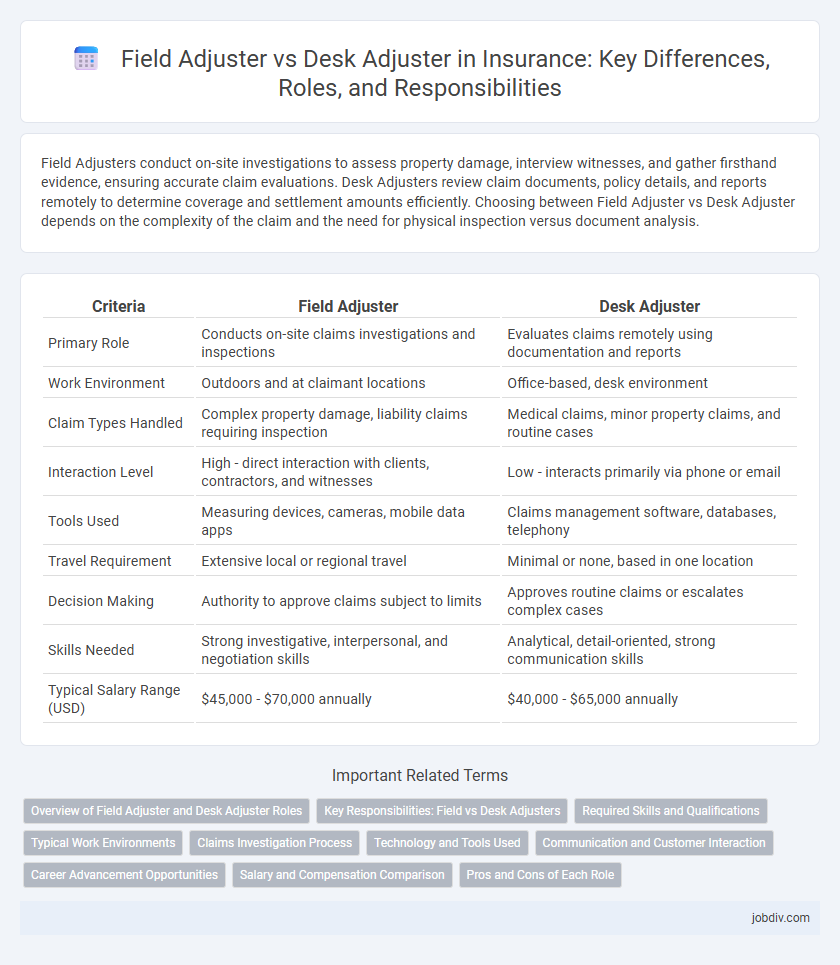

Field Adjusters conduct on-site investigations to assess property damage, interview witnesses, and gather firsthand evidence, ensuring accurate claim evaluations. Desk Adjusters review claim documents, policy details, and reports remotely to determine coverage and settlement amounts efficiently. Choosing between Field Adjuster vs Desk Adjuster depends on the complexity of the claim and the need for physical inspection versus document analysis.

Table of Comparison

| Criteria | Field Adjuster | Desk Adjuster |

|---|---|---|

| Primary Role | Conducts on-site claims investigations and inspections | Evaluates claims remotely using documentation and reports |

| Work Environment | Outdoors and at claimant locations | Office-based, desk environment |

| Claim Types Handled | Complex property damage, liability claims requiring inspection | Medical claims, minor property claims, and routine cases |

| Interaction Level | High - direct interaction with clients, contractors, and witnesses | Low - interacts primarily via phone or email |

| Tools Used | Measuring devices, cameras, mobile data apps | Claims management software, databases, telephony |

| Travel Requirement | Extensive local or regional travel | Minimal or none, based in one location |

| Decision Making | Authority to approve claims subject to limits | Approves routine claims or escalates complex cases |

| Skills Needed | Strong investigative, interpersonal, and negotiation skills | Analytical, detail-oriented, strong communication skills |

| Typical Salary Range (USD) | $45,000 - $70,000 annually | $40,000 - $65,000 annually |

Overview of Field Adjuster and Desk Adjuster Roles

Field adjusters conduct on-site investigations to assess physical damage and verify claims, often interacting directly with claimants and witnesses. Desk adjusters analyze claim documentation, policy details, and photographic evidence remotely to determine claim validity and settlement amounts. Both roles require strong analytical skills and knowledge of insurance policies, yet differ primarily in their approach to claim evaluation--field adjusters in-person and desk adjusters via office work.

Key Responsibilities: Field vs Desk Adjusters

Field adjusters handle on-site inspections, evaluating property damage, interviewing claimants and witnesses, and gathering firsthand evidence to accurately assess claims. Desk adjusters analyze claim documents, communicate with policyholders and contractors remotely, and process claims from the office without physical inspections. Their key responsibilities differ primarily in the location and method of investigation, with field adjusters providing direct, on-location assessments and desk adjusters managing claims through documentation and telecommunication.

Required Skills and Qualifications

Field Adjusters require strong investigative skills, attention to detail, and excellent communication abilities to assess insurance claims on-site effectively. Desk Adjusters need exceptional analytical skills, proficiency with claims management software, and the ability to evaluate documentation remotely for accurate claim resolution. Both roles demand a solid understanding of insurance policies, regulatory compliance, and negotiation skills to ensure fair settlements.

Typical Work Environments

Field adjusters typically work on-site at claim locations such as homes, vehicles, or businesses, allowing direct interaction with claimants and firsthand damage assessment. Desk adjusters operate mainly in office settings, processing claims remotely using phone calls, emails, and digital documentation. The distinct work environments influence the nature of their tasks, with field adjusters engaging in travel and outdoor conditions while desk adjusters manage high volumes of claims in a controlled, indoor workspace.

Claims Investigation Process

Field Adjusters conduct on-site inspections, interviews, and evidence gathering to accurately assess property damage and verify claimant statements during the claims investigation process. Desk Adjusters analyze claim information, review documentation, and communicate with claimants and service providers remotely to determine claim validity and settlement amounts. Both roles collaborate to ensure thorough investigation, fraud detection, and efficient resolution of insurance claims.

Technology and Tools Used

Field adjusters utilize mobile technology such as GPS-enabled devices, drones, and digital cameras to assess on-site damages accurately and efficiently. Desk adjusters rely heavily on advanced software platforms, virtual claim management tools, and video conferencing technology to evaluate claims remotely. Both roles benefit from AI-powered analytics and cloud-based systems to streamline data processing and improve claim resolution times.

Communication and Customer Interaction

Field Adjusters conduct on-site inspections, enabling direct, face-to-face communication with clients and witnesses, which enhances understanding of claim details and builds trust. Desk Adjusters handle claims remotely, relying heavily on phone calls, emails, and digital documentation, which can limit personal interaction but allows for efficient processing of multiple claims. Effective customer interaction for field adjusters often results in faster dispute resolution, while desk adjusters excel in managing high volumes through structured communication channels.

Career Advancement Opportunities

Field adjusters gain hands-on experience by investigating claims on-site, which often leads to faster career advancement into senior field roles or management positions within insurance companies. Desk adjusters primarily handle claims remotely, offering a pathway to specialize in complex claim analysis or transition into underwriting or claims supervision. Both roles provide unique skill sets that can be leveraged for career growth, but field adjusters typically have broader exposure to diverse claim scenarios, enhancing their promotion prospects.

Salary and Compensation Comparison

Field adjusters typically earn higher salaries than desk adjusters due to the nature of on-site claim investigations, with average annual earnings ranging from $50,000 to $70,000 compared to $40,000 to $60,000 for desk adjusters. Compensation for field adjusters often includes mileage reimbursement and per diem allowances, reflecting travel expenses, while desk adjusters usually receive standard benefits without travel-related perks. Performance bonuses and overtime pay are common for both roles but tend to be more substantial for field adjusters due to their hands-on claim handling and extended working hours.

Pros and Cons of Each Role

Field Adjusters provide in-person claim investigations, enabling detailed damage assessments and improved accuracy in settlements, but require extensive travel and time management. Desk Adjusters handle claims remotely, increasing efficiency and reducing travel costs, though they may rely heavily on documentation and secondary sources, potentially limiting claim evaluation accuracy. Both roles are essential for insurance companies, balancing thoroughness and cost-effectiveness in claims processing.

Field Adjuster vs Desk Adjuster Infographic

jobdiv.com

jobdiv.com