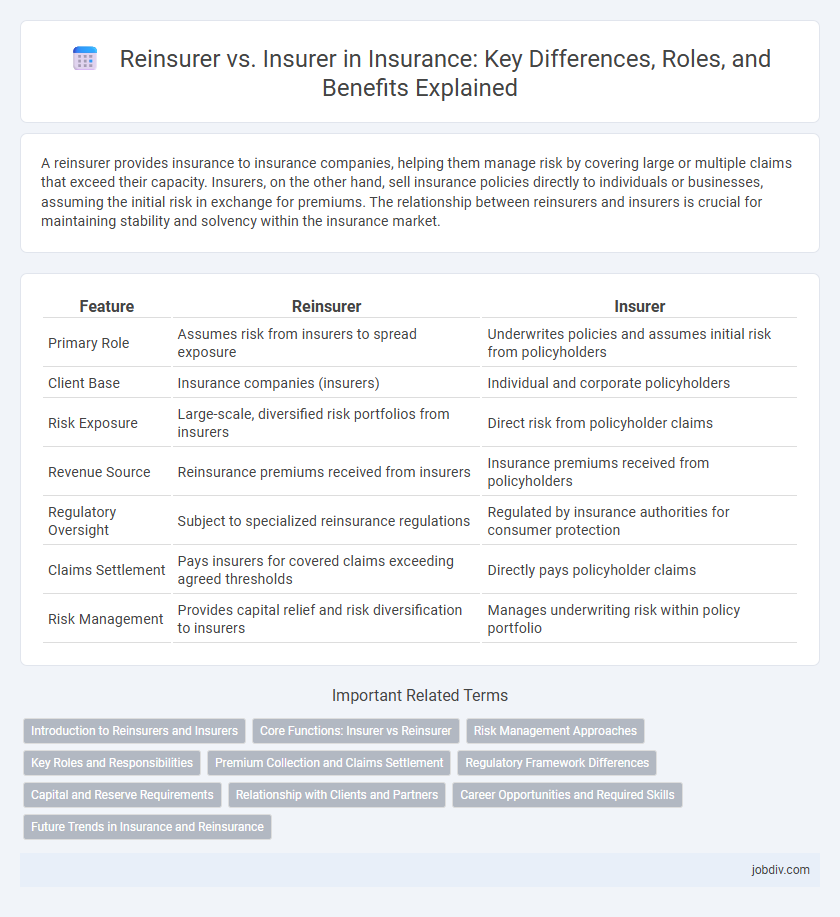

A reinsurer provides insurance to insurance companies, helping them manage risk by covering large or multiple claims that exceed their capacity. Insurers, on the other hand, sell insurance policies directly to individuals or businesses, assuming the initial risk in exchange for premiums. The relationship between reinsurers and insurers is crucial for maintaining stability and solvency within the insurance market.

Table of Comparison

| Feature | Reinsurer | Insurer |

|---|---|---|

| Primary Role | Assumes risk from insurers to spread exposure | Underwrites policies and assumes initial risk from policyholders |

| Client Base | Insurance companies (insurers) | Individual and corporate policyholders |

| Risk Exposure | Large-scale, diversified risk portfolios from insurers | Direct risk from policyholder claims |

| Revenue Source | Reinsurance premiums received from insurers | Insurance premiums received from policyholders |

| Regulatory Oversight | Subject to specialized reinsurance regulations | Regulated by insurance authorities for consumer protection |

| Claims Settlement | Pays insurers for covered claims exceeding agreed thresholds | Directly pays policyholder claims |

| Risk Management | Provides capital relief and risk diversification to insurers | Manages underwriting risk within policy portfolio |

Introduction to Reinsurers and Insurers

Reinsurers provide insurance to insurance companies, enabling risk distribution and enhanced financial stability for insurers. Insurers directly sell policies to individuals or businesses, managing premiums and claims to protect against potential losses. The relationship between reinsurers and insurers strengthens the overall insurance market by mitigating large-scale risks and promoting solvency.

Core Functions: Insurer vs Reinsurer

Insurers primarily underwrite and issue policies to individual and commercial policyholders, managing risks directly associated with claims and customer service. Reinsurers provide financial protection to insurers by assuming portions of the risk to stabilize loss exposure and enhance the insurer's capacity to underwrite more policies. This risk transfer mechanism enables insurers to maintain solvency and manage capital more efficiently in high-loss scenarios.

Risk Management Approaches

Reinsurers primarily manage risk by assuming portions of an insurer's portfolio, allowing insurers to stabilize losses and protect against catastrophic events. Insurers focus on underwriting risk, setting premiums, and managing claims to maintain profitability and solvency within their risk appetite. Effective collaboration between reinsurers and insurers enhances overall risk diversification and financial resilience across the insurance market.

Key Roles and Responsibilities

Reinsurers provide insurance to insurers, absorbing portions of risk to stabilize their financial exposure and enable capacity for larger or more policies. Insurers, also known as primary insurers, underwrite policies, assess risk, collect premiums, and handle claims directly with policyholders. The core responsibility of reinsurers lies in risk transfer and capital relief, while insurers focus on customer engagement and policy administration.

Premium Collection and Claims Settlement

Insurers directly collect premiums from policyholders and handle initial claims settlement processes, acting as the primary point of contact. Reinsurers do not collect premiums from individual customers but receive reinsurance premiums from insurers to share risk exposure and provide financial backing for large claims. In claims settlement, reinsurers reimburse insurers for agreed portions of losses, ensuring greater financial stability and capacity for insurers to underwrite more policies.

Regulatory Framework Differences

Reinsurers operate under a distinct regulatory framework that emphasizes capital adequacy and risk transfer due to their role in assuming insurance risks from primary insurers. Insurers face stricter consumer protection regulations, including comprehensive underwriting standards and claims handling requirements to safeguard policyholders directly. Regulatory bodies often impose different reporting and solvency requirements on reinsurers, reflecting their secondary position in the insurance value chain.

Capital and Reserve Requirements

Reinsurers typically maintain higher capital and reserve requirements compared to primary insurers to ensure they can cover large-scale or catastrophic risks transferred from insurers. Capital adequacy for reinsurers is often scrutinized under rigorous regulatory frameworks such as Solvency II in Europe or Risk-Based Capital (RBC) in the U.S., reflecting their pivotal role in risk mitigation within the insurance ecosystem. Insurers, while also regulated, tend to hold reserves based on underwriting portfolios and claims experience, focusing more on individual policy risk management.

Relationship with Clients and Partners

Insurers maintain direct relationships with clients, managing policy underwriting, claims processing, and customer service to address individual risk needs. Reinsurers operate behind the scenes, partnering primarily with insurers to provide risk transfer solutions that stabilize financial exposure and enhance underwriting capacity. This symbiotic relationship allows insurers to extend coverage limits while reinsurers gain diversified risk portfolios without direct client interaction.

Career Opportunities and Required Skills

Career opportunities in insurance often distinguish between reinsurers and insurers, with reinsurers focusing on risk management and portfolio analysis, requiring strong analytical and actuarial skills. Insurers emphasize client relations, underwriting, and claims management, demanding communication, negotiation, and compliance expertise. Both sectors offer roles in risk assessment, data analytics, and financial modeling, highlighting the need for proficiency in statistical software and regulatory knowledge.

Future Trends in Insurance and Reinsurance

Reinsurers are increasingly leveraging advanced data analytics and AI to price risks more accurately and manage catastrophic losses, driving innovation in the insurance ecosystem. Insurers are adopting digital platforms and personalized coverage models to enhance customer experience and streamline claim processes, responding to evolving market demands. Collaboration between insurers and reinsurers will intensify, focusing on sustainability risks, cyber threats, and climate change as key areas of future growth and risk mitigation.

Reinsurer vs Insurer Infographic

jobdiv.com

jobdiv.com