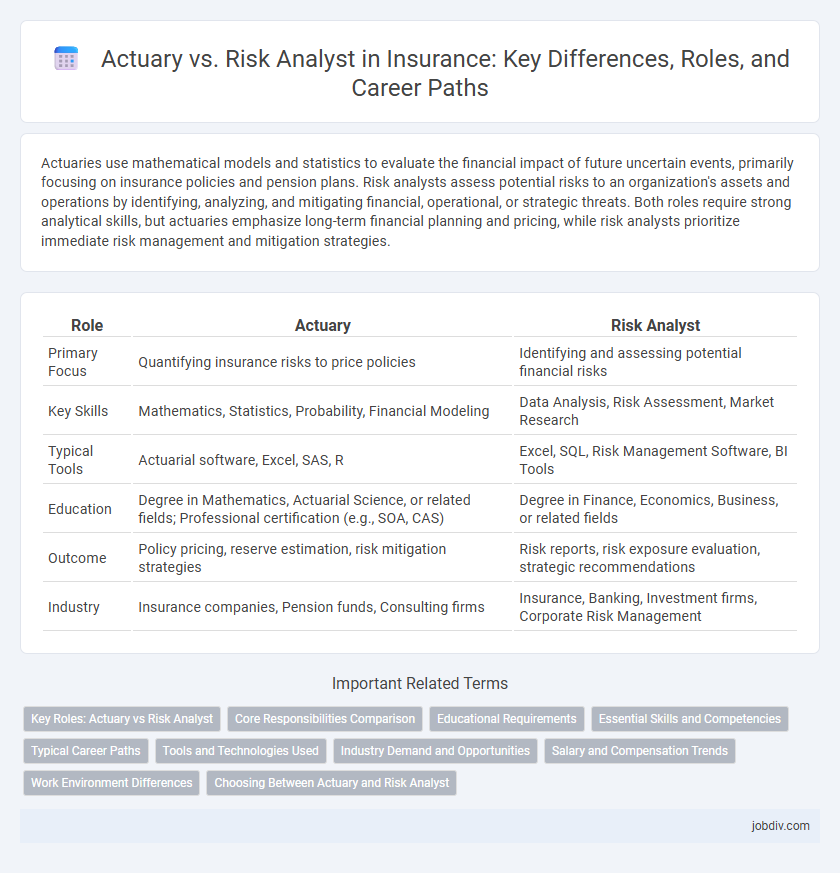

Actuaries use mathematical models and statistics to evaluate the financial impact of future uncertain events, primarily focusing on insurance policies and pension plans. Risk analysts assess potential risks to an organization's assets and operations by identifying, analyzing, and mitigating financial, operational, or strategic threats. Both roles require strong analytical skills, but actuaries emphasize long-term financial planning and pricing, while risk analysts prioritize immediate risk management and mitigation strategies.

Table of Comparison

| Role | Actuary | Risk Analyst |

|---|---|---|

| Primary Focus | Quantifying insurance risks to price policies | Identifying and assessing potential financial risks |

| Key Skills | Mathematics, Statistics, Probability, Financial Modeling | Data Analysis, Risk Assessment, Market Research |

| Typical Tools | Actuarial software, Excel, SAS, R | Excel, SQL, Risk Management Software, BI Tools |

| Education | Degree in Mathematics, Actuarial Science, or related fields; Professional certification (e.g., SOA, CAS) | Degree in Finance, Economics, Business, or related fields |

| Outcome | Policy pricing, reserve estimation, risk mitigation strategies | Risk reports, risk exposure evaluation, strategic recommendations |

| Industry | Insurance companies, Pension funds, Consulting firms | Insurance, Banking, Investment firms, Corporate Risk Management |

Key Roles: Actuary vs Risk Analyst

Actuaries specialize in using mathematical models to evaluate financial risks and determine insurance premiums by analyzing statistical data related to mortality, morbidity, and claim frequencies. Risk analysts focus on identifying, assessing, and mitigating potential losses by examining market trends, operational data, and regulatory impacts to inform strategic decision-making. Both roles support insurance companies but actuaries emphasize long-term financial stability, while risk analysts prioritize immediate risk management and prevention.

Core Responsibilities Comparison

Actuaries specialize in applying mathematics, statistics, and financial theory to assess the probability and financial impact of future events, primarily focusing on pricing insurance policies, reserving, and ensuring regulatory compliance. Risk analysts evaluate potential risks that could negatively affect an organization's assets or earning capacity by analyzing market trends, credit data, and operational risks to develop mitigation strategies. While actuaries emphasize quantifying long-term financial risks using predictive models, risk analysts concentrate more on operational and strategic risk management across broader business contexts.

Educational Requirements

Actuaries typically require a bachelor's degree in mathematics, actuarial science, or statistics, followed by a series of professional exams administered by bodies such as the Society of Actuaries (SOA) or the Casualty Actuarial Society (CAS). Risk analysts usually hold degrees in finance, economics, business administration, or risk management, with less emphasis on rigorous certification exams compared to actuaries. Professional certifications like Financial Risk Manager (FRM) or Chartered Enterprise Risk Analyst (CERA) can enhance a risk analyst's qualifications but are not as standardized as actuarial credentials.

Essential Skills and Competencies

Actuaries excel in advanced mathematical modeling, probability theory, and statistical analysis to evaluate financial risks and design insurance policies, requiring strong skills in economics, finance, and data interpretation. Risk Analysts focus on identifying, assessing, and mitigating operational and market risks through qualitative analysis, scenario evaluation, and knowledge of regulatory compliance and risk management frameworks. Both roles demand proficiency in data analysis tools, critical thinking, and effective communication to support strategic decision-making in the insurance industry.

Typical Career Paths

Actuaries often begin their careers by passing a series of professional exams through organizations such as the Society of Actuaries or the Casualty Actuarial Society, progressing from analyst roles to senior actuary positions in insurance companies or consulting firms. Risk analysts typically start with degrees in finance, economics, or risk management and gain experience in identifying and evaluating financial risks, advancing to roles like risk manager or director of risk management within corporations or financial institutions. Both career paths offer opportunities to specialize in areas such as enterprise risk management, underwriting, or financial modeling.

Tools and Technologies Used

Actuaries primarily utilize statistical software such as SAS, R, and Python for predictive modeling, along with Excel for financial forecasting and risk assessment. Risk analysts often rely on data visualization tools like Tableau and Power BI, supplemented by SQL for database management and risk simulation software to evaluate potential outcomes. Both professionals leverage advanced analytics and big data technologies to enhance risk evaluation and decision-making processes in insurance.

Industry Demand and Opportunities

Actuaries and risk analysts are highly sought-after in the insurance industry, where precise risk assessment drives decision-making and profitability. Actuaries use advanced mathematical models to evaluate long-term financial risks, leading to higher demand in life insurance, pension funds, and health insurance sectors. Risk analysts focus on identifying and mitigating short-term operational and market risks, creating opportunities in underwriting, claims management, and regulatory compliance.

Salary and Compensation Trends

Actuaries typically command higher salaries than risk analysts due to their specialized expertise in statistical modeling and predictive analytics within insurance companies, with median annual compensation often exceeding $110,000. Risk analysts earn comparatively less, averaging around $70,000 to $90,000 annually, reflecting their focus on market and operational risk assessment rather than complex actuarial calculations. Both roles offer strong salary growth potential, driven by increasing demand for data-driven decision-making in underwriting, claims management, and regulatory compliance.

Work Environment Differences

Actuaries typically work in office settings within insurance companies, consulting firms, or government agencies, relying heavily on statistical software and historical data to evaluate financial risks related to insurance policies and pension plans. Risk analysts often operate in more dynamic environments across various industries, including finance and corporate sectors, assessing potential risks through qualitative and quantitative methods to support strategic decision-making. While actuaries focus on long-term risk estimation using complex mathematical models, risk analysts emphasize real-time risk assessment and mitigation in changing market conditions.

Choosing Between Actuary and Risk Analyst

Choosing between an actuary and a risk analyst depends on career goals and skill sets; actuaries specialize in using mathematics, statistics, and financial theory to evaluate the financial impact of risk, primarily within insurance and pension industries. Risk analysts focus on identifying and mitigating potential risks across various sectors by analyzing data trends and implementing risk management strategies. The decision involves considering whether one prefers the rigorous certification path and predictive modeling of an actuary or the broader risk assessment and strategy development role of a risk analyst.

Actuary vs Risk Analyst Infographic

jobdiv.com

jobdiv.com