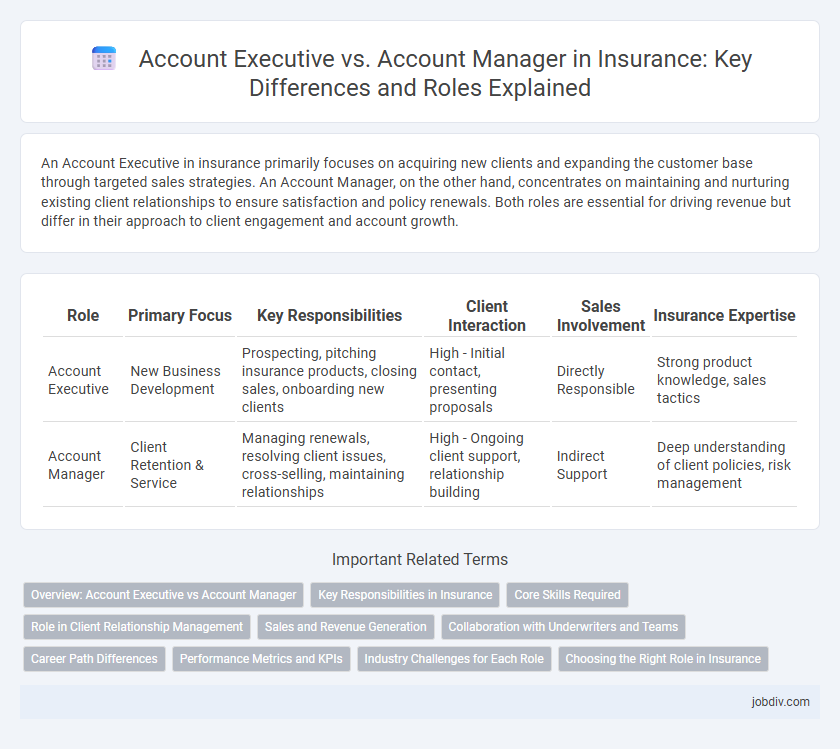

An Account Executive in insurance primarily focuses on acquiring new clients and expanding the customer base through targeted sales strategies. An Account Manager, on the other hand, concentrates on maintaining and nurturing existing client relationships to ensure satisfaction and policy renewals. Both roles are essential for driving revenue but differ in their approach to client engagement and account growth.

Table of Comparison

| Role | Primary Focus | Key Responsibilities | Client Interaction | Sales Involvement | Insurance Expertise |

|---|---|---|---|---|---|

| Account Executive | New Business Development | Prospecting, pitching insurance products, closing sales, onboarding new clients | High - Initial contact, presenting proposals | Directly Responsible | Strong product knowledge, sales tactics |

| Account Manager | Client Retention & Service | Managing renewals, resolving client issues, cross-selling, maintaining relationships | High - Ongoing client support, relationship building | Indirect Support | Deep understanding of client policies, risk management |

Overview: Account Executive vs Account Manager

Account Executives in insurance primarily focus on acquiring new clients and driving sales growth, emphasizing outreach and contract negotiation. Account Managers concentrate on maintaining client relationships, ensuring satisfaction, and managing policy renewals and claims support. Both roles require strong communication skills, but Account Executives prioritize business development while Account Managers focus on client retention and service.

Key Responsibilities in Insurance

Account Executives in insurance primarily focus on new client acquisition, policy sales, and meeting revenue targets through strategic prospecting and closing deals. Account Managers oversee existing client relationships, handling policy renewals, claims support, and customer retention to ensure client satisfaction and long-term business growth. Both roles require strong communication and industry knowledge, but Executives prioritize growth while Managers emphasize service continuity.

Core Skills Required

Account Executives in insurance require strong sales proficiency, client acquisition strategies, and contract negotiation skills to drive business growth effectively. Account Managers emphasize client retention, relationship management, and detailed policy knowledge to ensure ongoing customer satisfaction and renewals. Both roles demand excellent communication, problem-solving abilities, and a deep understanding of insurance products and regulatory compliance.

Role in Client Relationship Management

An Account Executive in insurance primarily focuses on acquiring new clients and initiating policy discussions, driving business growth through prospecting and sales. An Account Manager concentrates on maintaining and nurturing existing client relationships by providing ongoing support, policy renewals, and addressing client needs to ensure retention and satisfaction. Both roles are essential in client relationship management, with Executives spearheading new business and Managers fostering long-term client loyalty.

Sales and Revenue Generation

Account Executives in insurance primarily focus on driving new sales and generating revenue by acquiring new clients and expanding business opportunities. Account Managers concentrate on maintaining and nurturing existing client relationships to maximize policy renewals and upsell additional coverage. Both roles are essential for sustaining consistent revenue growth, with Account Executives targeting market expansion and Account Managers ensuring client retention and satisfaction.

Collaboration with Underwriters and Teams

Account Executives in insurance primarily focus on securing new business by collaborating closely with underwriters to assess risk and tailor policy offerings that meet client needs. Account Managers maintain ongoing relationships, working with underwriters and internal teams to ensure policy renewals, claims processing, and client satisfaction are seamlessly managed. Both roles require effective communication and coordination with underwriting teams to optimize risk assessment and deliver comprehensive insurance solutions.

Career Path Differences

Account Executives in insurance typically focus on acquiring new clients and driving sales growth, emphasizing prospecting and closing deals. Account Managers concentrate on fostering client relationships, ensuring policy retention, renewals, and customer satisfaction through ongoing service and support. Career progression for Account Executives often leads to senior sales roles or business development, while Account Managers advance toward client services leadership or strategic account management positions.

Performance Metrics and KPIs

Account Executives in insurance are primarily measured by sales performance metrics such as new policy acquisition, conversion rates, and revenue generated from new clients. Account Managers focus on KPIs related to client retention, policy renewals, cross-selling success, and customer satisfaction scores. Both roles utilize performance dashboards to track key metrics like client engagement frequency and overall portfolio growth, ensuring alignment with business objectives.

Industry Challenges for Each Role

Account Executives in the insurance industry face pressure to rapidly acquire new clients amid fierce market competition and evolving regulatory landscapes, requiring strong negotiation and product knowledge skills. Account Managers grapple with maintaining client retention and satisfaction while managing policy renewals, claims adjustments, and compliance with shifting industry standards. Both roles must adapt to digital transformation challenges, such as integrating advanced analytics and ensuring data security, to remain effective in servicing client needs.

Choosing the Right Role in Insurance

Choosing the right role in insurance depends on your career goals and skill set, with Account Executives focusing on acquiring new clients and driving sales, while Account Managers emphasize maintaining client relationships and ensuring customer satisfaction. Account Executives typically work to grow the company's revenue through targeted marketing strategies and prospecting, whereas Account Managers handle policy renewals, claims support, and account retention for existing customers. Understanding these distinctions helps professionals align their expertise with either aggressive business development or client service optimization in the insurance industry.

Account Executive vs Account Manager Infographic

jobdiv.com

jobdiv.com