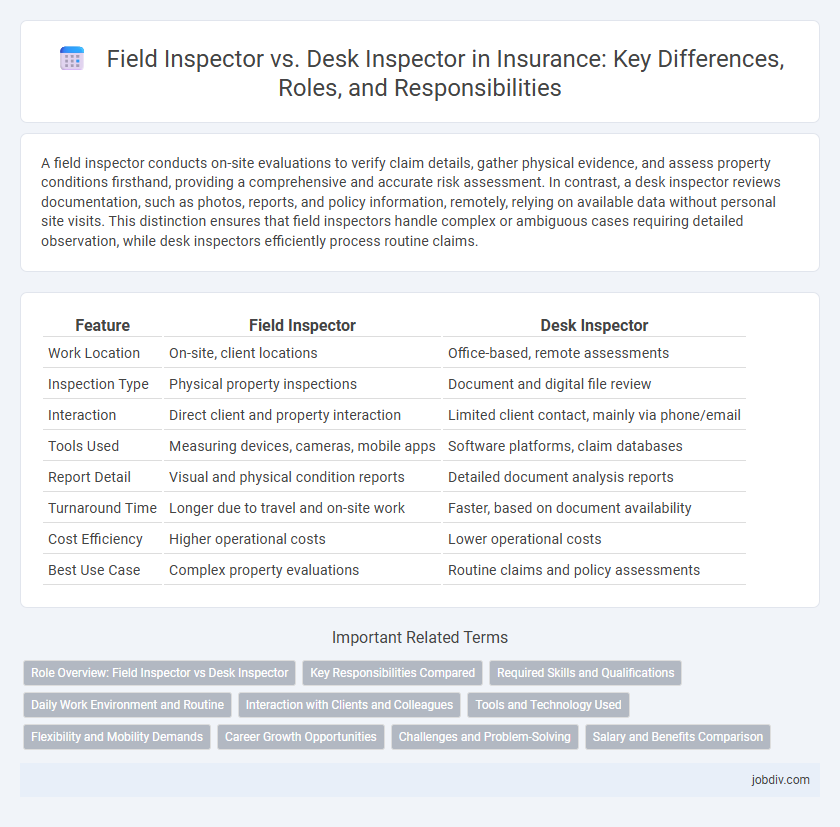

A field inspector conducts on-site evaluations to verify claim details, gather physical evidence, and assess property conditions firsthand, providing a comprehensive and accurate risk assessment. In contrast, a desk inspector reviews documentation, such as photos, reports, and policy information, remotely, relying on available data without personal site visits. This distinction ensures that field inspectors handle complex or ambiguous cases requiring detailed observation, while desk inspectors efficiently process routine claims.

Table of Comparison

| Feature | Field Inspector | Desk Inspector |

|---|---|---|

| Work Location | On-site, client locations | Office-based, remote assessments |

| Inspection Type | Physical property inspections | Document and digital file review |

| Interaction | Direct client and property interaction | Limited client contact, mainly via phone/email |

| Tools Used | Measuring devices, cameras, mobile apps | Software platforms, claim databases |

| Report Detail | Visual and physical condition reports | Detailed document analysis reports |

| Turnaround Time | Longer due to travel and on-site work | Faster, based on document availability |

| Cost Efficiency | Higher operational costs | Lower operational costs |

| Best Use Case | Complex property evaluations | Routine claims and policy assessments |

Role Overview: Field Inspector vs Desk Inspector

Field Inspectors conduct on-site evaluations of insured properties, gathering firsthand data on risk factors, damages, and compliance with policy terms, which enhances accuracy in claim assessments. Desk Inspectors analyze documentation, photos, and reports remotely to verify claims and assess risks without visiting the site, offering efficiency in processing high volumes of cases. Both roles are crucial for comprehensive insurance underwriting, balancing thorough field investigation with streamlined office-based evaluation.

Key Responsibilities Compared

Field Inspectors conduct on-site property inspections to assess damage, verify claims accuracy, and gather photographic evidence, ensuring thorough risk evaluation. Desk Inspectors analyze claim documentation remotely, review investigation reports, and validate claim legitimacy through data analysis and customer interviews. Both roles collaborate to enhance claim accuracy and expedite processing within insurance operations.

Required Skills and Qualifications

Field Inspectors require strong observational abilities, excellent communication skills, and the ability to conduct on-site evaluations under various environmental conditions, often necessitating a valid driver's license and physical stamina. Desk Inspectors typically need advanced analytical skills, proficiency with inspection software, and expertise in reviewing documentation and reports from a remote location, emphasizing detail orientation and critical thinking. Both roles demand knowledge of insurance policies, regulatory compliance, and effective risk assessment techniques.

Daily Work Environment and Routine

Field Inspectors spend most of their workday visiting properties, conducting on-site inspections, and gathering visual evidence to assess insurance claims or risks directly at the location. Desk Inspectors primarily work in office settings, analyzing reports, reviewing documents, and coordinating with field inspectors to verify information and make assessments. The daily routine of Field Inspectors involves travel and face-to-face interactions, while Desk Inspectors focus on data evaluation, report preparation, and communication through phone or email.

Interaction with Clients and Colleagues

Field Inspectors conduct on-site evaluations, engaging directly with clients to assess property conditions and gather accurate information, fostering personalized communication and immediate problem-solving. Desk Inspectors analyze reports and documentation remotely, collaborating extensively with underwriters and claims adjusters to ensure data accuracy and compliance without face-to-face client interaction. Effective communication skills are essential for both roles, but Field Inspectors prioritize client rapport and observation, while Desk Inspectors focus on interdisciplinary teamwork and detailed documentation review.

Tools and Technology Used

Field Inspectors utilize mobile devices, GPS technology, and specialized cameras to conduct on-site evaluations and gather real-time data efficiently. Desk Inspectors depend primarily on remote access software, claim management systems, and digital databases to analyze submitted information without physical presence. Both roles leverage advanced analytics and AI-based tools to enhance accuracy and streamline the inspection process in insurance claims.

Flexibility and Mobility Demands

Field inspectors require high flexibility and mobility as they conduct on-site assessments, often traveling to various locations and adapting to diverse environments and client schedules. Desk inspectors operate primarily from office settings, offering less mobility but requiring strong adaptability in managing remote data and client communications efficiently. Insurance companies balance these roles to optimize claim evaluations while addressing both on-the-ground inspection demands and streamlined desk-based processing.

Career Growth Opportunities

Field Inspectors gain hands-on experience conducting on-site evaluations, which enhances their practical skills and opens pathways to supervisory or specialized roles within insurance claim investigation. Desk Inspectors develop strong analytical abilities through reviewing and processing claims remotely, positioning them for advancement into underwriting or risk analysis careers. Both roles offer distinct growth opportunities tailored to different skill sets, allowing professionals to pivot toward management, technical specialties, or executive leadership in the insurance sector.

Challenges and Problem-Solving

Field Inspectors face challenges such as variable environmental conditions and the need for on-site assessment accuracy, requiring strong observational skills and quick decision-making to resolve unexpected issues. Desk Inspectors encounter problems related to data accuracy and verification, demanding thorough document analysis and effective communication with field teams to ensure information integrity. Both roles rely on problem-solving strategies tailored to their environments to support accurate insurance risk evaluation and claim processing.

Salary and Benefits Comparison

Field Inspectors typically earn higher salaries than Desk Inspectors due to the demanding nature of onsite evaluations and travel requirements, with average annual wages ranging from $50,000 to $70,000 compared to $40,000 to $55,000 for Desk Inspectors. Benefits for Field Inspectors often include mileage reimbursement, flexible schedules, and hazard pay, while Desk Inspectors usually receive more consistent hours, stable work environments, and standard health insurance packages. Both roles may offer bonuses and retirement plans, but the total compensation package varies based on the insurer's policies and geographic location.

Field Inspector vs Desk Inspector Infographic

jobdiv.com

jobdiv.com