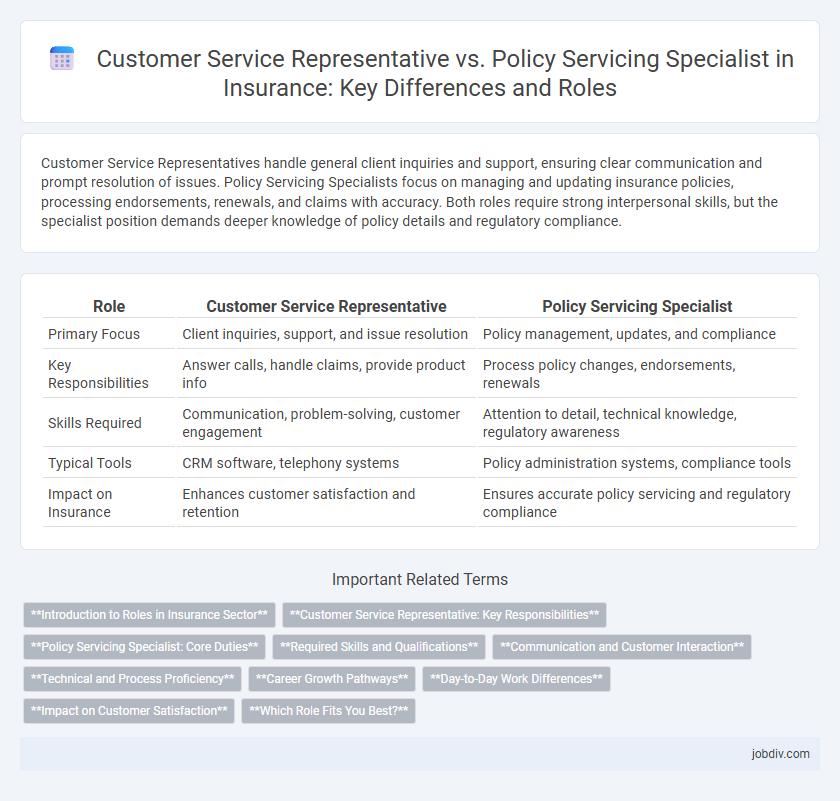

Customer Service Representatives handle general client inquiries and support, ensuring clear communication and prompt resolution of issues. Policy Servicing Specialists focus on managing and updating insurance policies, processing endorsements, renewals, and claims with accuracy. Both roles require strong interpersonal skills, but the specialist position demands deeper knowledge of policy details and regulatory compliance.

Table of Comparison

| Role | Customer Service Representative | Policy Servicing Specialist |

|---|---|---|

| Primary Focus | Client inquiries, support, and issue resolution | Policy management, updates, and compliance |

| Key Responsibilities | Answer calls, handle claims, provide product info | Process policy changes, endorsements, renewals |

| Skills Required | Communication, problem-solving, customer engagement | Attention to detail, technical knowledge, regulatory awareness |

| Typical Tools | CRM software, telephony systems | Policy administration systems, compliance tools |

| Impact on Insurance | Enhances customer satisfaction and retention | Ensures accurate policy servicing and regulatory compliance |

Introduction to Roles in Insurance Sector

Customer Service Representatives in the insurance sector primarily handle client inquiries, manage account information, and provide support throughout the claims process. Policy Servicing Specialists focus on policy administration tasks such as endorsements, renewals, and amendments, ensuring compliance with regulatory standards. Both roles contribute to maintaining customer satisfaction and operational efficiency in insurance companies.

Customer Service Representative: Key Responsibilities

Customer Service Representatives in insurance handle policy inquiries, process claims, and assist customers with billing and coverage questions to ensure client satisfaction. They serve as the primary contact for policyholders, resolving issues efficiently and maintaining accurate records of interactions. Expertise in communication and problem-solving is essential for managing diverse customer needs and facilitating smooth service delivery.

Policy Servicing Specialist: Core Duties

Policy Servicing Specialists manage policy administration tasks, including processing endorsements, renewals, and cancellations to ensure accurate and timely updates to insurance records. They handle client inquiries related to policy changes, coverage details, and billing, maintaining compliance with company guidelines and regulatory requirements. Expertise in policy documentation and claims coordination enables these specialists to enhance customer satisfaction and streamline operational workflows.

Required Skills and Qualifications

Customer Service Representatives in insurance require strong communication skills, basic knowledge of insurance products, and proficiency in CRM software to effectively address client inquiries and resolve issues. Policy Servicing Specialists demand advanced expertise in policy administration, attention to detail for processing endorsements and claims, and a thorough understanding of regulatory compliance. Both roles benefit from problem-solving abilities and customer-focused attitudes but differ in technical depth and policy management responsibilities.

Communication and Customer Interaction

Customer Service Representatives in insurance focus on addressing inquiries, resolving complaints, and providing general policy information through clear and empathetic communication. Policy Servicing Specialists handle more detailed client interactions, including policy amendments, endorsements, and claims support, requiring precise and technical communication skills. Both roles emphasize active listening and personalized service to enhance customer satisfaction and retention.

Technical and Process Proficiency

Customer Service Representatives demonstrate strong technical proficiency by managing policy inquiries and resolving claims with basic insurance software tools, ensuring efficient communication and problem-solving. Policy Servicing Specialists exhibit advanced process expertise, handling complex policy adjustments, endorsements, and renewals through specialized systems, optimizing workflow accuracy and compliance. Both roles require a thorough understanding of insurance regulations and technical platforms, but Policy Servicing Specialists possess deeper process integration skills for comprehensive policy management.

Career Growth Pathways

Customer Service Representatives in insurance often begin with handling client inquiries and claims support, building foundational knowledge essential for advancing to roles like Policy Servicing Specialists, who manage detailed policy modifications and renewals. Career growth pathways typically involve progressing from customer-facing roles to more specialized positions requiring expertise in policy administration and regulatory compliance. Gaining certifications such as CPCU (Chartered Property Casualty Underwriter) or progressing into underwriting, claims management, or supervisory roles can further enhance long-term career development in the insurance industry.

Day-to-Day Work Differences

Customer Service Representatives in insurance primarily manage incoming client inquiries, provide policy information, and resolve general service issues, emphasizing direct communication and problem-solving. Policy Servicing Specialists focus on detailed policy administration tasks such as processing endorsements, renewals, cancellations, and billing adjustments, requiring deep knowledge of policy terms and compliance. The Customer Service role centers on broad client interaction and support, while Policy Servicing Specialists handle precise transactional workflows and policy maintenance.

Impact on Customer Satisfaction

Customer Service Representatives directly influence customer satisfaction by addressing inquiries and resolving issues promptly, ensuring a positive customer experience. Policy Servicing Specialists enhance satisfaction through accurate and efficient management of policy updates, claims processing, and renewals, reducing errors and delays. Both roles are crucial, but effective communication from Customer Service Representatives often leads to higher immediate customer satisfaction levels.

Which Role Fits You Best?

A Customer Service Representative in insurance primarily handles client inquiries, resolves issues, and supports sales efforts, requiring strong communication and problem-solving skills. A Policy Servicing Specialist focuses on processing policy changes, endorsements, and renewals, demanding attention to detail and knowledge of insurance products. Assess your strengths in direct client interaction versus technical policy administration to determine which role aligns best with your skills and career goals.

Customer Service Representative vs Policy Servicing Specialist Infographic

jobdiv.com

jobdiv.com