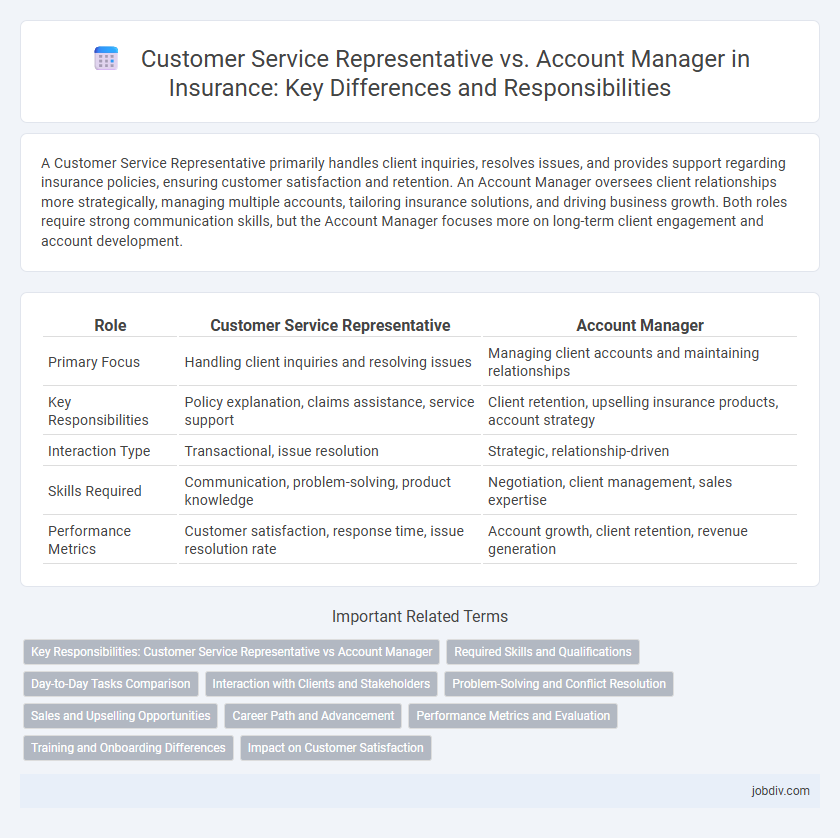

A Customer Service Representative primarily handles client inquiries, resolves issues, and provides support regarding insurance policies, ensuring customer satisfaction and retention. An Account Manager oversees client relationships more strategically, managing multiple accounts, tailoring insurance solutions, and driving business growth. Both roles require strong communication skills, but the Account Manager focuses more on long-term client engagement and account development.

Table of Comparison

| Role | Customer Service Representative | Account Manager |

|---|---|---|

| Primary Focus | Handling client inquiries and resolving issues | Managing client accounts and maintaining relationships |

| Key Responsibilities | Policy explanation, claims assistance, service support | Client retention, upselling insurance products, account strategy |

| Interaction Type | Transactional, issue resolution | Strategic, relationship-driven |

| Skills Required | Communication, problem-solving, product knowledge | Negotiation, client management, sales expertise |

| Performance Metrics | Customer satisfaction, response time, issue resolution rate | Account growth, client retention, revenue generation |

Key Responsibilities: Customer Service Representative vs Account Manager

Customer Service Representatives in insurance primarily handle policy inquiries, process claims, and resolve customer issues to ensure client satisfaction. Account Managers focus on developing client relationships, managing insurance portfolios, and providing tailored risk management solutions to meet business needs. Both roles require strong communication skills and industry knowledge, but Account Managers emphasize strategic account growth while Customer Service Representatives prioritize day-to-day client support.

Required Skills and Qualifications

Customer Service Representatives in insurance require strong communication skills, empathy, and problem-solving abilities to handle client inquiries and claims effectively. Account Managers need expertise in client relationship management, negotiation skills, and in-depth knowledge of insurance products to develop and maintain long-term customer accounts. Both roles demand proficiency in industry software, attention to detail, and a customer-focused mindset to ensure high satisfaction and retention rates.

Day-to-Day Tasks Comparison

Customer Service Representatives in insurance handle policy inquiries, process claims, and resolve customer issues, ensuring timely communication and support. Account Managers focus on maintaining client relationships, managing policy renewals, and advising on coverage adjustments to meet evolving needs. Both roles require strong interpersonal skills, but Account Managers engage in strategic planning while Customer Service Representatives emphasize operational assistance.

Interaction with Clients and Stakeholders

Customer Service Representatives in insurance focus on resolving client inquiries and processing policy changes, ensuring prompt and accurate communication to maintain customer satisfaction. Account Managers build long-term relationships by managing portfolios, coordinating with multiple stakeholders, and tailoring insurance solutions to meet complex client needs. Both roles require strong interpersonal skills, but Account Managers engage more in strategic discussions and personalized service compared to the transactional support provided by Customer Service Representatives.

Problem-Solving and Conflict Resolution

Customer Service Representatives in insurance focus on immediate problem-solving by addressing policy inquiries and claim issues with efficiency and empathy, ensuring customer satisfaction through clear communication. Account Managers handle more complex conflict resolution by managing ongoing client relationships, negotiating policy adjustments, and mitigating potential disputes to retain long-term accounts. Both roles require strong interpersonal skills, but Account Managers leverage strategic conflict resolution techniques to align insurance solutions with client needs.

Sales and Upselling Opportunities

Customer Service Representatives in insurance primarily handle client inquiries and resolve policy issues, ensuring customer satisfaction without focusing heavily on sales. Account Managers actively pursue sales and upselling opportunities by managing client portfolios, identifying needs for additional coverage, and promoting tailored insurance products. Their proactive approach directly contributes to revenue growth through renewals and expansion of client accounts.

Career Path and Advancement

A Customer Service Representative in insurance typically begins with handling client inquiries and resolving policy issues, providing a foundation in customer interaction and product knowledge crucial for career growth. Advancement often leads to roles such as Account Manager, where responsibilities expand to managing client portfolios, underwriting, and strategic account development, reflecting a shift towards higher-level client relations and business acumen. Account Managers possess greater decision-making authority and typically earn higher compensation, making this transition a key milestone in an insurance career path focused on leadership and specialized expertise.

Performance Metrics and Evaluation

Customer Service Representatives in insurance are primarily evaluated on metrics such as call resolution time, customer satisfaction scores, and first-contact resolution rates. Account Managers focus on performance indicators like policy retention rates, premium growth, and client portfolio profitability. Both roles rely heavily on customer feedback and compliance adherence to measure effectiveness and drive continuous improvement.

Training and Onboarding Differences

Customer Service Representatives in insurance typically undergo comprehensive training focused on policy details, claims processing, and customer interaction protocols to efficiently handle inquiries and resolve issues. Account Managers receive specialized onboarding that emphasizes client relationship management, portfolio analysis, and strategic upselling to foster long-term partnerships and optimize account growth. Both roles require ongoing education; however, Account Managers prioritize advanced negotiation and risk assessment skills, while Customer Service Representatives focus on compliance and communication techniques.

Impact on Customer Satisfaction

Customer Service Representatives directly handle inquiries and resolve issues, providing immediate support that significantly enhances customer satisfaction through timely and accurate assistance. Account Managers build long-term relationships by understanding client needs and offering tailored solutions, which fosters trust and loyalty, ultimately improving overall satisfaction. Both roles impact customer satisfaction differently: representatives ensure day-to-day problem resolution, while account managers drive strategic engagement and retention.

Customer Service Representative vs Account Manager Infographic

jobdiv.com

jobdiv.com