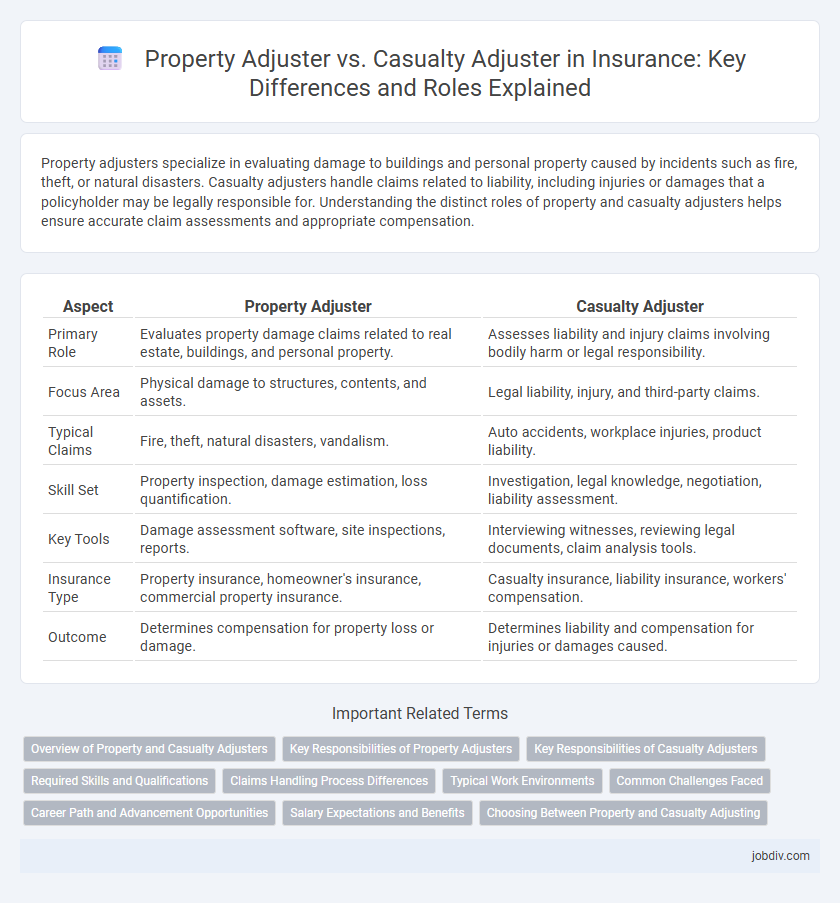

Property adjusters specialize in evaluating damage to buildings and personal property caused by incidents such as fire, theft, or natural disasters. Casualty adjusters handle claims related to liability, including injuries or damages that a policyholder may be legally responsible for. Understanding the distinct roles of property and casualty adjusters helps ensure accurate claim assessments and appropriate compensation.

Table of Comparison

| Aspect | Property Adjuster | Casualty Adjuster |

|---|---|---|

| Primary Role | Evaluates property damage claims related to real estate, buildings, and personal property. | Assesses liability and injury claims involving bodily harm or legal responsibility. |

| Focus Area | Physical damage to structures, contents, and assets. | Legal liability, injury, and third-party claims. |

| Typical Claims | Fire, theft, natural disasters, vandalism. | Auto accidents, workplace injuries, product liability. |

| Skill Set | Property inspection, damage estimation, loss quantification. | Investigation, legal knowledge, negotiation, liability assessment. |

| Key Tools | Damage assessment software, site inspections, reports. | Interviewing witnesses, reviewing legal documents, claim analysis tools. |

| Insurance Type | Property insurance, homeowner's insurance, commercial property insurance. | Casualty insurance, liability insurance, workers' compensation. |

| Outcome | Determines compensation for property loss or damage. | Determines liability and compensation for injuries or damages caused. |

Overview of Property and Casualty Adjusters

Property adjusters specialize in evaluating damage and loss related to real estate, personal property, and physical assets, ensuring accurate claim assessments for homeowners and businesses. Casualty adjusters focus on liabilities and injuries resulting from accidents, theft, or negligence, handling claims that involve bodily harm or legal responsibility. Both adjusters play crucial roles in the insurance industry by investigating claims, determining coverage, and negotiating settlements to facilitate fair and speedy resolution.

Key Responsibilities of Property Adjusters

Property adjusters specialize in assessing physical damage to real estate and personal property following events such as fires, storms, or vandalism. They meticulously inspect, document, and estimate repair or replacement costs to ensure accurate claim settlements aligned with policy terms. Their role involves coordinating with contractors, policyholders, and insurance companies to facilitate timely and fair compensation for property damages.

Key Responsibilities of Casualty Adjusters

Casualty adjusters investigate insurance claims involving bodily injury, liability, and property damage to determine coverage and verify claim validity. They analyze accident reports, interview witnesses, and assess damages to estimate settlement amounts accurately. Their expertise in legal regulations and liability assessment is essential for resolving claims involving third-party injuries and losses.

Required Skills and Qualifications

Property adjusters require strong knowledge of real estate valuation, construction, and property damage assessment, along with excellent negotiation and analytical skills. Casualty adjusters must have expertise in liability laws, personal injury claims, and accident investigation, complemented by strong interpersonal and critical thinking abilities. Both roles typically demand relevant insurance licenses and proficiency in claims management software.

Claims Handling Process Differences

Property adjusters specialize in assessing damages to real estate and physical assets, conducting detailed inspections to estimate repair costs and validate property insurance claims. Casualty adjusters focus on liability claims involving injuries or damages to people and third-party properties, investigating incidents, interviewing witnesses, and determining fault to manage claims effectively. The claims handling process differs as property adjusters emphasize property valuation, while casualty adjusters prioritize liability assessment and legal implications.

Typical Work Environments

Property adjusters typically operate in environments dealing with residential and commercial property damage, frequently visiting disaster sites, homes, and buildings to assess physical damages. Casualty adjusters often work in settings related to liability claims, such as accidents, injuries, and legal settlements, interacting with claimants, legal professionals, and medical facilities. Both roles require dynamic, on-site assessments combined with office work for documentation and communication with insurance companies.

Common Challenges Faced

Property adjusters and casualty adjusters commonly face challenges such as accurately assessing damages amidst incomplete or conflicting information and managing claimant expectations during complex loss evaluations. Both must navigate issues like fraud detection, policy interpretation discrepancies, and fluctuating market costs while maintaining compliance with regulatory requirements. Effective communication and thorough investigative skills are essential to resolve disputes and expedite claim settlements efficiently.

Career Path and Advancement Opportunities

Property adjusters specialize in evaluating damages to real estate and personal property, often progressing to senior adjuster or claims manager roles within the property insurance sector. Casualty adjusters focus on liability claims, including bodily injury and legal responsibility, with career advancements into specialized risk assessment or claims supervision positions. Both paths offer certifications like Licensed Adjuster or Chartered Property Casualty Underwriter (CPCU) that enhance career growth and industry recognition.

Salary Expectations and Benefits

Property adjusters typically earn a median salary ranging from $50,000 to $70,000 annually, with benefits often including health insurance, retirement plans, and performance bonuses. Casualty adjusters generally see a slightly higher salary range, approximately $55,000 to $75,000 per year, reflecting the complexity of liability and injury claims they handle, coupled with similar benefits such as paid time off and professional development opportunities. Both roles may offer overtime pay and expense reimbursements, but casualty adjusters often receive additional incentives due to the higher stakes involved in casualty claims.

Choosing Between Property and Casualty Adjusting

Choosing between property and casualty adjusting depends on the specific types of claims handled; property adjusters specialize in assessing damage to homes, buildings, and personal property after incidents like fires or natural disasters, while casualty adjusters focus on liability claims involving injuries, accidents, and legal responsibilities. Understanding the policy coverage and the nature of the loss is essential to determine whether expertise in property damage or casualty liability is required. Selecting the appropriate adjuster ensures accurate claim evaluation, fair settlements, and compliance with insurance regulations.

Property Adjuster vs Casualty Adjuster Infographic

jobdiv.com

jobdiv.com