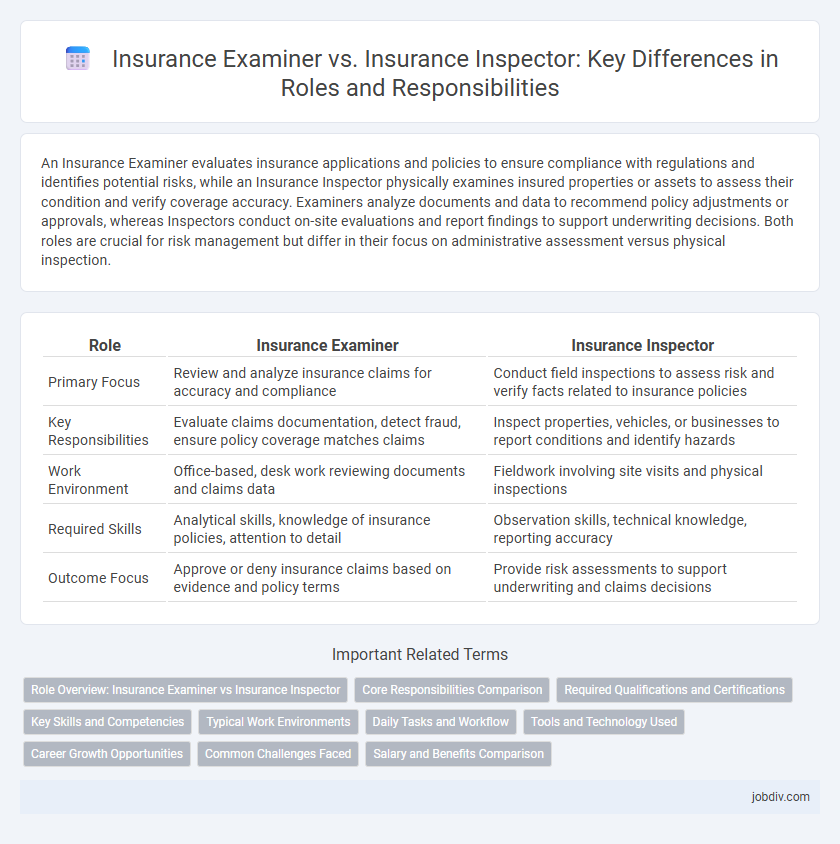

An Insurance Examiner evaluates insurance applications and policies to ensure compliance with regulations and identifies potential risks, while an Insurance Inspector physically examines insured properties or assets to assess their condition and verify coverage accuracy. Examiners analyze documents and data to recommend policy adjustments or approvals, whereas Inspectors conduct on-site evaluations and report findings to support underwriting decisions. Both roles are crucial for risk management but differ in their focus on administrative assessment versus physical inspection.

Table of Comparison

| Role | Insurance Examiner | Insurance Inspector |

|---|---|---|

| Primary Focus | Review and analyze insurance claims for accuracy and compliance | Conduct field inspections to assess risk and verify facts related to insurance policies |

| Key Responsibilities | Evaluate claims documentation, detect fraud, ensure policy coverage matches claims | Inspect properties, vehicles, or businesses to report conditions and identify hazards |

| Work Environment | Office-based, desk work reviewing documents and claims data | Fieldwork involving site visits and physical inspections |

| Required Skills | Analytical skills, knowledge of insurance policies, attention to detail | Observation skills, technical knowledge, reporting accuracy |

| Outcome Focus | Approve or deny insurance claims based on evidence and policy terms | Provide risk assessments to support underwriting and claims decisions |

Role Overview: Insurance Examiner vs Insurance Inspector

Insurance Examiners analyze insurance claims, policies, and company records to ensure compliance with regulations and assess risk factors accurately. Insurance Inspectors conduct on-site evaluations of insured properties or businesses to verify coverage details and detect potential fraud or damages. Both roles support underwriting and claims processes but focus on different stages: examiners review documentation, while inspectors perform physical assessments.

Core Responsibilities Comparison

Insurance examiners primarily review and analyze insurance claims for accuracy, fraud detection, and compliance with policy terms, ensuring proper payout and risk assessment. Insurance inspectors focus on evaluating physical properties, such as homes or businesses, to assess damage, verify insurance coverage, and provide detailed reports for underwriting and claims processes. Both roles play critical parts in risk management but differ in their approach: examiners handle claim investigation through documentation, while inspectors conduct on-site evaluations.

Required Qualifications and Certifications

Insurance Examiners typically require a bachelor's degree in finance, accounting, or a related field, with certifications like the Chartered Property Casualty Underwriter (CPCU) or Associate in Claims (AIC) enhancing job prospects. Insurance Inspectors generally need a high school diploma or equivalent, though specialized certifications such as the Certified Insurance Inspector (CII) or state-specific licensing are often mandated. Both roles demand strong analytical skills, but Examiners focus more on regulatory compliance and risk assessment, while Inspectors concentrate on property evaluations and physical inspections.

Key Skills and Competencies

Insurance Examiners demonstrate expertise in financial analysis, risk assessment, and regulatory compliance to evaluate insurance companies' solvency and business practices. Insurance Inspectors excel in property evaluation, damage assessment, and adherence to underwriting guidelines to accurately determine coverage eligibility and claim validity. Both roles require strong attention to detail, analytical thinking, and effective communication skills to ensure thorough investigations and accurate reporting within the insurance industry.

Typical Work Environments

Insurance examiners typically work in office settings such as insurance companies, financial institutions, or government agencies analyzing policy applications and claims. Insurance inspectors often perform fieldwork, visiting homes, businesses, or vehicles to assess risks and conditions for underwriting or claims investigations. Both roles require strong analytical skills, but examiners operate in a desk-based environment while inspectors engage directly with policyholders and physical properties.

Daily Tasks and Workflow

Insurance Examiners analyze insurance policies, risk factors, and financial records to ensure compliance with regulations and accurate premium calculations. Insurance Inspectors conduct on-site evaluations of properties, vehicles, or businesses to verify conditions and assess potential claims or underwriting risks. Their daily workflow involves detailed documentation, report preparation, and communication with clients or underwriters to support risk management decisions.

Tools and Technology Used

Insurance Examiners utilize advanced data analytics software and risk assessment platforms to evaluate complex financial records and policy compliance efficiently. Insurance Inspectors rely on mobile inspection devices, digital cameras, and specialized measurement tools to conduct on-site property evaluations and damage assessments accurately. Both roles incorporate electronic reporting systems to streamline documentation and enhance communication with insurance providers.

Career Growth Opportunities

Insurance Examiners typically advance into senior underwriting or claims management roles due to their expertise in policy evaluation and risk assessment. Insurance Inspectors often transition into specialized risk analysis or regulatory compliance positions, leveraging their field inspection experience. Both career paths offer growth potential in insurance auditing, fraud detection, and leadership within insurance companies.

Common Challenges Faced

Insurance examiners and insurance inspectors both confront challenges such as navigating complex policy details and ensuring accurate risk assessment under tight deadlines. They often face difficulties in verifying the authenticity of documents and detecting potential fraud while maintaining compliance with regulatory standards. Handling vast amounts of data and coordinating with multiple stakeholders adds to the complexity of their roles in the insurance claims process.

Salary and Benefits Comparison

Insurance Examiners earn an average salary of $70,000 to $95,000 annually, often benefiting from comprehensive health insurance, retirement plans, and performance bonuses. Insurance Inspectors typically have a salary range of $45,000 to $65,000 per year, with additional perks including travel reimbursements, flexible work schedules, and sometimes commission-based incentives. Both roles offer job stability and opportunities for career advancement, but Examiners generally receive higher compensation and more extensive benefits due to their regulatory and analytical responsibilities.

Insurance Examiner vs Insurance Inspector Infographic

jobdiv.com

jobdiv.com