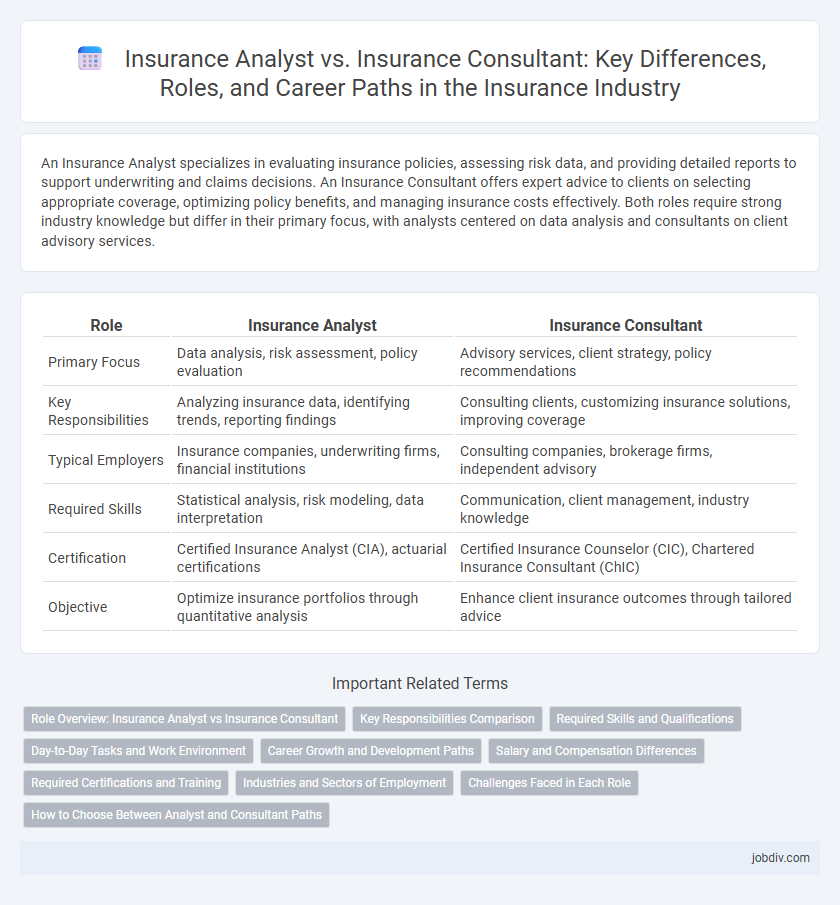

An Insurance Analyst specializes in evaluating insurance policies, assessing risk data, and providing detailed reports to support underwriting and claims decisions. An Insurance Consultant offers expert advice to clients on selecting appropriate coverage, optimizing policy benefits, and managing insurance costs effectively. Both roles require strong industry knowledge but differ in their primary focus, with analysts centered on data analysis and consultants on client advisory services.

Table of Comparison

| Role | Insurance Analyst | Insurance Consultant |

|---|---|---|

| Primary Focus | Data analysis, risk assessment, policy evaluation | Advisory services, client strategy, policy recommendations |

| Key Responsibilities | Analyzing insurance data, identifying trends, reporting findings | Consulting clients, customizing insurance solutions, improving coverage |

| Typical Employers | Insurance companies, underwriting firms, financial institutions | Consulting companies, brokerage firms, independent advisory |

| Required Skills | Statistical analysis, risk modeling, data interpretation | Communication, client management, industry knowledge |

| Certification | Certified Insurance Analyst (CIA), actuarial certifications | Certified Insurance Counselor (CIC), Chartered Insurance Consultant (ChIC) |

| Objective | Optimize insurance portfolios through quantitative analysis | Enhance client insurance outcomes through tailored advice |

Role Overview: Insurance Analyst vs Insurance Consultant

An Insurance Analyst evaluates data, risk factors, and market trends to assess insurance policies' performance and recommend strategic adjustments. An Insurance Consultant provides expert advice to clients on selecting appropriate insurance coverage, navigating policy details, and managing claims effectively. Both roles require deep industry knowledge but differ in focus: analysts emphasize data-driven insights, while consultants prioritize personalized client guidance.

Key Responsibilities Comparison

Insurance Analysts focus on data evaluation, risk assessment, and forecasting trends to support underwriting and claims decisions. Insurance Consultants prioritize advising clients on policy selection, risk management strategies, and regulatory compliance to tailor insurance solutions. Both roles require strong analytical skills, but Analysts emphasize data-driven insights, while Consultants concentrate on client-specific recommendations and strategy implementation.

Required Skills and Qualifications

Insurance analysts require strong analytical skills, proficiency in statistical software, and a deep understanding of risk assessment and financial modeling. Insurance consultants must possess excellent communication abilities, industry knowledge, and expertise in regulatory compliance to provide tailored advice to clients. Both roles demand a solid foundation in insurance principles, but analysts focus more on data interpretation, whereas consultants emphasize client interaction and strategic planning.

Day-to-Day Tasks and Work Environment

Insurance analysts primarily focus on evaluating data, assessing risk, and preparing reports to guide underwriting decisions, working mostly in office settings using analytical software. Insurance consultants engage directly with clients, providing tailored advice on policy selection, compliance, and risk management, often balancing office work with client meetings. Both roles require strong industry knowledge, but analysts emphasize quantitative analysis while consultants prioritize communication and client relations.

Career Growth and Development Paths

Insurance analysts typically focus on data evaluation, risk assessment, and financial modeling to support underwriting decisions, offering a clear progression into senior analyst or actuarial roles with a strong emphasis on quantitative skills. Insurance consultants, on the other hand, provide strategic advice to clients on coverage options and risk management, enabling career growth towards advisory, sales leadership, or specialized consultancy positions that leverage interpersonal and industry expertise. Both paths offer distinct development opportunities, with analysts advancing through technical proficiency and consultants through client-facing experience and business acumen.

Salary and Compensation Differences

Insurance analysts typically earn an average salary ranging from $60,000 to $85,000 annually, depending on experience and location, while insurance consultants often command higher compensation, averaging between $75,000 and $110,000 per year due to their advisory roles and client-facing responsibilities. Bonuses and commission structures further enhance consultants' total earnings, reflecting their impact on business development and client acquisition. Analyst salaries tend to be more fixed and tied to internal company performance metrics, whereas consultants' pay packages are often more variable and performance-driven.

Required Certifications and Training

Insurance Analysts commonly require certifications such as the Chartered Property Casualty Underwriter (CPCU) designation and proficiency in data analysis tools, with training emphasizing risk assessment and financial modeling. Insurance Consultants typically hold credentials like the Certified Insurance Counselor (CIC) or Certified Risk Manager (CRM), focusing their training on client advisory skills, policy evaluation, and regulatory compliance. Both roles benefit from continuous professional development to stay current with evolving insurance laws and market trends.

Industries and Sectors of Employment

Insurance analysts predominantly find employment within insurance companies, financial institutions, and risk management firms, specializing in data analysis and risk assessment across sectors such as healthcare, property, and casualty insurance. Insurance consultants often work with a broader client base including corporations, government agencies, and brokerage firms, providing strategic advice in sectors like employee benefits, commercial lines, and personal insurance. Both roles are critical in industries requiring detailed risk evaluation and regulatory compliance, but insurance consultants typically engage more directly with diverse client needs across multiple insurance markets.

Challenges Faced in Each Role

Insurance analysts often face challenges in accurately interpreting complex data sets and predicting risk trends, which requires strong analytical skills and attention to detail. Insurance consultants encounter difficulties in customizing policies to meet diverse client needs while navigating regulatory compliance and maintaining clear communication. Both roles demand staying updated with industry changes and technological advancements to provide effective insurance solutions.

How to Choose Between Analyst and Consultant Paths

Choosing between an Insurance Analyst and Insurance Consultant career depends on your strengths and professional goals. Insurance Analysts focus on data-driven risk assessment, policy evaluation, and actuarial analysis, ideal for those skilled in quantitative analysis and statistical modeling. Insurance Consultants, conversely, emphasize client advisory services, regulatory compliance, and strategic planning, suited for professionals with strong interpersonal communication and industry expertise.

Insurance Analyst vs Insurance Consultant Infographic

jobdiv.com

jobdiv.com