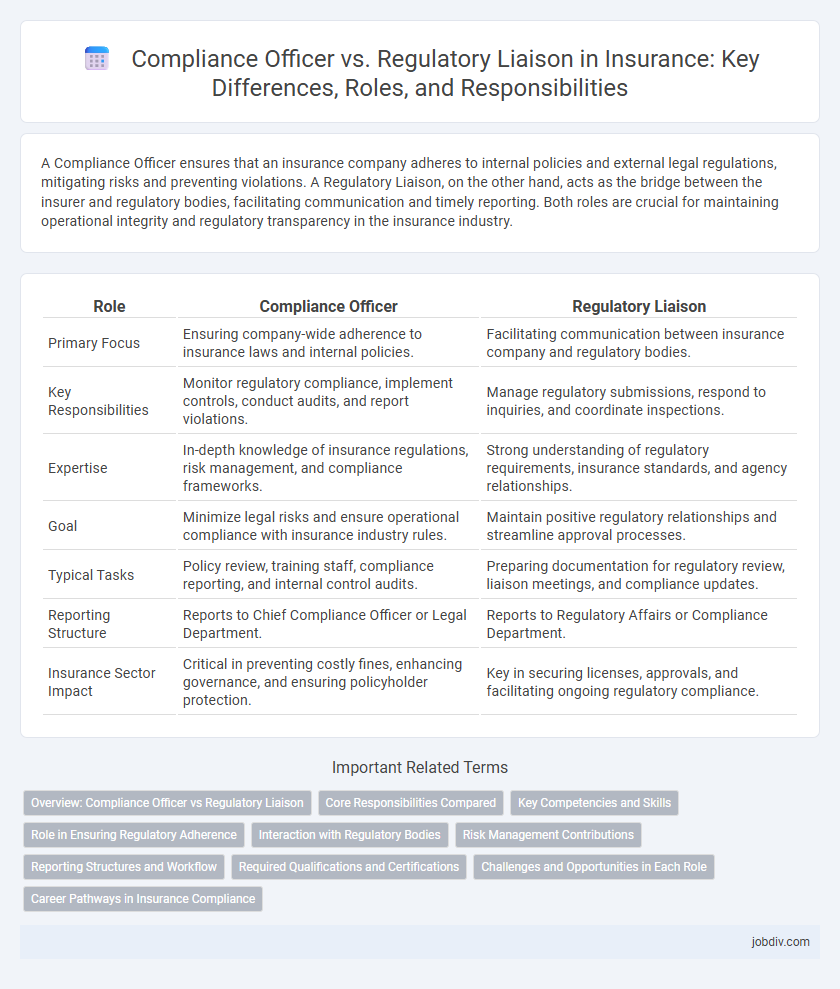

A Compliance Officer ensures that an insurance company adheres to internal policies and external legal regulations, mitigating risks and preventing violations. A Regulatory Liaison, on the other hand, acts as the bridge between the insurer and regulatory bodies, facilitating communication and timely reporting. Both roles are crucial for maintaining operational integrity and regulatory transparency in the insurance industry.

Table of Comparison

| Role | Compliance Officer | Regulatory Liaison |

|---|---|---|

| Primary Focus | Ensuring company-wide adherence to insurance laws and internal policies. | Facilitating communication between insurance company and regulatory bodies. |

| Key Responsibilities | Monitor regulatory compliance, implement controls, conduct audits, and report violations. | Manage regulatory submissions, respond to inquiries, and coordinate inspections. |

| Expertise | In-depth knowledge of insurance regulations, risk management, and compliance frameworks. | Strong understanding of regulatory requirements, insurance standards, and agency relationships. |

| Goal | Minimize legal risks and ensure operational compliance with insurance industry rules. | Maintain positive regulatory relationships and streamline approval processes. |

| Typical Tasks | Policy review, training staff, compliance reporting, and internal control audits. | Preparing documentation for regulatory review, liaison meetings, and compliance updates. |

| Reporting Structure | Reports to Chief Compliance Officer or Legal Department. | Reports to Regulatory Affairs or Compliance Department. |

| Insurance Sector Impact | Critical in preventing costly fines, enhancing governance, and ensuring policyholder protection. | Key in securing licenses, approvals, and facilitating ongoing regulatory compliance. |

Overview: Compliance Officer vs Regulatory Liaison

A Compliance Officer ensures that an insurance company adheres to internal policies and external regulations to mitigate risk and maintain ethical standards. A Regulatory Liaison acts as the primary point of contact between the insurance firm and regulatory agencies, facilitating communication and ensuring timely submission of required reports. Both roles are crucial for regulatory compliance but differ in focus, with Compliance Officers managing internal controls and Regulatory Liaisons handling external regulatory interactions.

Core Responsibilities Compared

Compliance Officers in insurance ensure adherence to internal policies and regulatory standards, conducting audits and risk assessments to prevent violations. Regulatory Liaisons primarily manage communication between the company and regulatory bodies, facilitating timely reporting and addressing external inquiries. Both roles are essential for maintaining legal compliance but differ in their focus on internal enforcement versus external regulatory engagement.

Key Competencies and Skills

Compliance Officers in insurance demonstrate expertise in risk assessment, regulatory frameworks, and internal control implementation to ensure organizational adherence to laws and policies. Regulatory Liaisons possess strong communication skills and in-depth knowledge of industry regulations to effectively coordinate between the company and regulatory bodies. Both roles require analytical thinking, attention to detail, and a thorough understanding of insurance compliance standards to mitigate legal risks and maintain operational integrity.

Role in Ensuring Regulatory Adherence

A Compliance Officer in insurance ensures internal policies align with regulatory requirements to minimize legal risks and maintain corporate integrity. The Regulatory Liaison acts as the primary contact between the insurance company and regulatory bodies, facilitating communication and timely submission of reports. Both roles collaborate to uphold adherence to insurance laws, regulatory guidelines, and industry standards.

Interaction with Regulatory Bodies

A Compliance Officer ensures that the insurance company adheres to all applicable laws and internal policies, directly interacting with regulatory bodies to submit reports and manage audits. The Regulatory Liaison acts as the primary communication conduit between the insurer and regulatory agencies, facilitating timely updates and clarifications on changing regulations. Both roles work closely to maintain transparent, proactive engagement with regulators, minimizing compliance risks and ensuring operational alignment.

Risk Management Contributions

Compliance Officers in insurance focus on internal policy enforcement and adherence to legal standards, mitigating operational risks through audits and training programs. Regulatory Liaisons specialize in communication with external regulatory bodies to ensure ongoing compliance, reducing legal and financial risks by facilitating timely reporting and issue resolution. Both roles collaboratively enhance risk management by bridging internal controls and external regulatory requirements, safeguarding the organization from penalties and reputational damage.

Reporting Structures and Workflow

Compliance officers typically report to senior management or the board of directors, ensuring adherence to internal policies and external regulations, while regulatory liaisons often communicate directly with regulatory agencies to facilitate smooth compliance processes. The workflow for compliance officers involves risk assessments, internal audits, and policy enforcement, whereas regulatory liaisons focus on submitting required reports, responding to regulatory inquiries, and coordinating inspections. Effective reporting structures integrate both roles by aligning internal compliance monitoring with external regulatory communication, optimizing overall organizational compliance.

Required Qualifications and Certifications

Compliance Officers in insurance typically require a bachelor's degree in finance, law, or business and certifications such as Certified Regulatory Compliance Manager (CRCM) or Certified Compliance and Ethics Professional (CCEP). Regulatory Liaisons often need specialized knowledge of insurance laws and regulations, with credentials like the Associate in Insurance Compliance (AIC) or Chartered Property Casualty Underwriter (CPCU) enhancing their qualifications. Both roles demand strong analytical skills, attention to detail, and up-to-date understanding of evolving regulatory frameworks to ensure organizational adherence.

Challenges and Opportunities in Each Role

Compliance Officers in insurance face challenges ensuring adherence to evolving regulatory frameworks such as Solvency II and IFRS 17, requiring constant policy updates and risk assessments to prevent costly penalties. Regulatory Liaisons encounter opportunities to streamline communication between insurers and regulatory bodies like the NAIC and FCA, facilitating faster approvals and improved transparency. Both roles demand deep industry knowledge and proactive adaptation to legislative changes, but Compliance Officers focus on internal enforcement while Regulatory Liaisons specialize in external stakeholder engagement.

Career Pathways in Insurance Compliance

Compliance Officers in insurance focus on developing and enforcing internal policies to ensure adherence to industry regulations, while Regulatory Liaisons act as intermediaries between the company and regulatory agencies to facilitate communication and compliance updates. Career pathways for Compliance Officers typically include advancing to roles such as Compliance Manager or Chief Compliance Officer, emphasizing risk management and policy development. Regulatory Liaisons often progress toward senior regulatory affairs positions or specialized advisory roles that require deep knowledge of regulatory frameworks and government relations.

Compliance Officer vs Regulatory Liaison Infographic

jobdiv.com

jobdiv.com