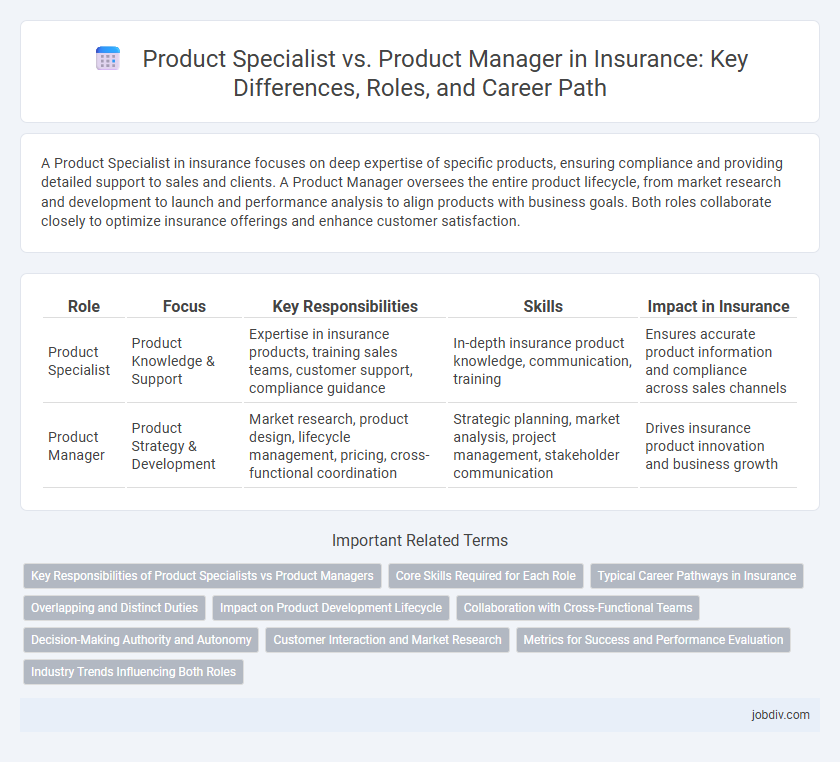

A Product Specialist in insurance focuses on deep expertise of specific products, ensuring compliance and providing detailed support to sales and clients. A Product Manager oversees the entire product lifecycle, from market research and development to launch and performance analysis to align products with business goals. Both roles collaborate closely to optimize insurance offerings and enhance customer satisfaction.

Table of Comparison

| Role | Focus | Key Responsibilities | Skills | Impact in Insurance |

|---|---|---|---|---|

| Product Specialist | Product Knowledge & Support | Expertise in insurance products, training sales teams, customer support, compliance guidance | In-depth insurance product knowledge, communication, training | Ensures accurate product information and compliance across sales channels |

| Product Manager | Product Strategy & Development | Market research, product design, lifecycle management, pricing, cross-functional coordination | Strategic planning, market analysis, project management, stakeholder communication | Drives insurance product innovation and business growth |

Key Responsibilities of Product Specialists vs Product Managers

Product Specialists in insurance focus on in-depth product knowledge, supporting sales teams with technical expertise, and ensuring accurate product information is communicated to clients. Product Managers oversee the entire product lifecycle, including market analysis, strategy development, and coordinating cross-functional teams to optimize product performance and profitability. While Product Specialists prioritize detailed product support and training, Product Managers drive product innovation, pricing, and positioning strategies.

Core Skills Required for Each Role

Product Specialists in insurance require in-depth knowledge of specific insurance products, strong analytical skills for market research, and the ability to communicate product features effectively to sales and clients. Product Managers need expertise in strategic planning, cross-functional team leadership, and data-driven decision-making to oversee product lifecycle management and drive profitability. Both roles demand proficiency in regulatory compliance, customer insights analysis, and strong collaboration skills within the insurance industry.

Typical Career Pathways in Insurance

Product Specialists in insurance often begin their careers by gaining deep expertise in specific products, progressing to roles such as Senior Product Specialist or Product Analyst where they refine product features and support sales teams. Product Managers typically start in entry-level management or marketing roles, advancing to positions like Product Owner or Senior Product Manager, where they oversee product development, strategy, and cross-functional team coordination. Both pathways offer opportunities to evolve into leadership roles such as Product Director or Head of Product, driving innovation and aligning insurance products with market demands.

Overlapping and Distinct Duties

Product Specialists in insurance focus on in-depth product knowledge, customer training, and supporting sales teams with technical expertise to ensure accurate product representation. Product Managers oversee the entire product lifecycle, including market research, pricing, regulatory compliance, and strategic planning to drive product development and profitability. Both roles collaborate on product enhancements and customer feedback, but Product Managers prioritize business strategy while Product Specialists emphasize technical accuracy and customer understanding.

Impact on Product Development Lifecycle

Product Specialists provide in-depth knowledge of insurance products, ensuring accurate feature details and compliance requirements are embedded during the product development lifecycle, which enhances product quality and market fit. Product Managers drive the strategic vision and coordinate cross-functional teams, aligning development milestones with business goals and customer needs to accelerate time-to-market. Their combined roles optimize innovation and operational efficiency, resulting in competitive insurance solutions that meet regulatory standards and customer expectations.

Collaboration with Cross-Functional Teams

Product Specialists in insurance work closely with sales, underwriting, and claims teams to ensure accurate product information and effective implementation. Product Managers coordinate with marketing, legal, and finance departments to align product development with business goals and regulatory compliance. Both roles require seamless collaboration with cross-functional teams to optimize insurance product performance and customer satisfaction.

Decision-Making Authority and Autonomy

Product Managers in insurance hold greater decision-making authority, driving strategic product development and market positioning with autonomy over product lifecycle and cross-functional alignment. Product Specialists focus on technical expertise and support, executing product specifications with limited authority, primarily advising Product Managers on features and compliance. Autonomy differentiates roles as Product Managers steer innovation and business outcomes, while Product Specialists ensure detailed product accuracy and regulatory adherence.

Customer Interaction and Market Research

Product Specialists in insurance often engage directly with customers to understand specific needs, tailor product features, and provide detailed technical support, enhancing customer satisfaction and retention. Product Managers focus on analyzing market trends, competitor products, and customer data to develop strategies that drive product innovation and market growth. Both roles collaborate closely, but Product Specialists prioritize customer interaction while Product Managers emphasize market research for strategic decision-making.

Metrics for Success and Performance Evaluation

Product Specialists in insurance focus on product knowledge dissemination, customer feedback analysis, and training effectiveness, measured through customer satisfaction scores and speed of issue resolution. Product Managers prioritize strategic outcomes like product profitability, market share growth, and feature adoption rates, often evaluated using KPIs such as revenue growth, time-to-market, and customer retention rates. Both roles rely on data-driven performance evaluation, but Product Managers are more closely aligned with high-level business impact metrics, while Product Specialists emphasize operational excellence and user engagement.

Industry Trends Influencing Both Roles

Emerging technologies like AI and big data analytics are reshaping product development strategies in insurance, requiring Product Specialists to deepen technical expertise while Product Managers focus on integrating customer-centric innovations. Regulatory changes and evolving consumer expectations drive both roles to enhance compliance knowledge and agile decision-making capabilities to maintain competitive advantage. Industry trends such as digital transformation and personalized insurance solutions necessitate closer collaboration between Product Specialists and Product Managers to accelerate market responsiveness and product lifecycle efficiency.

Product Specialist vs Product Manager Infographic

jobdiv.com

jobdiv.com