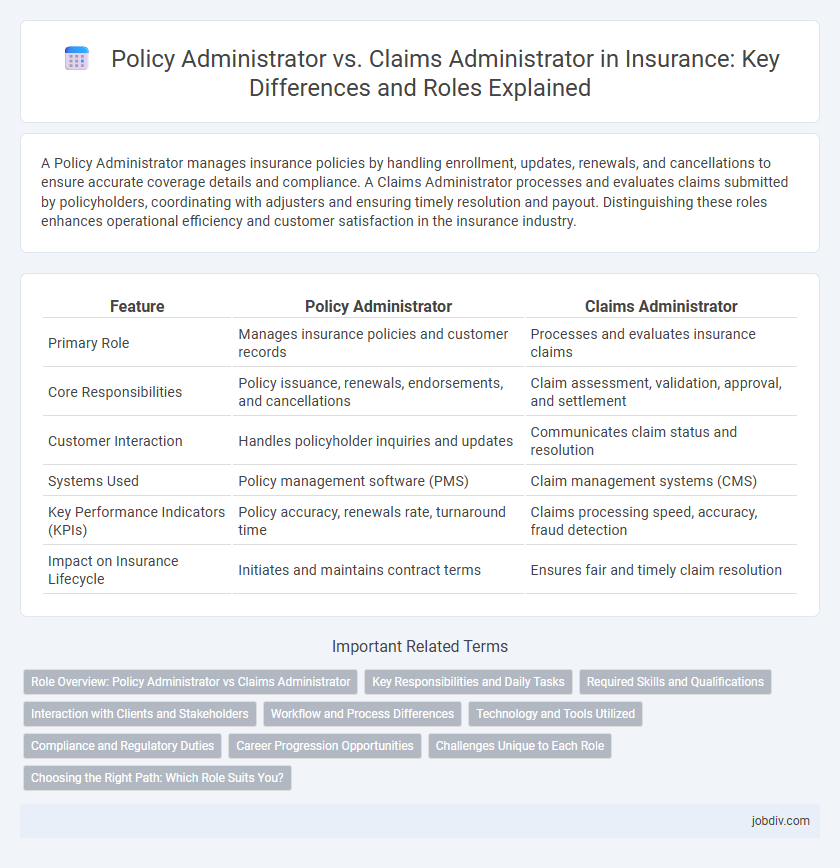

A Policy Administrator manages insurance policies by handling enrollment, updates, renewals, and cancellations to ensure accurate coverage details and compliance. A Claims Administrator processes and evaluates claims submitted by policyholders, coordinating with adjusters and ensuring timely resolution and payout. Distinguishing these roles enhances operational efficiency and customer satisfaction in the insurance industry.

Table of Comparison

| Feature | Policy Administrator | Claims Administrator |

|---|---|---|

| Primary Role | Manages insurance policies and customer records | Processes and evaluates insurance claims |

| Core Responsibilities | Policy issuance, renewals, endorsements, and cancellations | Claim assessment, validation, approval, and settlement |

| Customer Interaction | Handles policyholder inquiries and updates | Communicates claim status and resolution |

| Systems Used | Policy management software (PMS) | Claim management systems (CMS) |

| Key Performance Indicators (KPIs) | Policy accuracy, renewals rate, turnaround time | Claims processing speed, accuracy, fraud detection |

| Impact on Insurance Lifecycle | Initiates and maintains contract terms | Ensures fair and timely claim resolution |

Role Overview: Policy Administrator vs Claims Administrator

Policy Administrators manage the entire lifecycle of insurance policies, including issuing, updating, and renewing contracts while ensuring regulatory compliance. Claims Administrators focus on processing insurance claims efficiently, verifying coverage, assessing damages, and coordinating settlements to support customer satisfaction. Both roles require strong attention to detail and knowledge of insurance products but differ primarily in their focus on policy management versus claims resolution.

Key Responsibilities and Daily Tasks

Policy Administrators manage insurance policies by handling tasks such as policy issuance, endorsements, renewals, and maintaining accurate client records to ensure compliance with regulatory standards. Claims Administrators focus on processing insurance claims, verifying coverage, investigating claims validity, coordinating with adjusters, and facilitating timely settlements to support customer satisfaction. Both roles require strong attention to detail and communication skills, but Policy Administrators prioritize policy lifecycle management while Claims Administrators concentrate on claims adjudication and resolution.

Required Skills and Qualifications

Policy Administrators require strong analytical skills, attention to detail, and proficiency in policy management software to effectively handle underwriting data and policy issuance. Claims Administrators need expertise in claims processing, excellent negotiation abilities, knowledge of legal regulations, and experience with claims management systems to assess and settle claims accurately. Both roles demand good communication skills and a background in insurance principles, but Claims Administrators often require deeper legal and investigative knowledge.

Interaction with Clients and Stakeholders

Policy Administrators manage client interactions by ensuring accurate policy documentation and addressing coverage inquiries, maintaining clear communication with underwriters and agents. Claims Administrators engage directly with claimants and stakeholders to validate losses, coordinate investigations, and facilitate timely claim resolutions. Effective collaboration between both roles enhances client satisfaction and streamlines the insurance process.

Workflow and Process Differences

Policy administrators manage the end-to-end workflow of insurance policy lifecycle, including issuance, modifications, renewals, and cancellations, ensuring accurate documentation and compliance with underwriting guidelines. Claims administrators handle the claims process, from claim intake and validation to investigation, adjudication, and settlement, optimizing workflows for efficient claim resolution and fraud prevention. The key process difference lies in policy administrators focusing on proactive policy management, while claims administrators focus on reactive claims handling and customer support post-loss event.

Technology and Tools Utilized

Policy administrators leverage advanced policy management systems and automation tools to streamline underwriting, policy issuance, and renewals, enhancing accuracy and efficiency. Claims administrators utilize specialized claims management software integrated with AI-powered analytics and digital communication platforms to expedite claim processing, fraud detection, and customer service. Both roles increasingly rely on cloud-based technologies and data analytics for real-time updates and improved decision-making in the insurance lifecycle.

Compliance and Regulatory Duties

Policy administrators ensure compliance by maintaining accurate records, adhering to underwriting guidelines, and managing policy renewals in accordance with regulatory standards. Claims administrators focus on regulatory duties by validating claims legitimacy, ensuring timely processing, and enforcing anti-fraud measures while complying with legal requirements. Both roles require thorough knowledge of insurance laws and regulatory frameworks to mitigate risks and uphold organizational integrity.

Career Progression Opportunities

Career progression for a Policy Administrator often leads to roles in underwriting, insurance sales, or policy management, leveraging expertise in policy documentation and client communication. Claims Administrators typically advance into claims adjuster, claims manager, or risk assessment positions, focusing on damage evaluation, claims processing, and fraud detection. Both paths offer opportunities to specialize in areas like compliance, customer service leadership, or insurance operations, depending on industry demand and individual skills.

Challenges Unique to Each Role

Policy administrators face challenges like managing complex policy documents, ensuring regulatory compliance, and updating coverage details accurately to prevent disputes. Claims administrators encounter difficulties in verifying claim legitimacy, handling fraud detection, and managing timely settlements while maintaining client satisfaction. Both roles require specialized knowledge, but policy administrators emphasize contract accuracy, whereas claims administrators focus on claims validation and risk assessment.

Choosing the Right Path: Which Role Suits You?

Choosing between a Policy Administrator and a Claims Administrator depends on your strengths and career goals within the insurance industry. Policy Administrators specialize in managing insurance policies, ensuring accuracy in documentation and renewals, while Claims Administrators focus on processing and evaluating claims to facilitate timely settlements. Understanding the technical skills and customer service demands of each role will help you determine the best fit based on your attention to detail and interpersonal capabilities.

Policy Administrator vs Claims Administrator Infographic

jobdiv.com

jobdiv.com