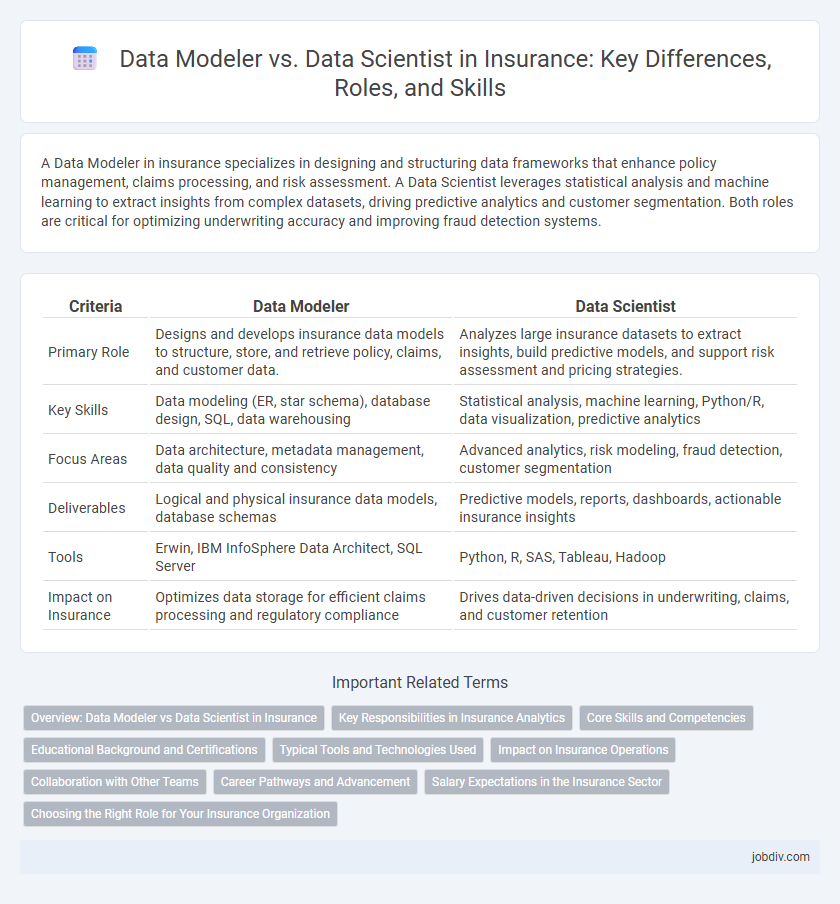

A Data Modeler in insurance specializes in designing and structuring data frameworks that enhance policy management, claims processing, and risk assessment. A Data Scientist leverages statistical analysis and machine learning to extract insights from complex datasets, driving predictive analytics and customer segmentation. Both roles are critical for optimizing underwriting accuracy and improving fraud detection systems.

Table of Comparison

| Criteria | Data Modeler | Data Scientist |

|---|---|---|

| Primary Role | Designs and develops insurance data models to structure, store, and retrieve policy, claims, and customer data. | Analyzes large insurance datasets to extract insights, build predictive models, and support risk assessment and pricing strategies. |

| Key Skills | Data modeling (ER, star schema), database design, SQL, data warehousing | Statistical analysis, machine learning, Python/R, data visualization, predictive analytics |

| Focus Areas | Data architecture, metadata management, data quality and consistency | Advanced analytics, risk modeling, fraud detection, customer segmentation |

| Deliverables | Logical and physical insurance data models, database schemas | Predictive models, reports, dashboards, actionable insurance insights |

| Tools | Erwin, IBM InfoSphere Data Architect, SQL Server | Python, R, SAS, Tableau, Hadoop |

| Impact on Insurance | Optimizes data storage for efficient claims processing and regulatory compliance | Drives data-driven decisions in underwriting, claims, and customer retention |

Overview: Data Modeler vs Data Scientist in Insurance

Data Modelers in insurance specialize in designing data architectures and schemas that optimize the organization and retrieval of complex insurance datasets. Data Scientists focus on analyzing these datasets using advanced statistical techniques and machine learning to identify risk patterns, predict claims, and improve underwriting accuracy. Both roles collaborate to enhance data-driven decision-making, with Data Modelers ensuring data integrity and structure while Data Scientists extract actionable insights to optimize insurance operations.

Key Responsibilities in Insurance Analytics

Data Modelers in insurance analytics primarily design and maintain structured databases, creating data schemas that optimize risk assessment and policy pricing accuracy. Data Scientists focus on analyzing complex datasets using machine learning algorithms to predict claim probabilities, detect fraud, and enhance customer segmentation. Both roles collaborate to transform raw insurance data into actionable insights, driving underwriting efficiency and improving loss prevention strategies.

Core Skills and Competencies

In insurance, Data Modelers excel in designing and implementing statistical models that accurately assess risk and predict claims, leveraging strong expertise in SQL, data warehousing, and data integration techniques. Data Scientists bring advanced machine learning, programming in Python or R, and exploratory data analysis skills to uncover patterns and optimize underwriting processes. Both roles require a deep understanding of insurance domain knowledge, but Data Scientists typically emphasize predictive analytics and algorithm development, whereas Data Modelers focus on precise model construction and validation.

Educational Background and Certifications

Data Modelers in insurance typically have a strong foundation in computer science, mathematics, or information systems, often holding degrees in these fields complemented by certifications such as CDMP (Certified Data Management Professional). Data Scientists generally possess advanced degrees in statistics, data science, or related quantitative disciplines, with certifications like CAP (Certified Analytics Professional) enhancing their expertise in predictive modeling and machine learning. Both roles benefit from specialized training in insurance analytics and regulatory compliance to effectively manage and interpret complex insurance data.

Typical Tools and Technologies Used

Data Modelers in insurance primarily utilize ERwin, PowerDesigner, and SQL tools to design and manage complex data schemas essential for underwriting and claims processing. Data Scientists leverage Python, R, TensorFlow, and Spark to build predictive models and perform advanced analytics on policyholder data and risk factors. Both roles often collaborate using cloud platforms like AWS and Azure to ensure scalable, secure data storage and computation.

Impact on Insurance Operations

Data Modelers in insurance focus on designing and structuring data frameworks that enhance underwriting accuracy and claims processing efficiency. Data Scientists leverage advanced analytics and machine learning algorithms to identify risk patterns, optimize pricing models, and detect fraudulent activities. Their combined efforts drive improved decision-making, operational agility, and customer-centric product development within insurance companies.

Collaboration with Other Teams

Data Modelers in insurance collaborate closely with underwriting and claims teams to structure and optimize data frameworks that reflect risk assessment and policy performance. Data Scientists integrate insights from marketing and actuarial departments to develop predictive algorithms enhancing customer segmentation and fraud detection. Both roles depend on iterative feedback loops and cross-functional communication to ensure data-driven strategies align with regulatory requirements and business objectives.

Career Pathways and Advancement

Data Modelers in insurance specialize in designing structured data frameworks, enabling efficient risk assessment and policy underwriting. Data Scientists advance by applying machine learning algorithms and predictive analytics to improve claims forecasting and fraud detection, unlocking strategic insights for business growth. Career pathways often shift from foundational data architecture roles to advanced analytical positions, emphasizing continuous skill development in programming, statistics, and domain expertise.

Salary Expectations in the Insurance Sector

Data Scientists in the insurance sector typically command higher salaries than Data Modelers, with median annual earnings around $110,000 compared to $85,000, reflecting the advanced analytical skills and machine learning expertise required. Insurance companies prioritize Data Scientists for complex risk modeling and predictive analytics, driving demand and salary growth. Data Modelers, while essential for structuring and managing data, generally see more stable but lower compensation linked to maintaining data architecture.

Choosing the Right Role for Your Insurance Organization

Choosing between a Data Modeler and a Data Scientist in an insurance organization depends on strategic goals and data complexity. A Data Modeler excels in creating structured data frameworks and optimizing databases critical for risk evaluation and underwriting processes. Data Scientists leverage advanced analytics and machine learning to uncover patterns in claims data, enhancing fraud detection and customer segmentation, driving predictive insights for business growth.

Data Modeler vs Data Scientist Infographic

jobdiv.com

jobdiv.com