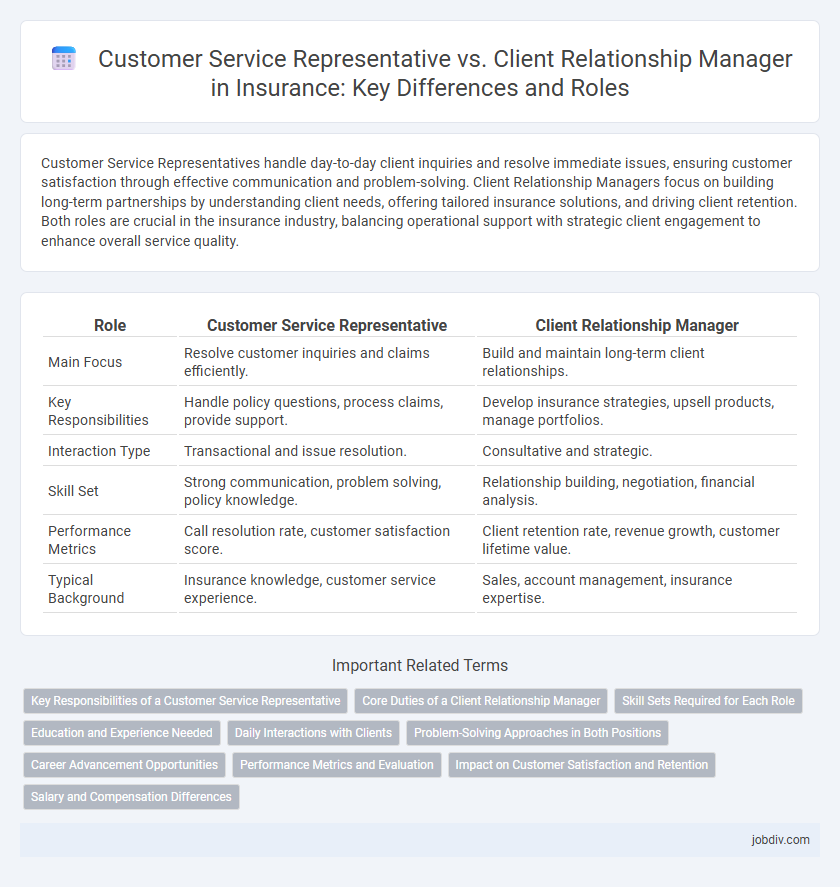

Customer Service Representatives handle day-to-day client inquiries and resolve immediate issues, ensuring customer satisfaction through effective communication and problem-solving. Client Relationship Managers focus on building long-term partnerships by understanding client needs, offering tailored insurance solutions, and driving client retention. Both roles are crucial in the insurance industry, balancing operational support with strategic client engagement to enhance overall service quality.

Table of Comparison

| Role | Customer Service Representative | Client Relationship Manager |

|---|---|---|

| Main Focus | Resolve customer inquiries and claims efficiently. | Build and maintain long-term client relationships. |

| Key Responsibilities | Handle policy questions, process claims, provide support. | Develop insurance strategies, upsell products, manage portfolios. |

| Interaction Type | Transactional and issue resolution. | Consultative and strategic. |

| Skill Set | Strong communication, problem solving, policy knowledge. | Relationship building, negotiation, financial analysis. |

| Performance Metrics | Call resolution rate, customer satisfaction score. | Client retention rate, revenue growth, customer lifetime value. |

| Typical Background | Insurance knowledge, customer service experience. | Sales, account management, insurance expertise. |

Key Responsibilities of a Customer Service Representative

A Customer Service Representative in insurance handles policy inquiries, processes claims efficiently, and provides detailed information on coverage options to ensure client satisfaction. They manage customer accounts, update records accurately, and resolve disputes promptly to maintain trust and loyalty. These representatives act as the first point of contact, delivering personalized assistance and supporting policyholders throughout the insurance lifecycle.

Core Duties of a Client Relationship Manager

A Client Relationship Manager in insurance focuses on nurturing long-term client partnerships by understanding individual policyholder needs and providing tailored solutions. Core duties include managing customer portfolios, addressing complex inquiries, and coordinating with underwriting and claims teams to ensure client satisfaction and retention. This role emphasizes proactive communication and strategic advice to enhance customer loyalty and maximize account growth.

Skill Sets Required for Each Role

Customer Service Representatives in insurance require strong communication skills, problem-solving abilities, and proficiency in handling policy inquiries and claims processing efficiently. Client Relationship Managers need expertise in relationship-building, strategic account management, and a deep understanding of insurance products to tailor solutions and drive customer loyalty. Both roles demand attention to detail and knowledge of regulatory compliance, but Relationship Managers emphasize negotiation and long-term client retention strategies.

Education and Experience Needed

Customer Service Representatives in insurance typically require a high school diploma or equivalent, with on-the-job training emphasizing product knowledge and communication skills. Client Relationship Managers often hold a bachelor's degree in business, finance, or related fields, combined with several years of experience in client management or sales roles within the insurance sector. Advanced certifications such as Chartered Insurance Professional (CIP) or Certified Financial Planner (CFP) can enhance prospects for Client Relationship Managers by demonstrating specialized expertise and commitment.

Daily Interactions with Clients

Customer Service Representatives in insurance handle routine inquiries, policy updates, and claims processing, ensuring timely and accurate responses to client questions. Client Relationship Managers maintain long-term relationships by providing tailored advice, proactively addressing client needs, and coordinating policy reviews to optimize coverage. Daily interactions for Customer Service Representatives are transactional and solution-focused, whereas Client Relationship Managers engage in strategic communication to enhance client satisfaction and retention.

Problem-Solving Approaches in Both Positions

Customer Service Representatives in insurance prioritize resolving immediate client issues through standardized protocols and quick issue escalation, ensuring efficient claim processing and policy inquiries. Client Relationship Managers adopt a strategic problem-solving approach by analyzing client needs to provide tailored insurance solutions, fostering long-term loyalty and identifying cross-selling opportunities. Both roles utilize data-driven insights and CRM tools to enhance response accuracy and client satisfaction in complex insurance scenarios.

Career Advancement Opportunities

Customer Service Representatives in insurance gain foundational skills in policy details and claims processing, enabling a solid entry-level career start. Client Relationship Managers leverage expertise in customer needs and market trends to drive retention and upsell opportunities, positioning themselves for strategic roles. Career advancement for Representatives often leads to senior support or specialized roles, while Relationship Managers progress toward leadership and business development positions.

Performance Metrics and Evaluation

Customer Service Representatives in insurance are typically evaluated based on metrics such as call resolution time, customer satisfaction scores (CSAT), and adherence to compliance standards, emphasizing efficiency and problem-solving skills. Client Relationship Managers focus on long-term client retention rates, lifetime value (LTV), and upselling success, reflecting their role in fostering ongoing client trust and business growth. Both roles use Net Promoter Scores (NPS) to gauge overall client sentiment but prioritize different performance indicators aligned with their responsibilities.

Impact on Customer Satisfaction and Retention

Customer Service Representatives handle day-to-day inquiries and resolve immediate issues, ensuring quick and efficient support that boosts customer satisfaction by addressing urgent needs. Client Relationship Managers develop long-term strategies to nurture relationships, personalize services, and anticipate client needs, significantly enhancing retention through trust and loyalty. Effective collaboration between both roles maximizes client satisfaction and promotes durable insurance policy renewals.

Salary and Compensation Differences

Customer Service Representatives in insurance typically earn an annual salary ranging from $35,000 to $50,000, reflecting entry-level responsibilities focused on policyholder inquiries and claims assistance. Client Relationship Managers command higher compensation, often between $60,000 and $90,000 annually, due to their strategic role in managing key accounts, increasing client retention, and driving revenue growth. Bonuses and commissions are more prevalent for Client Relationship Managers, directly linked to performance metrics and client portfolio expansion.

Customer Service Representative vs Client Relationship Manager Infographic

jobdiv.com

jobdiv.com