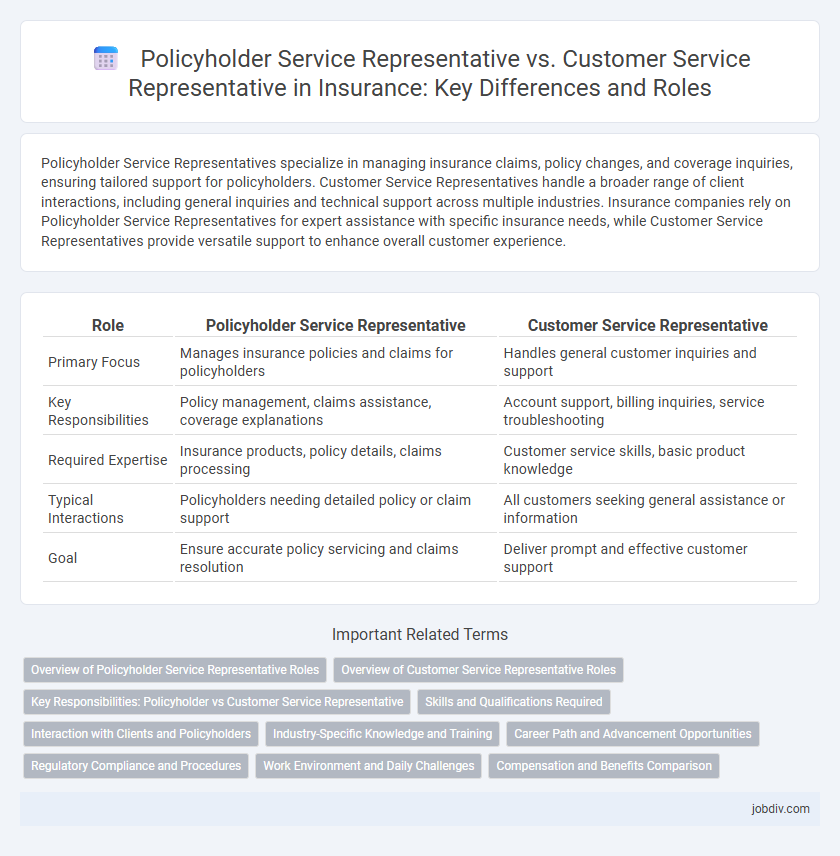

Policyholder Service Representatives specialize in managing insurance claims, policy changes, and coverage inquiries, ensuring tailored support for policyholders. Customer Service Representatives handle a broader range of client interactions, including general inquiries and technical support across multiple industries. Insurance companies rely on Policyholder Service Representatives for expert assistance with specific insurance needs, while Customer Service Representatives provide versatile support to enhance overall customer experience.

Table of Comparison

| Role | Policyholder Service Representative | Customer Service Representative |

|---|---|---|

| Primary Focus | Manages insurance policies and claims for policyholders | Handles general customer inquiries and support |

| Key Responsibilities | Policy management, claims assistance, coverage explanations | Account support, billing inquiries, service troubleshooting |

| Required Expertise | Insurance products, policy details, claims processing | Customer service skills, basic product knowledge |

| Typical Interactions | Policyholders needing detailed policy or claim support | All customers seeking general assistance or information |

| Goal | Ensure accurate policy servicing and claims resolution | Deliver prompt and effective customer support |

Overview of Policyholder Service Representative Roles

Policyholder Service Representatives specialize in managing insurance policies, addressing claims, and providing detailed coverage information to policyholders. They handle tasks such as policy updates, billing inquiries, and processing endorsements, ensuring compliance with insurance regulations. Their role requires in-depth knowledge of insurance products, claims procedures, and customer communication within the insurance industry.

Overview of Customer Service Representative Roles

Customer Service Representatives in insurance handle inquiries, process claims, and provide policy information to ensure client satisfaction and retention. They act as the primary communication link between the insurer and policyholders, addressing concerns related to billing, coverage, and policy changes. Their role requires strong knowledge of insurance products, excellent communication skills, and proficiency in claims management systems.

Key Responsibilities: Policyholder vs Customer Service Representative

Policyholder Service Representatives specialize in managing insurance policy inquiries, processing claims, and providing detailed information about coverage options and policy updates. Customer Service Representatives handle a broader range of tasks including answering general questions, resolving billing issues, and assisting with account management across multiple insurance products. Both roles prioritize effective communication, but Policyholder Service Representatives focus on specific policyholder needs while Customer Service Representatives address overall customer satisfaction.

Skills and Qualifications Required

Policyholder Service Representatives require strong knowledge of insurance policies, claims processing, and regulatory compliance, along with excellent communication and problem-solving skills to address complex policyholder inquiries effectively. Customer Service Representatives in insurance need proficiency in handling general customer inquiries, basic policy information, and service requests, emphasizing interpersonal skills and adaptability. Both roles benefit from experience in data management systems and a solid understanding of insurance terminology, but Policyholder Service Representatives typically require more specialized training and certifications related to insurance products.

Interaction with Clients and Policyholders

Policyholder Service Representatives specialize in managing insurance-specific inquiries, assisting clients with policy details, claims processing, and coverage options to ensure accurate and compliant communication. Customer Service Representatives handle a broader range of service requests, addressing general account issues, billing questions, and basic support across multiple product lines. The interaction with policyholders demands in-depth insurance knowledge and personalized guidance, whereas customer service focuses on efficient resolution and customer satisfaction across diverse service areas.

Industry-Specific Knowledge and Training

Policyholder Service Representatives possess specialized training in insurance policies, claims processing, and regulatory compliance, enabling them to address complex policyholder inquiries accurately and efficiently. Customer Service Representatives generally receive broader training focused on general customer support skills without the in-depth insurance industry expertise. This targeted knowledge enhances the policyholder representative's ability to guide clients through nuanced coverage details, claims resolution, and policy modifications.

Career Path and Advancement Opportunities

Policyholder Service Representatives in insurance companies specialize in managing client policies, claims, and coverage details, which provides a solid foundation for advancement into underwriting or claims adjustment roles. Customer Service Representatives often handle broader customer inquiries and support functions, creating pathways toward sales, marketing, or operational management positions within the insurance sector. Career progression for both roles depends on skill development in insurance products, communication, and regulatory compliance, with Policyholder Service Representatives typically advancing more directly into specialized insurance roles.

Regulatory Compliance and Procedures

Policyholder Service Representatives specialize in guiding clients through complex insurance policies while ensuring strict adherence to regulatory compliance and industry-specific procedures. Customer Service Representatives handle general inquiries and support but may lack in-depth knowledge of regulatory requirements, making them less equipped to navigate compliance issues. Emphasizing regulatory oversight, Policyholder Service Representatives ensure that all communications and transactions align with legal standards, reducing risk and enhancing policyholder trust.

Work Environment and Daily Challenges

Policyholder Service Representatives in insurance often work in office settings with direct access to policy databases and claims management systems, enabling detailed support for complex inquiries. Customer Service Representatives typically handle high call volumes in call centers, requiring quick problem resolution and strong communication skills to manage diverse customer concerns efficiently. Both roles face daily challenges such as navigating regulatory compliance, maintaining accuracy in policy details, and managing customer expectations under time constraints.

Compensation and Benefits Comparison

Policyholder Service Representatives in insurance typically receive higher base salaries and specialized bonuses due to their in-depth knowledge of policy details and claims processes, compared to general Customer Service Representatives. Benefits for Policyholder Service Representatives often include comprehensive health plans, performance-based incentives, and opportunities for career advancement within insurance firms. Customer Service Representatives may have standard benefits packages with fewer role-specific incentives and lower overall compensation reflecting the broader, less specialized nature of their duties.

Policyholder Service Representative vs Customer Service Representative Infographic

jobdiv.com

jobdiv.com