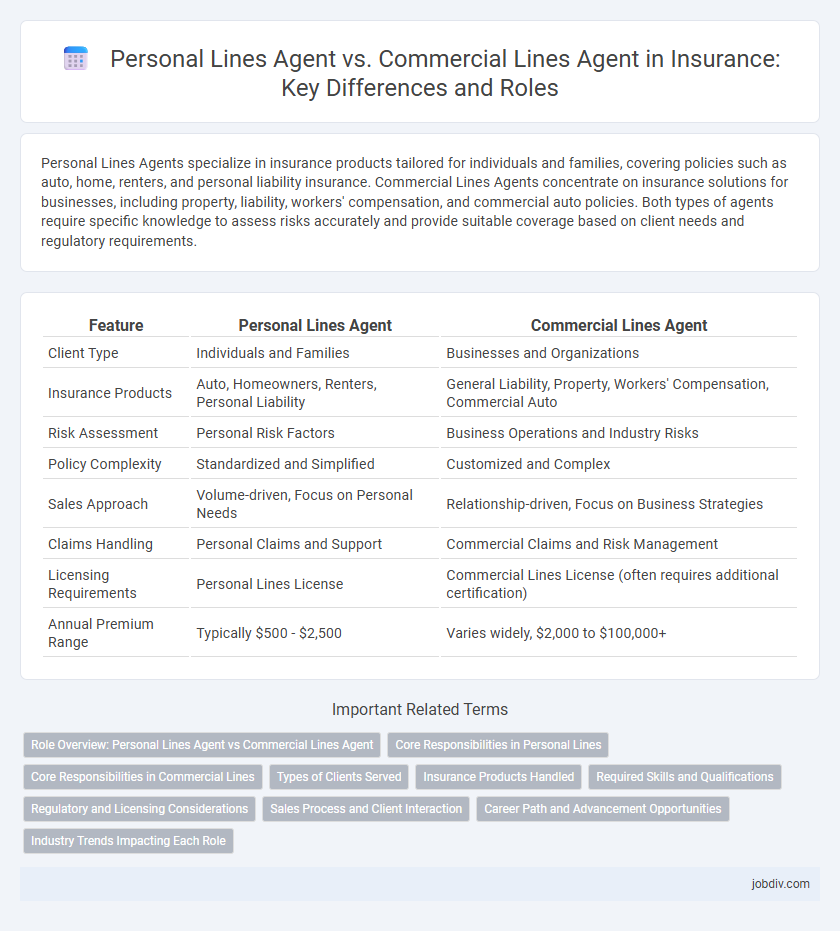

Personal Lines Agents specialize in insurance products tailored for individuals and families, covering policies such as auto, home, renters, and personal liability insurance. Commercial Lines Agents concentrate on insurance solutions for businesses, including property, liability, workers' compensation, and commercial auto policies. Both types of agents require specific knowledge to assess risks accurately and provide suitable coverage based on client needs and regulatory requirements.

Table of Comparison

| Feature | Personal Lines Agent | Commercial Lines Agent |

|---|---|---|

| Client Type | Individuals and Families | Businesses and Organizations |

| Insurance Products | Auto, Homeowners, Renters, Personal Liability | General Liability, Property, Workers' Compensation, Commercial Auto |

| Risk Assessment | Personal Risk Factors | Business Operations and Industry Risks |

| Policy Complexity | Standardized and Simplified | Customized and Complex |

| Sales Approach | Volume-driven, Focus on Personal Needs | Relationship-driven, Focus on Business Strategies |

| Claims Handling | Personal Claims and Support | Commercial Claims and Risk Management |

| Licensing Requirements | Personal Lines License | Commercial Lines License (often requires additional certification) |

| Annual Premium Range | Typically $500 - $2,500 | Varies widely, $2,000 to $100,000+ |

Role Overview: Personal Lines Agent vs Commercial Lines Agent

Personal Lines Agents specialize in insuring individuals and families, offering coverage for personal assets such as homes, autos, and personal liability. Commercial Lines Agents focus on businesses, providing tailored insurance solutions like property, liability, workers' compensation, and commercial auto policies. Both roles require in-depth knowledge of risk assessment and regulatory compliance but differ significantly in client type and policy complexity.

Core Responsibilities in Personal Lines

Personal Lines Agents specialize in managing insurance policies for individuals, including auto, home, renters, and personal liability coverage. They assess clients' personal risks, recommend suitable coverage options, and assist with policy changes and claims tailored to individual needs. Their core responsibilities involve building relationships with consumers, providing personalized service, and ensuring policy compliance with state regulations.

Core Responsibilities in Commercial Lines

Commercial Lines Agents specialize in providing insurance solutions tailored for businesses, including property, liability, and workers' compensation coverage. Their core responsibilities involve assessing complex risk exposures, customizing policies to meet diverse commercial needs, and maintaining compliance with industry regulations. These agents collaborate closely with brokers and underwriters to develop comprehensive coverage plans that protect business assets and mitigate financial risks.

Types of Clients Served

Personal lines agents specialize in serving individual clients by providing insurance products tailored to personal needs such as auto, home, and renters insurance. Commercial lines agents focus on business clients, offering coverage for commercial property, liability, workers' compensation, and specialized commercial policies. The distinction in client types directly influences the expertise and product offerings required for each agent category.

Insurance Products Handled

Personal lines agents specialize in insurance products designed for individuals and families, such as auto, homeowners, renters, and personal umbrella policies. Commercial lines agents handle insurance solutions tailored for businesses, including general liability, commercial property, workers' compensation, and business interruption coverage. Each agent focuses on distinct risk profiles to meet the specific needs of either personal or commercial clients.

Required Skills and Qualifications

Personal Lines Agents require in-depth knowledge of personal insurance products such as homeowners, auto, and renters insurance, along with strong customer service and communication skills to deal directly with individual clients. Commercial Lines Agents must possess expertise in complex commercial policies, risk management, and underwriting processes, coupled with analytical abilities to assess business needs and negotiate tailored coverage. Both roles typically require state licensing, a background in sales, and continuous education to stay updated on regulatory changes and industry trends.

Regulatory and Licensing Considerations

Personal lines agents typically require state-specific licenses focused on individual consumer policies such as home, auto, and renters insurance, adhering to regulations designed to protect personal policyholders. Commercial lines agents must obtain licenses that cover broader risk categories, including business property, liability, and workers' compensation insurance, often facing more stringent regulatory compliance due to increased liability exposure. Understanding state insurance department requirements and continuing education mandates is critical for both agents to maintain licensure and effectively serve their respective markets.

Sales Process and Client Interaction

Personal Lines Agents focus on individual clients, tailoring policies like auto, home, and renters insurance through a streamlined sales process emphasizing personalized service and risk assessment. Commercial Lines Agents handle business clients, requiring detailed analysis of complex exposures and customized coverage, often involving multi-step negotiations and ongoing risk management consultations. Client interaction in personal lines centers on quick, empathetic communication, whereas commercial lines demand in-depth collaboration and long-term relationship building to address evolving business needs.

Career Path and Advancement Opportunities

Personal Lines Agents typically focus on individual clients, selling auto, home, and renters insurance, which offers steady career growth through specialization in customer service and policy management. Commercial Lines Agents handle business insurance needs such as liability, property, and workers' compensation, providing opportunities for advancement into complex risk assessment and account management roles. The commercial sector generally provides broader career paths with higher earning potential due to the complexity and scale of business insurance solutions.

Industry Trends Impacting Each Role

Personal lines agents face increasing demand for digital tools and personalized customer experiences driven by evolving consumer expectations and the rise of insurtech innovations. Commercial lines agents must adapt to complex risk management challenges associated with regulatory changes, cyber liability exposures, and the growing need for specialized industry knowledge. The insurance industry trend toward automation and data analytics impacts both roles differently, as personal lines focus on streamlined client interactions while commercial lines emphasize customized risk solutions.

Personal Lines Agent vs Commercial Lines Agent Infographic

jobdiv.com

jobdiv.com