Claims Managers oversee the entire claims process, ensuring accuracy, compliance, and efficient resolution while managing the claims team. Claims Supervisors focus more on day-to-day operations, directly guiding adjusters and analysts to handle claims according to company policies. Both roles are essential for minimizing risk, optimizing claims handling, and enhancing customer satisfaction in insurance companies.

Table of Comparison

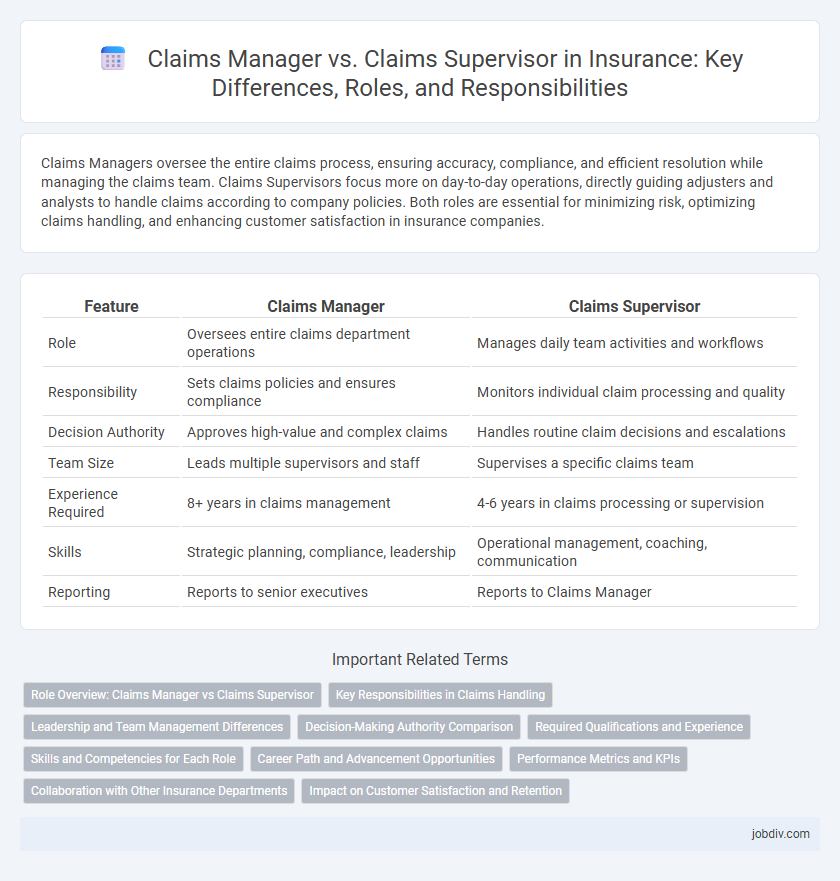

| Feature | Claims Manager | Claims Supervisor |

|---|---|---|

| Role | Oversees entire claims department operations | Manages daily team activities and workflows |

| Responsibility | Sets claims policies and ensures compliance | Monitors individual claim processing and quality |

| Decision Authority | Approves high-value and complex claims | Handles routine claim decisions and escalations |

| Team Size | Leads multiple supervisors and staff | Supervises a specific claims team |

| Experience Required | 8+ years in claims management | 4-6 years in claims processing or supervision |

| Skills | Strategic planning, compliance, leadership | Operational management, coaching, communication |

| Reporting | Reports to senior executives | Reports to Claims Manager |

Role Overview: Claims Manager vs Claims Supervisor

A Claims Manager oversees the entire claims process, ensuring compliance with company policies and regulatory standards while managing a team of claims specialists to optimize claims resolution efficiency. In contrast, a Claims Supervisor directly monitors daily claims operations, providing guidance and support to adjusters and examiners to meet performance targets. Both roles are crucial for maintaining effective claims handling, with the manager focusing on strategic oversight and the supervisor on operational execution.

Key Responsibilities in Claims Handling

Claims Managers oversee the entire claims process, ensuring compliance with regulatory standards, managing large teams, and coordinating complex claim investigations. Claims Supervisors focus on daily operational management, directly guiding claims adjusters, reviewing case files for accuracy, and implementing workflow improvements. Both roles emphasize efficient claims handling but differ in strategic oversight versus hands-on team management.

Leadership and Team Management Differences

Claims Managers oversee the entire claims department, setting strategic goals and managing high-level operations to ensure efficient claims processing and compliance. Claims Supervisors focus on day-to-day team leadership, directly managing adjusters and support staff, resolving workflow issues, and ensuring timely claim settlements. The Claims Manager emphasizes broad leadership and policy implementation, while the Claims Supervisor concentrates on direct team management and operational execution.

Decision-Making Authority Comparison

Claims Managers hold higher decision-making authority than Claims Supervisors, overseeing complex claim evaluations and final approvals. Claims Supervisors primarily manage daily team operations and provide recommendations but escalate significant decisions to the Claims Manager. This hierarchical structure ensures efficient claims resolution and risk management within insurance operations.

Required Qualifications and Experience

Claims Managers typically require a bachelor's degree in insurance, finance, or business administration, coupled with 5-7 years of experience in claims handling and leadership roles. Claims Supervisors often need a minimum of 3-5 years in claims processing or investigation, with strong knowledge of insurance policies and regulatory compliance. Both roles demand proficiency in claims management software, excellent analytical skills, and strong communication abilities to effectively oversee claims resolution and team coordination.

Skills and Competencies for Each Role

A Claims Manager demonstrates advanced leadership skills, strategic decision-making, and proficiency in claims analysis, risk assessment, and regulatory compliance, ensuring efficient claims resolution and operational excellence. A Claims Supervisor excels in team coordination, workflow management, and detailed claims investigation, providing hands-on support and direct oversight to claims adjusters while maintaining quality control and customer service standards. Both roles require strong communication, problem-solving abilities, and knowledge of insurance policies, but the manager role emphasizes high-level strategic planning and departmental management.

Career Path and Advancement Opportunities

Claims Managers oversee the entire claims process, managing teams and ensuring compliance, while Claims Supervisors focus on day-to-day team leadership and operational efficiency. Career advancement from Claims Supervisor to Claims Manager typically involves gaining strategic decision-making skills, leadership experience, and expertise in claims adjudication. Professionals aiming for higher roles can further progress to senior management positions such as Claims Director or Risk Manager within the insurance sector.

Performance Metrics and KPIs

Claims Managers oversee overall claims processing efficiency, focusing on KPIs such as claim settlement time, accuracy rate, and customer satisfaction scores to ensure optimal performance. Claims Supervisors monitor day-to-day activities, emphasizing metrics like team productivity, error rates, and compliance adherence to maintain high-quality claim handling. Both roles use performance metrics to drive operational improvements but differ in scope, with Managers focusing on strategic outcomes and Supervisors on tactical execution.

Collaboration with Other Insurance Departments

Claims Managers and Claims Supervisors play crucial roles in fostering collaboration across insurance departments, enhancing overall claims processing efficiency. Claims Managers often coordinate with underwriting, legal, and customer service teams to ensure comprehensive claims evaluation and risk assessment, while Claims Supervisors directly oversee claims adjusters and liaise closely with fraud detection and compliance units. Effective interdepartmental collaboration driven by both roles leads to improved fraud prevention, faster claim settlements, and optimized customer satisfaction.

Impact on Customer Satisfaction and Retention

A Claims Manager directly influences customer satisfaction by ensuring efficient claims processing and resolution, which leads to faster settlements and fewer disputes. Claims Supervisors play a critical role in maintaining quality control and staff performance, indirectly boosting customer retention through consistent service standards. Both positions are pivotal in minimizing claim errors and enhancing overall customer trust in the insurance provider.

Claims Manager vs Claims Supervisor Infographic

jobdiv.com

jobdiv.com