analytical skills to assess risk portfolios and determine appropriate coverage terms accurately. Expertise in financial modeling and market trends enables them to price reinsurance contracts competitively while maintaining profitability. Proficiency in regulatory compliance and contract negotiation ensures adherence to industry standards and effective risk management.

Daily Workflow: Broker vs Underwriter

Reinsurance brokers primarily manage client relationships, negotiate contract terms, and analyze market conditions to secure optimal coverage, focusing on communication and advocacy. Reinsurance underwriters concentrate on risk assessment, evaluating underwriting submissions, pricing policies, and enforcing underwriting guidelines to ensure portfolio profitability. Daily workflows differ as brokers prioritize client engagement and deal facilitation, while underwriters focus on detailed risk evaluation and policy approval.

Client Interaction and Relationship Management

Reinsurance brokers act as intermediaries who directly engage with clients to understand their risk management needs and negotiate optimal reinsurance coverage. They maintain ongoing relationships by providing tailored advice, market insights, and facilitating communication between insurers and reinsurers. Reinsurance underwriters focus primarily on assessing risk and pricing policies, interacting with brokers and clients less frequently, emphasizing contract terms and risk evaluation rather than client relationship management.

Decision-Making Processes in Both Roles

Reinsurance brokers analyze risk portfolios and market conditions to advise clients on optimal coverage, leveraging negotiation skills to secure favorable terms. Reinsurance underwriters assess underwriting data and risk exposures directly, making decisions on policy acceptance and pricing based on actuarial models and company risk appetite. Both roles require detailed risk evaluation, but brokers focus on client representation while underwriters concentrate on capital management and risk selection.

Regulatory and Compliance Considerations

Reinsurance brokers must navigate complex regulatory frameworks to ensure compliance with licensing, disclosure, and anti-money laundering requirements in multiple jurisdictions. Reinsurance underwriters are subject to stringent solvency and capital adequacy regulations designed to maintain insurer financial stability and policyholder protection. Both roles require adherence to international standards such as Solvency II in Europe and risk-based capital guidelines in the United States to mitigate systemic risks and promote market transparency.

Career Pathways: Broker vs Underwriter

Career pathways in reinsurance diverge significantly between brokers and underwriters, with brokers focusing on client relationship management, market analysis, and deal negotiation, often requiring strong sales and networking skills. Reinsurance underwriters emphasize risk assessment, policy structuring, and financial analysis, demanding expertise in actuarial science, statistics, and regulatory compliance. Professionals aspiring to leadership roles in brokers pursue client acquisition and portfolio diversification, while underwriters advance through technical mastery and underwriting authority enhancement.

Reinsurance Broker vs Reinsurance Underwriter Infographic

jobdiv.com

jobdiv.com