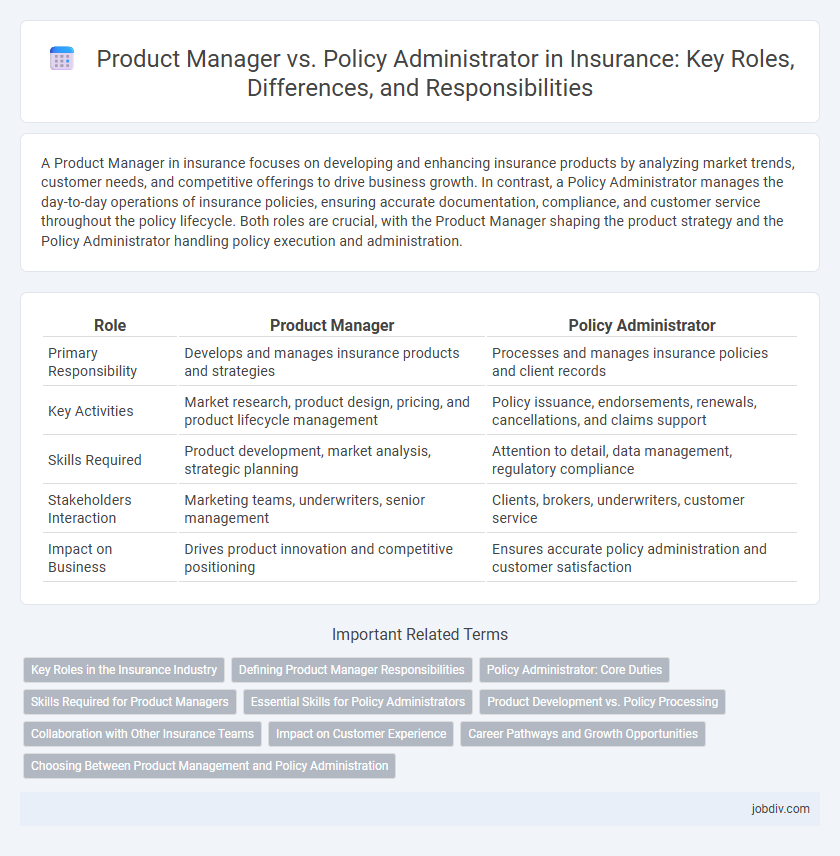

A Product Manager in insurance focuses on developing and enhancing insurance products by analyzing market trends, customer needs, and competitive offerings to drive business growth. In contrast, a Policy Administrator manages the day-to-day operations of insurance policies, ensuring accurate documentation, compliance, and customer service throughout the policy lifecycle. Both roles are crucial, with the Product Manager shaping the product strategy and the Policy Administrator handling policy execution and administration.

Table of Comparison

| Role | Product Manager | Policy Administrator |

|---|---|---|

| Primary Responsibility | Develops and manages insurance products and strategies | Processes and manages insurance policies and client records |

| Key Activities | Market research, product design, pricing, and product lifecycle management | Policy issuance, endorsements, renewals, cancellations, and claims support |

| Skills Required | Product development, market analysis, strategic planning | Attention to detail, data management, regulatory compliance |

| Stakeholders Interaction | Marketing teams, underwriters, senior management | Clients, brokers, underwriters, customer service |

| Impact on Business | Drives product innovation and competitive positioning | Ensures accurate policy administration and customer satisfaction |

Key Roles in the Insurance Industry

A Product Manager in insurance drives the development and lifecycle of insurance products, aligning offerings with market demands and regulatory requirements. A Policy Administrator handles the day-to-day management of insurance policies, ensuring accurate documentation, claims processing, and customer service. Both roles are critical for operational efficiency and customer satisfaction in the insurance industry.

Defining Product Manager Responsibilities

Product Managers in insurance oversee product strategy, market analysis, and lifecycle management to ensure competitive and compliant offerings. They collaborate with actuarial, underwriting, and marketing teams to define product features, pricing, and distribution channels. Policy Administrators focus on issuing, maintaining, and servicing policies, whereas Product Managers drive innovation and alignment with business goals.

Policy Administrator: Core Duties

Policy Administrators handle the daily management of insurance policies, including processing applications, endorsements, renewals, and cancellations to ensure accurate and timely updates. They serve as the primary liaison between underwriters, agents, and customers, managing communication and resolving issues related to policy details and billing. Their role ensures compliance with regulatory requirements and supports claims processing by maintaining detailed records and documentation.

Skills Required for Product Managers

Product Managers in insurance require strong skills in market analysis, product lifecycle management, and strategic planning to develop competitive insurance products that meet regulatory standards. They must possess expertise in risk assessment, customer segmentation, and cross-functional team leadership to drive product innovation and profitability. Proficiency in data analytics and effective communication is essential for aligning product features with market demands and ensuring seamless product launches.

Essential Skills for Policy Administrators

Policy Administrators require essential skills such as strong organizational abilities, attention to detail, and proficiency in insurance software to manage policy documentation and client records effectively. They must possess excellent communication skills to coordinate between clients, underwriters, and claims departments while ensuring compliance with regulatory requirements. Critical thinking and problem-solving capabilities are also vital for resolving policy discrepancies and addressing client inquiries promptly.

Product Development vs. Policy Processing

Product Managers in insurance focus on product development by designing, testing, and launching new insurance offerings based on market research and customer needs. Policy Administrators handle policy processing, managing the lifecycle of insurance policies including issuance, endorsements, renewals, and claims administration. Effective collaboration between Product Managers and Policy Administrators ensures seamless integration of product innovation with efficient policy management operations.

Collaboration with Other Insurance Teams

Product Managers collaborate closely with underwriting, actuarial, and marketing teams to develop insurance products that meet market demands and regulatory requirements. Policy Administrators coordinate with claims, customer service, and compliance departments to ensure efficient policy issuance, maintenance, and renewals. Effective collaboration between these roles enhances product lifecycle management and optimizes customer experience.

Impact on Customer Experience

A Product Manager in insurance shapes customer experience by designing innovative policies tailored to market needs, ensuring alignment with customer expectations and regulatory compliance. In contrast, a Policy Administrator directly influences customer satisfaction through timely and accurate policy processing, claims handling, and personalized service interactions. Both roles are critical, with Product Managers driving product relevance and Policy Administrators ensuring seamless, responsive service delivery.

Career Pathways and Growth Opportunities

A Product Manager in insurance drives the development and strategy of insurance products, leveraging market analysis and customer insights to enhance competitive positioning, with career growth often leading to senior executive roles like Chief Product Officer. In contrast, a Policy Administrator focuses on the lifecycle management of insurance policies, ensuring accuracy and compliance, with career advancement typically progressing toward senior operations or compliance management roles. Both paths offer distinct opportunities: Product Managers gain strategic leadership experience, while Policy Administrators develop deep operational expertise crucial for regulatory and client services advancements.

Choosing Between Product Management and Policy Administration

Choosing between product management and policy administration in insurance involves evaluating distinct career focuses and skill sets. Product managers drive strategic development, market analysis, and customer-driven innovation to create competitive insurance products, while policy administrators handle policy issuance, administration, and compliance to ensure accurate processing and servicing. Professionals seeking a role with broader business impact often prefer product management, whereas those inclined towards operational precision and regulatory adherence tend to favor policy administration.

Product Manager vs Policy Administrator Infographic

jobdiv.com

jobdiv.com