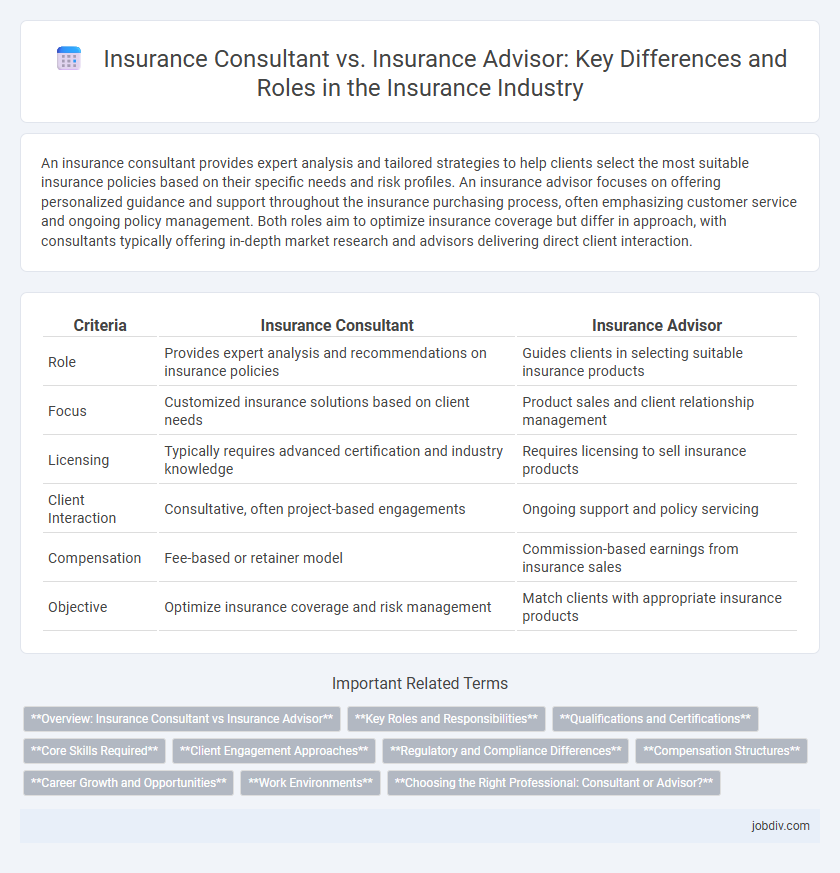

An insurance consultant provides expert analysis and tailored strategies to help clients select the most suitable insurance policies based on their specific needs and risk profiles. An insurance advisor focuses on offering personalized guidance and support throughout the insurance purchasing process, often emphasizing customer service and ongoing policy management. Both roles aim to optimize insurance coverage but differ in approach, with consultants typically offering in-depth market research and advisors delivering direct client interaction.

Table of Comparison

| Criteria | Insurance Consultant | Insurance Advisor |

|---|---|---|

| Role | Provides expert analysis and recommendations on insurance policies | Guides clients in selecting suitable insurance products |

| Focus | Customized insurance solutions based on client needs | Product sales and client relationship management |

| Licensing | Typically requires advanced certification and industry knowledge | Requires licensing to sell insurance products |

| Client Interaction | Consultative, often project-based engagements | Ongoing support and policy servicing |

| Compensation | Fee-based or retainer model | Commission-based earnings from insurance sales |

| Objective | Optimize insurance coverage and risk management | Match clients with appropriate insurance products |

Overview: Insurance Consultant vs Insurance Advisor

Insurance consultants provide in-depth risk assessment and tailored insurance solutions for businesses, often focusing on complex coverage analysis and regulatory compliance. Insurance advisors primarily assist individual clients with selecting suitable insurance policies based on personal needs, emphasizing product options and claims support. Both roles require expertise in insurance products but differ in client scope and service complexity.

Key Roles and Responsibilities

An Insurance Consultant provides expert analysis on insurance policies and risk management strategies tailored to clients' specific needs, focusing on detailed policy evaluation and financial planning. An Insurance Advisor primarily offers guidance on selecting suitable insurance products, helping clients understand policy terms and coverage options for informed decision-making. Both roles require in-depth knowledge of insurance products but differ in the depth of strategic consultation versus product recommendation.

Qualifications and Certifications

Insurance consultants often hold advanced certifications such as Chartered Life Underwriter (CLU) or Certified Insurance Counselor (CIC), demonstrating expertise in risk management and financial planning. Insurance advisors typically possess licenses required by state insurance departments, including Life and Health Insurance Producer licenses, ensuring compliance with regulatory standards. Both professionals may pursue continued education to maintain credentials and stay updated on industry regulations and product knowledge.

Core Skills Required

Insurance consultants require strong analytical abilities, expertise in risk assessment, and comprehensive knowledge of insurance policies to tailor solutions for clients. Insurance advisors emphasize excellent communication skills, client relationship management, and an in-depth understanding of product offerings to guide customers effectively. Both roles demand proficiency in regulatory compliance and market trends to provide accurate and relevant insurance guidance.

Client Engagement Approaches

Insurance consultants emphasize personalized risk assessment and tailored policy recommendations through in-depth client interviews and comprehensive financial analysis. Insurance advisors focus on building long-term relationships by offering ongoing support, policy reviews, and proactive communication to adapt coverage based on changing client needs. Both professionals utilize data-driven insights to enhance client engagement but differ in their approach scope, with consultants leaning towards strategic planning and advisors prioritizing continuous service.

Regulatory and Compliance Differences

Insurance consultants operate under stricter regulatory frameworks, often requiring licensure and adherence to state-specific compliance standards, whereas insurance advisors may work with fewer regulatory obligations depending on jurisdiction. Consultants are mandated to provide unbiased, comprehensive risk assessments and compliance documentation, ensuring alignment with industry regulations such as state insurance commissions. In contrast, advisors typically focus on client-specific product recommendations without the same level of regulatory scrutiny or mandatory compliance audits.

Compensation Structures

Insurance consultants typically receive compensation through fixed fees or hourly rates, reflecting their advisory role without product sales incentives. Insurance advisors often earn commissions based on the insurance policies they sell, creating a direct link between sales volume and income. Understanding these distinct compensation structures is crucial for clients seeking unbiased advice versus policy recommendations tied to earnings.

Career Growth and Opportunities

Insurance consultants typically experience faster career growth due to their specialized expertise and involvement in complex risk assessment projects, making them valuable assets for corporate clients. Insurance advisors often build long-term client relationships, leading to steady commissions and expansion into personalized insurance planning, which fosters opportunities in financial advisory roles. Both career paths offer potential for advancement into management positions, but consultants are more likely to transition into strategic consulting or underwriting leadership roles within insurance firms.

Work Environments

Insurance consultants typically operate within corporate settings, dealing with businesses to analyze risk and design customized insurance solutions. Insurance advisors often work in client-facing environments such as agencies or brokerage firms, providing personalized policy recommendations to individuals or families. Both roles require strong communication skills, but consultants tend to engage more with corporate clients while advisors focus on direct consumer interaction.

Choosing the Right Professional: Consultant or Advisor?

Selecting the right professional between an insurance consultant and an insurance advisor depends on your specific needs; consultants offer expert analysis and strategic planning for complex insurance portfolios, while advisors typically provide personalized policy recommendations and ongoing support. Insurance consultants often work with businesses to assess risks and design tailored solutions, whereas advisors focus on individual clients seeking guidance on coverage options. Understanding the scope of services and expertise ensures you make an informed decision aligned with your insurance goals.

Insurance Consultant vs Insurance Advisor Infographic

jobdiv.com

jobdiv.com