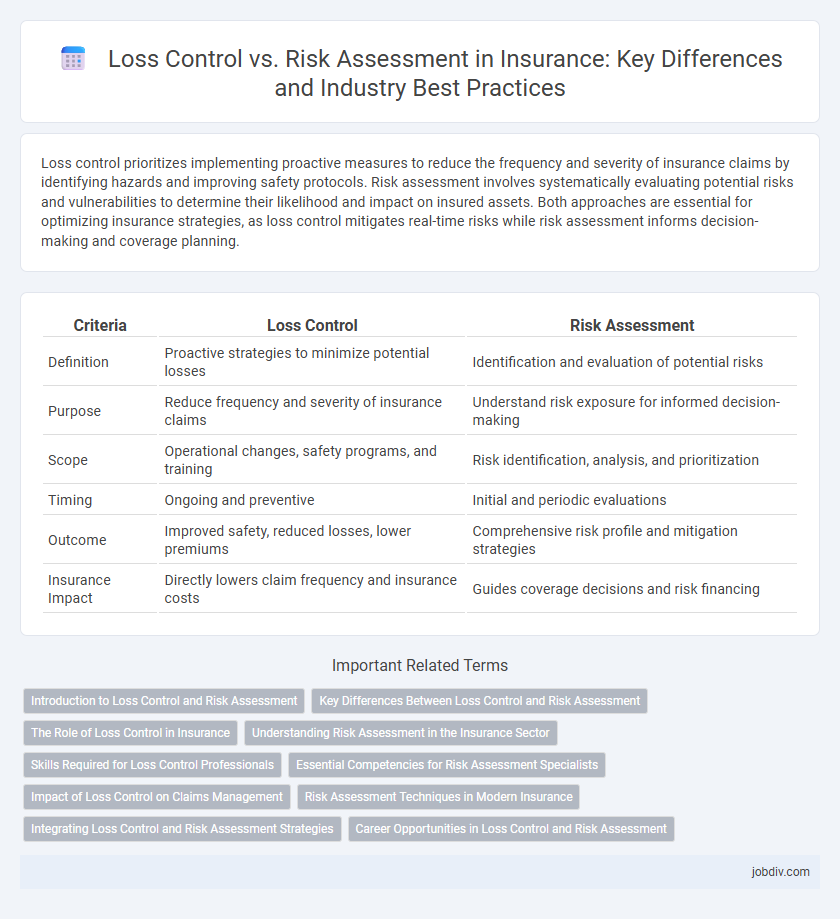

Loss control prioritizes implementing proactive measures to reduce the frequency and severity of insurance claims by identifying hazards and improving safety protocols. Risk assessment involves systematically evaluating potential risks and vulnerabilities to determine their likelihood and impact on insured assets. Both approaches are essential for optimizing insurance strategies, as loss control mitigates real-time risks while risk assessment informs decision-making and coverage planning.

Table of Comparison

| Criteria | Loss Control | Risk Assessment |

|---|---|---|

| Definition | Proactive strategies to minimize potential losses | Identification and evaluation of potential risks |

| Purpose | Reduce frequency and severity of insurance claims | Understand risk exposure for informed decision-making |

| Scope | Operational changes, safety programs, and training | Risk identification, analysis, and prioritization |

| Timing | Ongoing and preventive | Initial and periodic evaluations |

| Outcome | Improved safety, reduced losses, lower premiums | Comprehensive risk profile and mitigation strategies |

| Insurance Impact | Directly lowers claim frequency and insurance costs | Guides coverage decisions and risk financing |

Introduction to Loss Control and Risk Assessment

Loss control involves proactive strategies to prevent or minimize potential losses by identifying hazards and implementing safety measures, while risk assessment systematically evaluates the likelihood and impact of various risks to an organization. Effective loss control programs reduce insurance claims and operational disruptions by addressing physical and procedural vulnerabilities. Risk assessment provides the foundational data needed to tailor loss control efforts, ensuring resources target the most significant exposures.

Key Differences Between Loss Control and Risk Assessment

Loss control involves proactive strategies to reduce the frequency and severity of potential insurance claims by implementing safety measures and compliance protocols, while risk assessment focuses on identifying, analyzing, and evaluating possible risks that could impact an organization's assets or operations. Loss control emphasizes prevention and mitigation tactics, such as installing fire suppression systems and regular safety training, whereas risk assessment delivers a detailed understanding of risk exposures through data analysis and risk modeling. The key difference lies in loss control being an active management process to minimize losses, whereas risk assessment serves as a foundational evaluation tool to inform insurance underwriting and decision-making.

The Role of Loss Control in Insurance

Loss control in insurance plays a critical role in minimizing potential claims by implementing proactive measures to reduce hazards and improve safety standards. It involves systematic identification, evaluation, and mitigation of risks before they result in financial loss, directly impacting underwriting decisions and premium rates. By enhancing loss prevention strategies, insurers protect assets, decrease claim frequency, and promote long-term risk management for policyholders.

Understanding Risk Assessment in the Insurance Sector

Risk assessment in the insurance sector involves identifying, evaluating, and prioritizing potential risks to determine the likelihood and financial impact of insured events. This process uses data analytics, historical claims, and actuarial models to quantify exposure and establish appropriate premium rates. Understanding risk assessment enables insurers to develop tailored policies and enhance underwriting accuracy, ultimately improving risk management and profitability.

Skills Required for Loss Control Professionals

Loss control professionals require expertise in hazard identification, risk mitigation strategies, and regulatory compliance to effectively minimize potential insurance claims. Strong analytical skills, combined with thorough knowledge of safety standards and industry-specific protocols, enable them to design and implement targeted loss prevention programs. Proficiency in communication and training ensures these professionals can promote risk awareness and foster a culture of safety within organizations.

Essential Competencies for Risk Assessment Specialists

Risk assessment specialists must possess strong analytical skills to identify potential hazards and evaluate their impact on business operations accurately. Expertise in data interpretation, regulatory compliance, and risk mitigation strategies is essential for developing effective loss prevention plans. Proficiency in communication and report writing enables specialists to convey findings clearly and support informed decision-making within the insurance industry.

Impact of Loss Control on Claims Management

Loss control significantly reduces claim frequency and severity by implementing proactive safety measures and hazard mitigation strategies. Effective loss control enhances risk management processes, resulting in fewer costly claims and expedited claims resolution. Improved claims management driven by loss control efforts leads to reduced insurance premiums and increased operational efficiency for policyholders.

Risk Assessment Techniques in Modern Insurance

Risk assessment techniques in modern insurance utilize advanced data analytics, machine learning algorithms, and predictive modeling to evaluate potential risks with greater accuracy. These methods enable insurers to quantify exposure by analyzing historical claims data, environmental factors, and customer behavior patterns. Enhanced risk assessment supports tailored underwriting decisions and proactive loss prevention strategies, reducing overall insurance costs.

Integrating Loss Control and Risk Assessment Strategies

Integrating loss control and risk assessment strategies enhances the effectiveness of insurance management by identifying potential hazards and implementing proactive measures to mitigate them. Combining detailed risk assessments with targeted loss control interventions reduces claim frequency and severity, leading to lower premiums and improved safety compliance. This integrated approach supports a comprehensive risk management framework that aligns with insurer requirements and regulatory standards.

Career Opportunities in Loss Control and Risk Assessment

Career opportunities in loss control focus on identifying hazards and implementing safety measures to reduce potential insurance claims, often requiring expertise in engineering or safety management. Risk assessment careers emphasize analyzing potential risks, forecasting financial impact, and advising on risk mitigation strategies, typically demanding strong analytical and actuarial skills. Both paths offer roles in insurance companies, consulting firms, and corporate risk management, with growing demand driven by increasing regulatory requirements and risk awareness.

Loss Control vs Risk Assessment Infographic

jobdiv.com

jobdiv.com