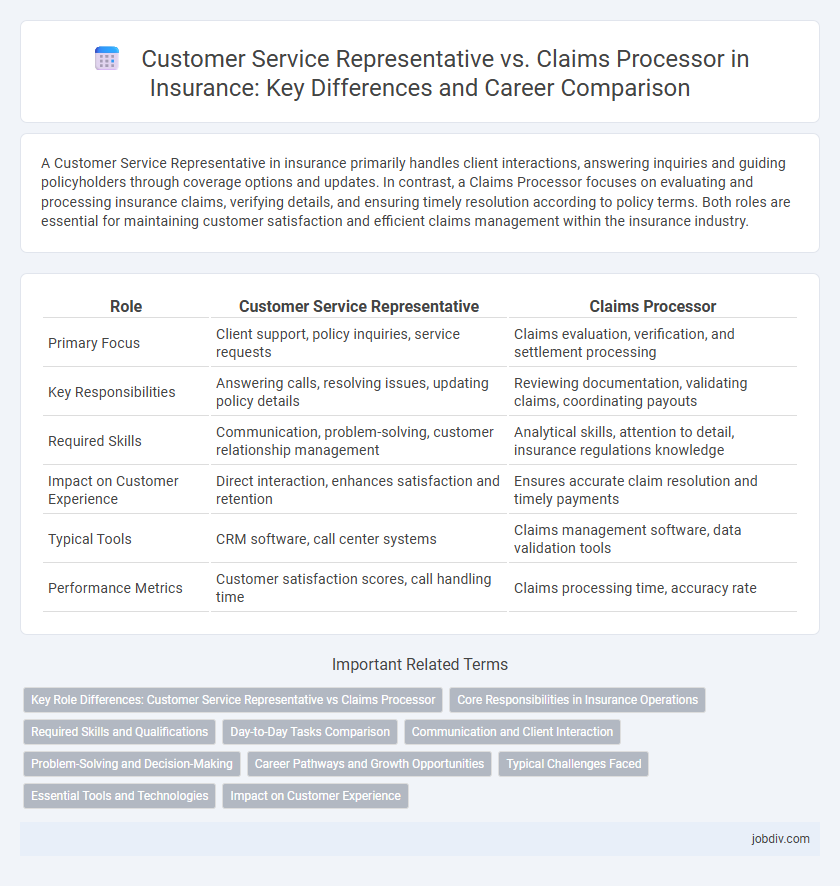

A Customer Service Representative in insurance primarily handles client interactions, answering inquiries and guiding policyholders through coverage options and updates. In contrast, a Claims Processor focuses on evaluating and processing insurance claims, verifying details, and ensuring timely resolution according to policy terms. Both roles are essential for maintaining customer satisfaction and efficient claims management within the insurance industry.

Table of Comparison

| Role | Customer Service Representative | Claims Processor |

|---|---|---|

| Primary Focus | Client support, policy inquiries, service requests | Claims evaluation, verification, and settlement processing |

| Key Responsibilities | Answering calls, resolving issues, updating policy details | Reviewing documentation, validating claims, coordinating payouts |

| Required Skills | Communication, problem-solving, customer relationship management | Analytical skills, attention to detail, insurance regulations knowledge |

| Impact on Customer Experience | Direct interaction, enhances satisfaction and retention | Ensures accurate claim resolution and timely payments |

| Typical Tools | CRM software, call center systems | Claims management software, data validation tools |

| Performance Metrics | Customer satisfaction scores, call handling time | Claims processing time, accuracy rate |

Key Role Differences: Customer Service Representative vs Claims Processor

Customer Service Representatives in insurance primarily handle client inquiries, policy information, and support, ensuring customer satisfaction and retention. Claims Processors focus on evaluating, verifying, and processing insurance claims accurately to facilitate timely settlements. The key role difference lies in customer interaction and policy assistance for Representatives versus detailed claims assessment and adjudication for Processors.

Core Responsibilities in Insurance Operations

Customer Service Representatives in insurance focus on client interaction, addressing inquiries, policy information, and providing support to ensure customer satisfaction. Claims Processors specialize in evaluating claims, verifying documentation, and coordinating with adjusters to facilitate accurate and timely claim settlements. Both roles contribute to efficient insurance operations by balancing customer engagement and claims administration.

Required Skills and Qualifications

Customer Service Representatives in insurance require strong communication skills, problem-solving abilities, and proficiency in customer relationship management (CRM) software to effectively assist policyholders and respond to inquiries. Claims Processors must possess analytical skills, attention to detail, and knowledge of claims adjudication systems, as well as a solid understanding of insurance policies and regulatory requirements to evaluate and process claims accurately. Both roles demand familiarity with industry-specific software and compliance standards, but Claims Processors typically require more specialized knowledge in claims evaluation and documentation.

Day-to-Day Tasks Comparison

Customer Service Representatives in insurance handle policy inquiries, provide product information, and assist with billing issues, ensuring client satisfaction through direct communication. Claims Processors focus on verifying claim details, evaluating documentation, and coordinating with adjusters to process claims accurately and timely. Both roles require strong attention to detail and knowledge of insurance policies but differ in customer interaction levels and operational responsibilities.

Communication and Client Interaction

Customer Service Representatives in insurance primarily manage direct client communication, addressing inquiries and providing policy information to enhance customer satisfaction. Claims Processors focus on analyzing claim details, requiring precise interaction with clients to verify information and ensure accurate settlement. Effective communication skills are crucial in both roles to maintain trust and resolve issues efficiently in the insurance claims lifecycle.

Problem-Solving and Decision-Making

A Customer Service Representative in insurance typically excels in problem-solving by addressing policyholder inquiries and resolving billing or coverage issues through effective communication and empathy. Claims Processors concentrate on decision-making by evaluating claim validity, verifying documentation, and determining payout amounts based on policy terms and regulatory guidelines. Both roles require critical thinking, but Customer Service Representatives prioritize client interaction resolution while Claims Processors focus on analytical assessment and accurate claim adjudication.

Career Pathways and Growth Opportunities

Customer Service Representatives in insurance often begin their careers handling policy inquiries and assisting clients, which builds strong communication skills and industry knowledge crucial for advancing to roles such as Claims Processor or Underwriting Specialist. Claims Processors gain specialized expertise in evaluating and managing insurance claims, positioning them for growth into senior claims adjuster, fraud investigator, or claims management roles. Both career pathways offer opportunities to progress into supervisory or managerial positions, with Claims Processors typically focusing more on analytical and decision-making skills while Customer Service Representatives develop client relationship management competencies.

Typical Challenges Faced

Customer Service Representatives in insurance frequently face challenges involving managing high call volumes and resolving complex customer inquiries promptly to maintain satisfaction. Claims Processors often encounter difficulties in accurately verifying claim details and navigating regulatory compliance while ensuring timely claim settlements. Both roles require strong attention to detail, effective communication skills, and the ability to handle stressful situations efficiently.

Essential Tools and Technologies

Customer Service Representatives in insurance utilize CRM software and communication platforms to manage client interactions efficiently. Claims Processors rely heavily on specialized claims management systems and data analytics tools to evaluate and process claims accurately. Both roles benefit from integration with digital document management systems and AI-powered automation to enhance productivity and reduce errors.

Impact on Customer Experience

Customer Service Representatives directly engage with policyholders, addressing inquiries and resolving issues, which significantly shapes the customer's perception of the insurance company. Claims Processors handle claim evaluations and settlements behind the scenes, impacting the speed and accuracy of claim resolutions that affect customer satisfaction. Optimizing both roles enhances overall customer experience by combining efficient communication with timely claim processing.

Customer Service Representative vs Claims Processor Infographic

jobdiv.com

jobdiv.com