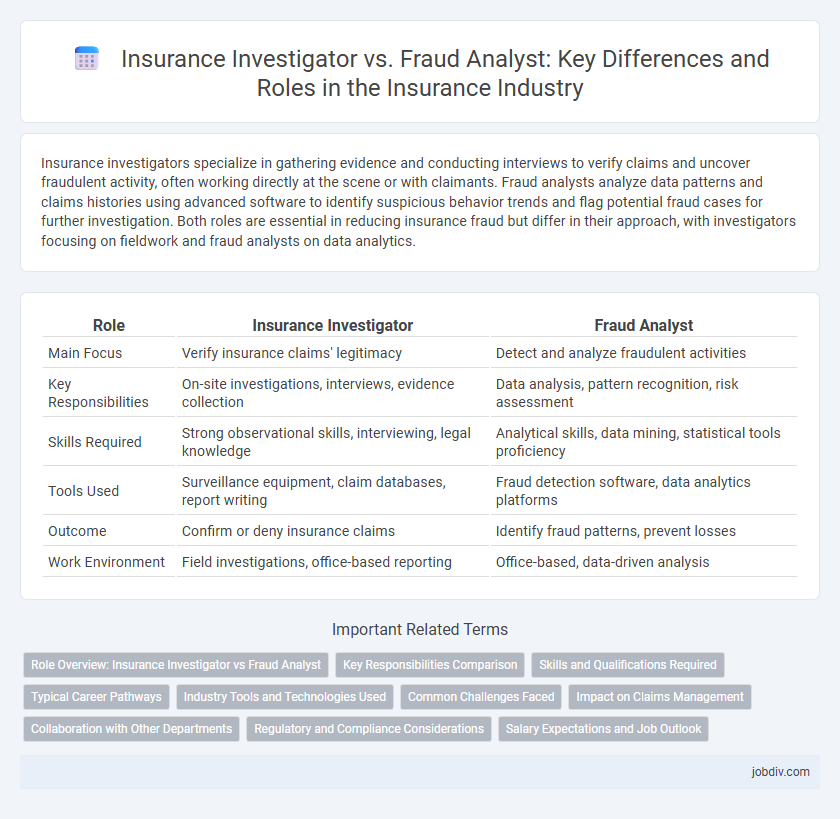

Insurance investigators specialize in gathering evidence and conducting interviews to verify claims and uncover fraudulent activity, often working directly at the scene or with claimants. Fraud analysts analyze data patterns and claims histories using advanced software to identify suspicious behavior trends and flag potential fraud cases for further investigation. Both roles are essential in reducing insurance fraud but differ in their approach, with investigators focusing on fieldwork and fraud analysts on data analytics.

Table of Comparison

| Role | Insurance Investigator | Fraud Analyst |

|---|---|---|

| Main Focus | Verify insurance claims' legitimacy | Detect and analyze fraudulent activities |

| Key Responsibilities | On-site investigations, interviews, evidence collection | Data analysis, pattern recognition, risk assessment |

| Skills Required | Strong observational skills, interviewing, legal knowledge | Analytical skills, data mining, statistical tools proficiency |

| Tools Used | Surveillance equipment, claim databases, report writing | Fraud detection software, data analytics platforms |

| Outcome | Confirm or deny insurance claims | Identify fraud patterns, prevent losses |

| Work Environment | Field investigations, office-based reporting | Office-based, data-driven analysis |

Role Overview: Insurance Investigator vs Fraud Analyst

An Insurance Investigator gathers evidence, interviews witnesses, and inspects damage to validate insurance claims, ensuring legitimacy and preventing false payouts. A Fraud Analyst analyzes data patterns and employs predictive models to detect suspicious activities, focusing on identifying and mitigating potential insurance fraud proactively. Both roles are essential in safeguarding insurer assets but differ in approach, with investigators concentrating on case-specific verification and fraud analysts leveraging data analytics for broader fraud detection.

Key Responsibilities Comparison

Insurance investigators gather and verify evidence related to suspicious claims by conducting interviews, site inspections, and reviewing documentation to determine claim validity. Fraud analysts utilize data analytics, pattern recognition, and behavioral modeling to detect anomalies and predict fraudulent activities within insurance portfolios. Both roles collaborate to mitigate financial losses but focus respectively on hands-on investigation and data-driven fraud detection strategies.

Skills and Qualifications Required

Insurance investigators require strong analytical skills, attention to detail, and expertise in interviewing techniques to uncover fraud or verify claims, often holding certifications like Certified Fraud Examiner (CFE). Fraud analysts must possess advanced data analysis abilities, knowledge of fraud detection software, and proficiency in interpreting financial records, typically supported by backgrounds in finance, criminal justice, or cybersecurity. Both roles demand critical thinking, knowledge of insurance policies, and familiarity with legal regulations to effectively identify and prevent fraudulent activities.

Typical Career Pathways

Insurance investigators typically start as claims adjusters or in law enforcement before specializing in fraud detection and gathering evidence for insurance claims. Fraud analysts often begin in data analysis or auditing roles, gradually gaining expertise in identifying patterns of fraudulent activity through advanced analytics and reporting tools. Both career paths can lead to senior roles such as fraud management or compliance officers within insurance companies.

Industry Tools and Technologies Used

Insurance investigators utilize advanced surveillance equipment, digital forensics software, and GPS tracking tools to gather tangible evidence and verify claims, enhancing the detection of fraudulent activities in field operations. Fraud analysts employ data analytics platforms, machine learning algorithms, and predictive modeling to scrutinize claims data, identify suspicious patterns, and generate real-time fraud alerts within insurance databases. Both roles integrate industry-specific technologies like claims management systems and fraud detection software to optimize accuracy and efficiency in combating insurance fraud.

Common Challenges Faced

Insurance investigators and fraud analysts often encounter challenges such as uncovering complex fraudulent schemes, handling incomplete or misleading evidence, and navigating legal regulations to ensure compliance. Both roles require meticulous data analysis and collaboration with law enforcement, yet they must overcome obstacles like time constraints and evolving fraud tactics. Effective communication and continuous training are essential to stay ahead of sophisticated insurance fraud methods.

Impact on Claims Management

Insurance investigators enhance claims management by conducting detailed field investigations, verifying claim validity, and uncovering potential fraud through evidence collection. Fraud analysts utilize advanced data analytics and algorithms to detect suspicious patterns and anomalies within claims, enabling proactive identification of fraudulent activities. Together, their combined expertise reduces financial losses, improves claim processing efficiency, and strengthens overall fraud prevention strategies.

Collaboration with Other Departments

Insurance investigators and fraud analysts collaborate closely with legal, claims, and underwriting departments to enhance fraud detection and resolution. They share critical data and insights to streamline investigations and support risk assessment processes, improving overall claim accuracy and reducing financial losses. This interdepartmental cooperation ensures thorough case evaluations and strengthens the insurer's fraud prevention strategies.

Regulatory and Compliance Considerations

Insurance investigators ensure compliance by thoroughly examining claims to detect fraud while adhering to regulatory guidelines such as state insurance laws and the Insurance Fraud Prevention Act. Fraud analysts utilize advanced data analytics and pattern recognition to identify suspicious activities, ensuring compliance with data privacy regulations like the Gramm-Leach-Bliley Act and industry-specific standards. Both roles play a critical part in maintaining regulatory compliance and protecting insurers from financial losses due to fraudulent claims.

Salary Expectations and Job Outlook

Insurance investigators typically earn between $50,000 and $75,000 annually, with salary growth linked to experience and specialization in claims or criminal investigation. Fraud analysts have a comparable salary range, often between $55,000 and $80,000, benefiting from increasing demand due to rising insurance fraud cases. Job outlook for both roles is positive, driven by advancements in data analytics and regulatory enforcement within the insurance industry.

Insurance Investigator vs Fraud Analyst Infographic

jobdiv.com

jobdiv.com