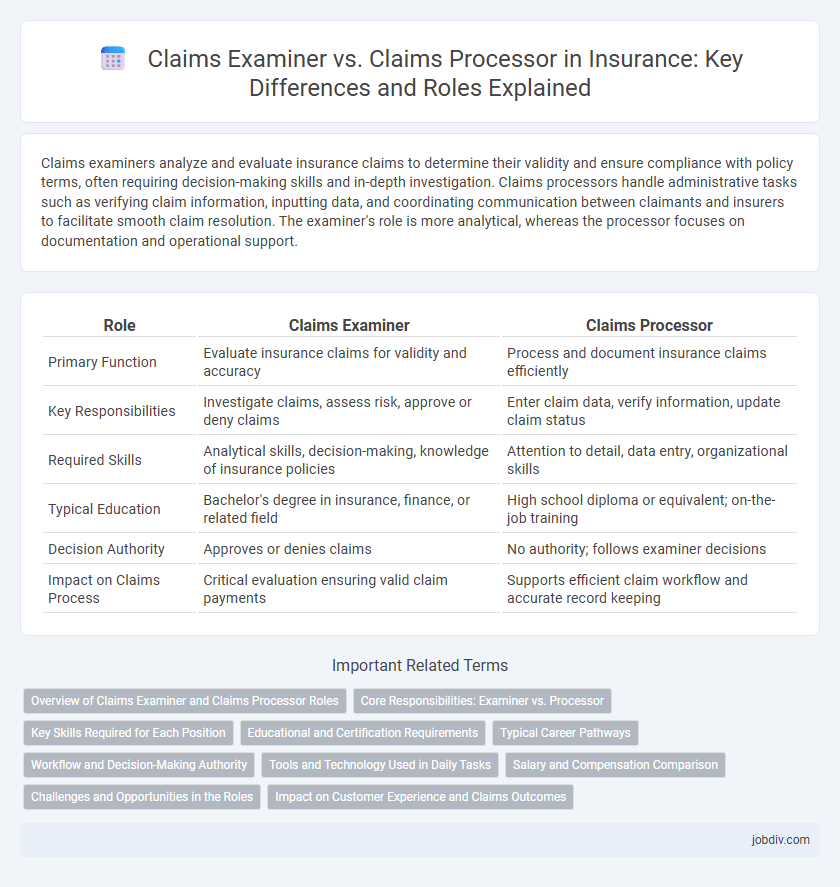

Claims examiners analyze and evaluate insurance claims to determine their validity and ensure compliance with policy terms, often requiring decision-making skills and in-depth investigation. Claims processors handle administrative tasks such as verifying claim information, inputting data, and coordinating communication between claimants and insurers to facilitate smooth claim resolution. The examiner's role is more analytical, whereas the processor focuses on documentation and operational support.

Table of Comparison

| Role | Claims Examiner | Claims Processor |

|---|---|---|

| Primary Function | Evaluate insurance claims for validity and accuracy | Process and document insurance claims efficiently |

| Key Responsibilities | Investigate claims, assess risk, approve or deny claims | Enter claim data, verify information, update claim status |

| Required Skills | Analytical skills, decision-making, knowledge of insurance policies | Attention to detail, data entry, organizational skills |

| Typical Education | Bachelor's degree in insurance, finance, or related field | High school diploma or equivalent; on-the-job training |

| Decision Authority | Approves or denies claims | No authority; follows examiner decisions |

| Impact on Claims Process | Critical evaluation ensuring valid claim payments | Supports efficient claim workflow and accurate record keeping |

Overview of Claims Examiner and Claims Processor Roles

Claims Examiners evaluate insurance claims by reviewing detailed documentation and determining the validity and extent of the insurer's liability based on policy terms. Claims Processors handle the administrative tasks involved in claims management, including data entry, verifying claimant information, and coordinating communication between clients and adjusters. Both roles are critical in ensuring efficient claims handling but differ in their focus on analytical assessment versus operational support.

Core Responsibilities: Examiner vs. Processor

Claims Examiners analyze and investigate insurance claims, verifying details to determine coverage validity and fraud risks, ensuring accurate claim settlements. Claims Processors handle the administrative aspects, such as data entry, documentation, and communication, facilitating the smooth processing and timely payment of approved claims. Examiner roles emphasize critical evaluation and decision-making, while processors focus on operational efficiency and compliance with procedural standards.

Key Skills Required for Each Position

Claims Examiners require strong analytical skills, attention to detail, and expertise in legal and medical terminology to evaluate claims' validity and compliance accurately. Claims Processors need proficiency in data entry, administrative skills, and familiarity with insurance software systems to efficiently manage claim documentation and status updates. Both roles demand excellent communication abilities and knowledge of insurance policies, but Examiners focus more on investigation and assessment, while Processors emphasize accuracy and workflow management.

Educational and Certification Requirements

Claims Examiners typically require a bachelor's degree in insurance, finance, or a related field, often complemented by professional certifications such as the Associate in Claims (AIC) or Certified Claims Professional (CCP). Claims Processors usually hold an associate degree or a high school diploma with specialized training or certification in claims processing software and procedures. Both roles benefit from ongoing education to stay current with industry regulations and advancements in insurance claims management systems.

Typical Career Pathways

Claims Examiners often progress from entry-level roles like Claims Processors, gaining expertise in evaluating, investigating, and negotiating insurance claims. Claims Processors typically start with data entry and documentation tasks before advancing into analyst or examiner positions, acquiring skills in claim validation and fraud detection. Career growth may lead Claims Examiners into specialties such as risk management, underwriting, or claims management roles within insurance companies.

Workflow and Decision-Making Authority

Claims Examiners conduct in-depth evaluations of insurance claims, verifying details and investigating discrepancies to ensure compliance with policy terms, while Claims Processors handle the administrative aspects, including data entry and documentation. Examiners possess decision-making authority to approve, deny, or request further information on claims, directly impacting claim resolution outcomes. Processors support the workflow by organizing and preparing claims for review, enabling Examiners to focus on complex judgment calls in the claims lifecycle.

Tools and Technology Used in Daily Tasks

Claims Examiners utilize advanced claims management systems, data analytics software, and fraud detection tools to assess claim validity and ensure accurate settlements. Claims Processors rely heavily on automated workflow platforms, document imaging technology, and electronic data interchange (EDI) systems for efficient claim entry, verification, and routing. Both roles leverage customer relationship management (CRM) tools to enhance communication and streamline claim handling processes.

Salary and Compensation Comparison

Claims Examiners typically earn higher salaries than Claims Processors, with median annual wages around $65,000 compared to $45,000 respectively, reflecting their more complex decision-making responsibilities. Compensation packages for Claims Examiners often include performance bonuses and advanced benefits, while Claims Processors generally receive standardized salary structures with fewer incentives. Salary growth potential is stronger for Claims Examiners due to their specialized expertise in risk assessment and claims validation.

Challenges and Opportunities in the Roles

Claims Examiners face challenges in accurately assessing complex claims, requiring in-depth knowledge of policies and regulations to mitigate fraud and approve valid claims efficiently. Claims Processors encounter opportunities to streamline workflow through automation and detailed data management, ensuring timely processing and improved customer satisfaction. Both roles demand adaptability to evolving insurance technologies and regulatory changes to enhance claims accuracy and operational efficiency.

Impact on Customer Experience and Claims Outcomes

Claims Examiners deeply analyze and evaluate insurance claims to ensure accurate coverage decisions, directly enhancing customer satisfaction by providing thorough and fair claim resolutions. Claims Processors focus on the efficient handling and documentation of claims, speeding up the transaction timeline and improving customer experience through timely communication and prompt payments. Both roles collaboratively influence claims outcomes and customer trust, with Examiners emphasizing claim validity and Processors ensuring seamless operational flow.

Claims Examiner vs Claims Processor Infographic

jobdiv.com

jobdiv.com