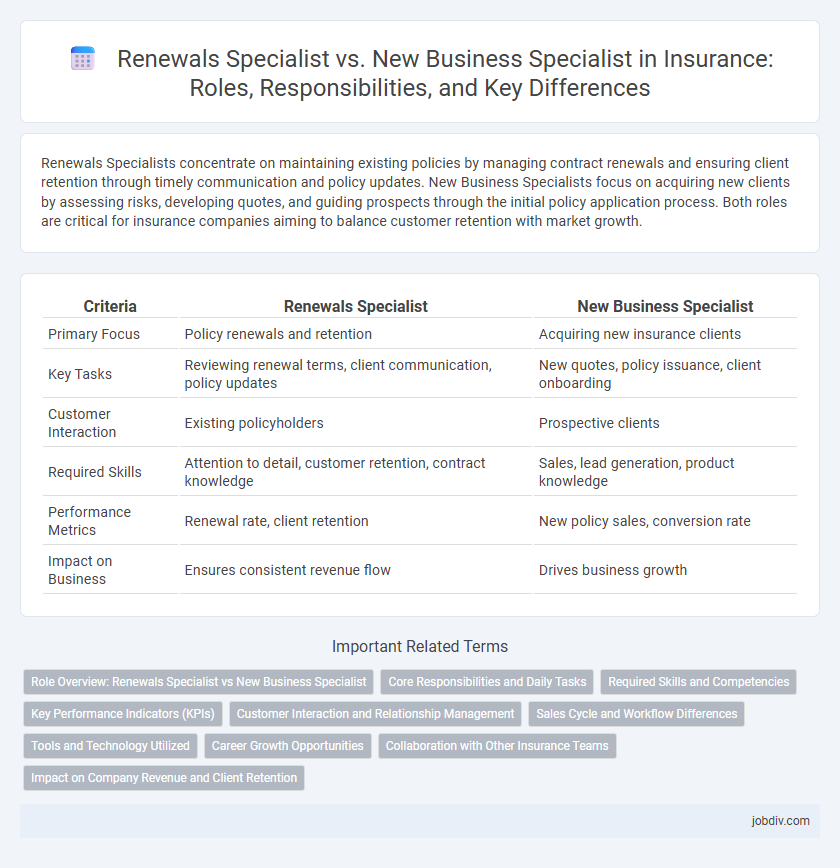

Renewals Specialists concentrate on maintaining existing policies by managing contract renewals and ensuring client retention through timely communication and policy updates. New Business Specialists focus on acquiring new clients by assessing risks, developing quotes, and guiding prospects through the initial policy application process. Both roles are critical for insurance companies aiming to balance customer retention with market growth.

Table of Comparison

| Criteria | Renewals Specialist | New Business Specialist |

|---|---|---|

| Primary Focus | Policy renewals and retention | Acquiring new insurance clients |

| Key Tasks | Reviewing renewal terms, client communication, policy updates | New quotes, policy issuance, client onboarding |

| Customer Interaction | Existing policyholders | Prospective clients |

| Required Skills | Attention to detail, customer retention, contract knowledge | Sales, lead generation, product knowledge |

| Performance Metrics | Renewal rate, client retention | New policy sales, conversion rate |

| Impact on Business | Ensures consistent revenue flow | Drives business growth |

Role Overview: Renewals Specialist vs New Business Specialist

Renewals Specialists manage policy renewals by evaluating risk, updating client information, and ensuring continuous coverage to minimize lapses and improve retention rates. New Business Specialists focus on acquiring new clients, conducting risk assessments, preparing quotes, and facilitating policy issuance to expand the insurer's client base. Both roles require strong communication skills, but Renewals Specialists emphasize relationship management while New Business Specialists prioritize sales and underwriting expertise.

Core Responsibilities and Daily Tasks

Renewals Specialists focus on managing policy renewals by reviewing existing contracts, assessing risk, and ensuring client retention through timely communication and policy adjustments. New Business Specialists prioritize acquiring new clients, conducting risk assessments, quoting policies, and guiding prospects through application processes. Both roles require collaboration with underwriters and customer service teams but differ fundamentally in targeting retention versus new policy acquisition.

Required Skills and Competencies

Renewals Specialists require strong skills in policy management, client retention, and attention to detail to ensure seamless contract renewals and minimize lapses. New Business Specialists must excel in sales techniques, prospecting, and risk assessment to successfully acquire new clients and tailor insurance solutions. Both roles demand excellent communication, negotiation abilities, and a thorough understanding of insurance products and regulatory compliance.

Key Performance Indicators (KPIs)

Renewals Specialists primarily track retention rates, renewal conversion percentages, and policy lapse frequencies to measure client loyalty and revenue stability. New Business Specialists emphasize lead conversion rates, quote-to-sale ratios, and new policy acquisition numbers to evaluate market expansion and sales effectiveness. Both roles rely on customer satisfaction scores and average handling time to optimize service quality and operational efficiency in insurance sales processes.

Customer Interaction and Relationship Management

Renewals Specialists concentrate on maintaining and nurturing existing client relationships by managing policy renewals, ensuring customer satisfaction, and addressing concerns to secure ongoing business. New Business Specialists focus on acquiring new customers through targeted outreach, personalized consultations, and educating prospects about insurance offerings and benefits. Both roles require strong communication skills but differ in their approach, with Renewals Specialists emphasizing retention and loyalty, while New Business Specialists prioritize expansion and market growth.

Sales Cycle and Workflow Differences

Renewals Specialists concentrate on managing existing client policies by facilitating contract renewals, ensuring continuous coverage, and addressing policy adjustments, which streamlines the sales cycle through relationship maintenance and retention strategies. New Business Specialists engage in prospecting, qualifying leads, and guiding potential customers through an initial purchase process, resulting in a longer, more complex sales cycle focused on customer acquisition and underwriting evaluations. Workflow differences highlight that Renewals Specialists prioritize client communication and policy renewals with scheduled reminders, whereas New Business Specialists implement lead generation techniques, proposal presentations, and risk assessments within their sales pipeline.

Tools and Technology Utilized

Renewals Specialists primarily utilize customer relationship management (CRM) systems and automated email marketing tools to track policy expiration dates and streamline renewal communications. New Business Specialists depend on quoting software, digital underwriting platforms, and online application portals to manage new client acquisition and policy issuance efficiently. Both roles leverage data analytics tools to assess client needs and optimize policy offers, but their technology stacks differ to support their distinct workflows.

Career Growth Opportunities

Renewals Specialists develop deep expertise in client retention strategies and policy lifecycle management, positioning themselves for roles in account management or client relations leadership. New Business Specialists gain critical skills in market analysis, lead generation, and sales techniques, which can accelerate advancement into business development and strategic sales management positions. Both career paths offer growth through specialized knowledge, with Renewals Specialists often progressing into customer success roles and New Business Specialists advancing toward executive sales positions.

Collaboration with Other Insurance Teams

Renewals Specialists collaborate closely with underwriting, claims, and customer service teams to ensure seamless policy renewals and maintain client satisfaction. New Business Specialists coordinate with marketing, sales, and underwriting departments to streamline the onboarding process for new clients and optimize policy issuance. Effective communication between these specialists and internal teams enhances operational efficiency and drives overall business growth in the insurance sector.

Impact on Company Revenue and Client Retention

Renewals Specialists drive consistent company revenue by ensuring timely policy renewals and minimizing lapses, directly boosting client retention through sustained customer engagement. New Business Specialists contribute to revenue growth by acquiring fresh clients and expanding market share, though their impact on retention is limited without effective renewal processes. Balancing both roles enhances overall financial stability and long-term client loyalty for insurance companies.

Renewals Specialist vs New Business Specialist Infographic

jobdiv.com

jobdiv.com