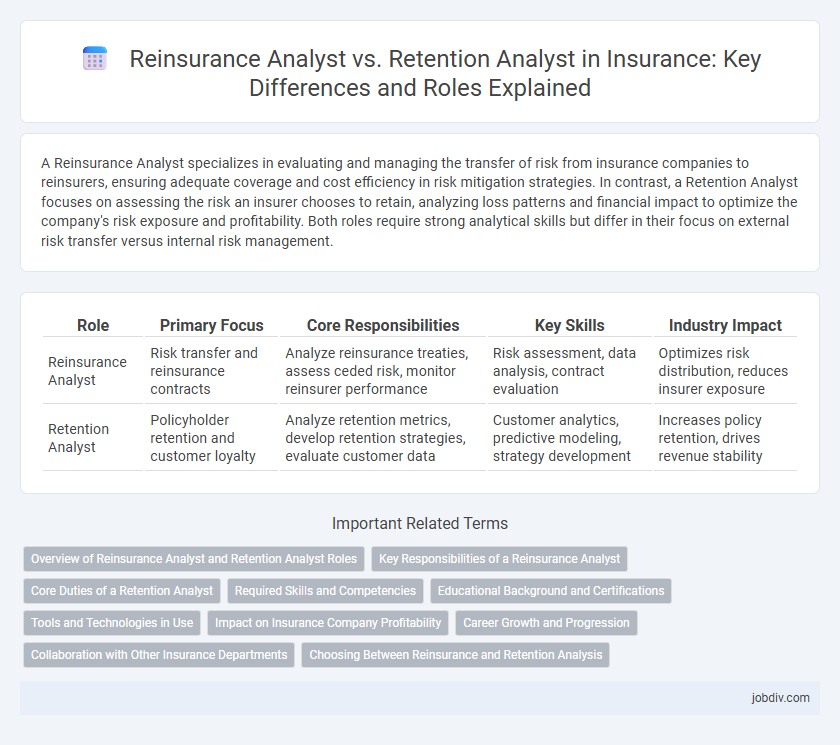

A Reinsurance Analyst specializes in evaluating and managing the transfer of risk from insurance companies to reinsurers, ensuring adequate coverage and cost efficiency in risk mitigation strategies. In contrast, a Retention Analyst focuses on assessing the risk an insurer chooses to retain, analyzing loss patterns and financial impact to optimize the company's risk exposure and profitability. Both roles require strong analytical skills but differ in their focus on external risk transfer versus internal risk management.

Table of Comparison

| Role | Primary Focus | Core Responsibilities | Key Skills | Industry Impact |

|---|---|---|---|---|

| Reinsurance Analyst | Risk transfer and reinsurance contracts | Analyze reinsurance treaties, assess ceded risk, monitor reinsurer performance | Risk assessment, data analysis, contract evaluation | Optimizes risk distribution, reduces insurer exposure |

| Retention Analyst | Policyholder retention and customer loyalty | Analyze retention metrics, develop retention strategies, evaluate customer data | Customer analytics, predictive modeling, strategy development | Increases policy retention, drives revenue stability |

Overview of Reinsurance Analyst and Retention Analyst Roles

Reinsurance Analysts evaluate risk portfolios and negotiate reinsurance treaties to optimize risk transfer and capital management for insurance companies. Retention Analysts focus on analyzing policyholder data to determine optimal retention levels and pricing strategies that maximize profitability and minimize loss exposure. Both roles require strong analytical skills and a deep understanding of risk assessment but differ in their focus on external risk mitigation versus internal risk retention.

Key Responsibilities of a Reinsurance Analyst

A Reinsurance Analyst evaluates and manages reinsurance portfolios by analyzing risk exposures, ceded premiums, and claims data to optimize the company's risk transfer strategies. Their key responsibilities include reviewing reinsurance contracts, monitoring treaty performance, and preparing detailed reports to support underwriting and financial planning. This role requires strong analytical skills to assess the impact of reinsurance on the insurer's capital and loss reserves.

Core Duties of a Retention Analyst

A Retention Analyst in insurance primarily focuses on analyzing policyholder data to identify trends in customer retention and lapse rates, helping insurers develop strategies to minimize policy cancellations. They evaluate risk profiles, assess policy renewals, and collaborate with underwriting and marketing teams to optimize retention efforts. Core duties include monitoring retention metrics, conducting financial impact assessments of retention initiatives, and providing actionable insights to enhance customer loyalty and profitability.

Required Skills and Competencies

A Reinsurance Analyst must possess strong analytical skills, proficiency in risk assessment, and expertise in treaty and facultative reinsurance structures. Retention Analysts require in-depth knowledge of policyholder behavior, customer retention strategies, and data-driven decision-making abilities. Both roles demand excellent communication skills and proficiency in insurance software, but a Reinsurance Analyst leans more toward financial modeling and risk transfer evaluation, whereas a Retention Analyst focuses on client relationship management and loss prevention.

Educational Background and Certifications

Reinsurance Analysts often hold degrees in finance, actuarial science, or risk management and typically pursue certifications such as the Associate in Reinsurance (ARe) or Chartered Property Casualty Underwriter (CPCU) to deepen expertise in risk transfer and treaty analysis. Retention Analysts generally have educational backgrounds in business administration, insurance, or statistics, and benefit from credentials like the Associate in Management (AIM) or Certified Insurance Counselor (CIC) to optimize client retention strategies through data analytics. Both roles value professional development aligned with industry standards, emphasizing specialized training that enhances underwriting and portfolio management skills.

Tools and Technologies in Use

Reinsurance Analysts utilize advanced risk modeling software and data analytics platforms such as RMS, AIR, and SAS to evaluate and mitigate large-scale risk exposure effectively. Retention Analysts focus on CRM tools like Salesforce and policy management systems to monitor customer retention rates and optimize policy renewals. Both roles increasingly rely on artificial intelligence and machine learning technologies to enhance predictive accuracy and streamline underwriting processes.

Impact on Insurance Company Profitability

Reinsurance Analysts evaluate risk transfer strategies to optimize coverage costs, directly influencing the insurance company's loss ratios and capital efficiency. Retention Analysts focus on identifying and managing risks that should be retained internally, balancing risk exposure with premium income to maximize profitability. Effective collaboration between reinsurance and retention analysis improves overall risk management, enhancing underwriting results and driving sustainable profit growth.

Career Growth and Progression

Reinsurance Analysts typically experience career growth through specialization in risk assessment, treaty negotiation, and portfolio management, leading to roles such as Senior Reinsurance Analyst or Reinsurance Manager. Retention Analysts focus on policyholder behavior and renewal strategies, often advancing toward positions like Retention Manager or Customer Insights Lead. Both career paths offer progression opportunities, with Reinsurance Analysts leaning toward technical underwriting expertise and Retention Analysts evolving in client-focused analytics and retention strategies.

Collaboration with Other Insurance Departments

Reinsurance Analysts collaborate closely with underwriting and risk management teams to assess and mitigate portfolio risks through effective reinsurance strategies. Retention Analysts work alongside claims and sales departments to evaluate policyholder behavior and optimize retention rates, ensuring customer loyalty and profitability. Both roles require seamless communication with actuarial and finance units to align risk assessment with financial objectives.

Choosing Between Reinsurance and Retention Analysis

Choosing between a Reinsurance Analyst and a Retention Analyst depends on the company's risk management strategy and financial goals. Reinsurance Analysts focus on evaluating external risk transfer options to mitigate potential losses, while Retention Analysts concentrate on optimizing the amount of risk the company retains to maximize profitability. Understanding the balance between risk transfer costs and retained risk benefits is crucial for effective decision-making in insurance portfolios.

Reinsurance Analyst vs Retention Analyst Infographic

jobdiv.com

jobdiv.com