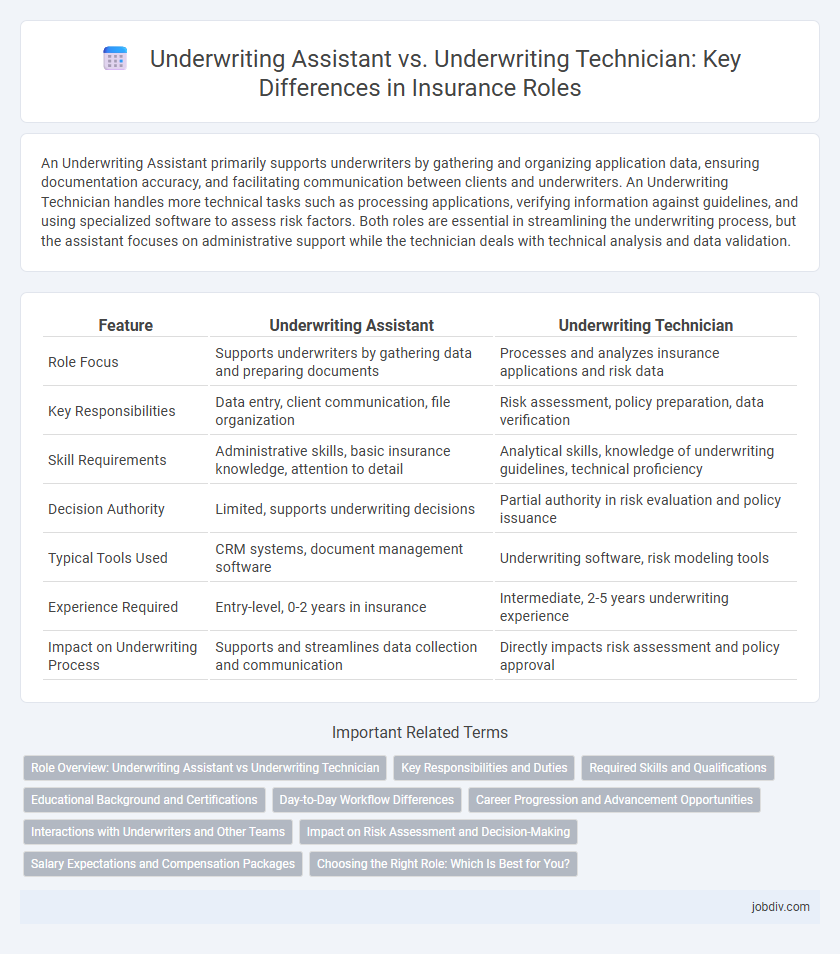

An Underwriting Assistant primarily supports underwriters by gathering and organizing application data, ensuring documentation accuracy, and facilitating communication between clients and underwriters. An Underwriting Technician handles more technical tasks such as processing applications, verifying information against guidelines, and using specialized software to assess risk factors. Both roles are essential in streamlining the underwriting process, but the assistant focuses on administrative support while the technician deals with technical analysis and data validation.

Table of Comparison

| Feature | Underwriting Assistant | Underwriting Technician |

|---|---|---|

| Role Focus | Supports underwriters by gathering data and preparing documents | Processes and analyzes insurance applications and risk data |

| Key Responsibilities | Data entry, client communication, file organization | Risk assessment, policy preparation, data verification |

| Skill Requirements | Administrative skills, basic insurance knowledge, attention to detail | Analytical skills, knowledge of underwriting guidelines, technical proficiency |

| Decision Authority | Limited, supports underwriting decisions | Partial authority in risk evaluation and policy issuance |

| Typical Tools Used | CRM systems, document management software | Underwriting software, risk modeling tools |

| Experience Required | Entry-level, 0-2 years in insurance | Intermediate, 2-5 years underwriting experience |

| Impact on Underwriting Process | Supports and streamlines data collection and communication | Directly impacts risk assessment and policy approval |

Role Overview: Underwriting Assistant vs Underwriting Technician

Underwriting Assistants support underwriters by handling preliminary tasks such as document preparation, data entry, and customer communication to streamline the underwriting process. Underwriting Technicians focus on technical duties, including risk assessment analysis, policy verification, and compliance checks to ensure accurate underwriting decisions. Both roles are critical in managing underwriting workflows but differ in complexity and hands-on involvement with risk evaluation.

Key Responsibilities and Duties

Underwriting Assistants primarily support underwriters by gathering and organizing applicant data, managing documentation, and facilitating communication between clients and underwriters to ensure efficient application processing. Underwriting Technicians perform more specialized tasks such as analyzing risk data, verifying information accuracy, and preparing detailed reports to assist underwriters in decision-making. Both roles contribute to risk assessment, but Underwriting Technicians typically handle more technical and analytical responsibilities compared to the administrative focus of Underwriting Assistants.

Required Skills and Qualifications

Underwriting Assistants require strong analytical skills, attention to detail, and proficient knowledge of insurance principles, with qualifications often including a bachelor's degree in finance or business and experience with underwriting software. Underwriting Technicians need technical expertise in data processing, familiarity with insurance policies and regulations, and skills in document preparation, commonly holding certifications such as CPCU or specific underwriting licenses. Both roles demand proficiency in risk assessment and communication, but Underwriting Assistants focus more on policy evaluation while Technicians emphasize administrative and technical support tasks.

Educational Background and Certifications

Underwriting Assistants typically hold a bachelor's degree in finance, business, or a related field, often supported by entry-level insurance certifications such as the Chartered Property Casualty Underwriter (CPCU) or Associate in Commercial Underwriting (AU). Underwriting Technicians usually possess specialized certifications like the Insurance Technology Specialist (ITS) and may have vocational training or associate degrees emphasizing technical skills in insurance data analysis and document management. Both roles benefit from certifications that enhance underwriting knowledge, but Underwriting Assistants focus more on theoretical financial education while Underwriting Technicians emphasize practical, technical expertise.

Day-to-Day Workflow Differences

Underwriting Assistants primarily handle data entry, documentation review, and communication coordination to support underwriters, enabling efficient risk assessment. Underwriting Technicians focus on conducting detailed risk analyses, verifying policy information, and preparing underwriting reports that require technical expertise. The day-to-day workflow of Assistants emphasizes administrative support tasks, while Technicians engage in more specialized, analytical underwriting activities.

Career Progression and Advancement Opportunities

Underwriting Assistants often serve as entry-level professionals supporting underwriters by gathering and organizing information, which provides a foundational understanding of insurance risk assessment. Underwriting Technicians possess more specialized skills in analyzing policy data and preparing detailed reports, positioning them for advanced roles within underwriting departments. Career progression for Underwriting Assistants typically involves gaining technical knowledge and moving into Underwriting Technician roles, ultimately leading to senior underwriting or management positions.

Interactions with Underwriters and Other Teams

Underwriting Assistants collaborate closely with underwriters, providing comprehensive support by gathering essential documentation and facilitating communication to streamline the decision-making process. Underwriting Technicians primarily handle technical tasks such as data entry and risk assessment calculations, ensuring accuracy while interacting with actuarial teams and underwriting departments. Both roles require strong coordination skills but differ in the depth of interaction with underwriters, where assistants engage more in direct communication and technicians focus on detailed technical support.

Impact on Risk Assessment and Decision-Making

Underwriting Assistants enhance risk assessment accuracy by efficiently gathering and organizing applicant data, enabling underwriters to make informed decisions faster. Underwriting Technicians support decision-making through detailed data verification and policy documentation, ensuring compliance and reducing errors. Both roles collaboratively improve overall underwriting quality, risk evaluation, and policy approval processes in insurance operations.

Salary Expectations and Compensation Packages

Underwriting Assistants typically earn between $45,000 and $60,000 annually, reflecting their role in supporting underwriters with administrative tasks and data management. Underwriting Technicians command higher salaries ranging from $55,000 to $75,000 due to their specialized skills in risk assessment and policy documentation. Compensation packages for both roles often include health benefits, bonuses, and retirement plans, with Underwriting Technicians receiving more performance-based incentives tied to underwriting accuracy.

Choosing the Right Role: Which Is Best for You?

Choosing between an Underwriting Assistant and an Underwriting Technician depends on your career goals and skill set; Underwriting Assistants typically handle administrative support and data entry, while Underwriting Technicians engage in more technical analysis and risk assessment. Candidates with strong analytical skills and a preference for detailed risk evaluation may find the Underwriting Technician role more aligned with their expertise. Understanding job responsibilities, required qualifications, and growth opportunities can help determine the best fit within the insurance underwriting field.

Underwriting Assistant vs Underwriting Technician Infographic

jobdiv.com

jobdiv.com