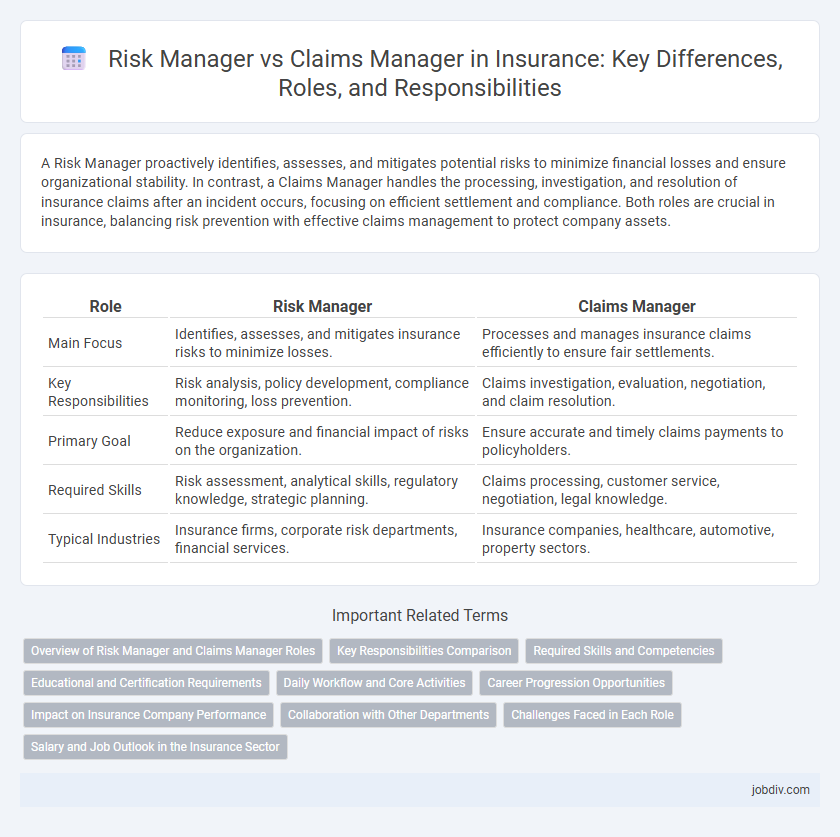

A Risk Manager proactively identifies, assesses, and mitigates potential risks to minimize financial losses and ensure organizational stability. In contrast, a Claims Manager handles the processing, investigation, and resolution of insurance claims after an incident occurs, focusing on efficient settlement and compliance. Both roles are crucial in insurance, balancing risk prevention with effective claims management to protect company assets.

Table of Comparison

| Role | Risk Manager | Claims Manager |

|---|---|---|

| Main Focus | Identifies, assesses, and mitigates insurance risks to minimize losses. | Processes and manages insurance claims efficiently to ensure fair settlements. |

| Key Responsibilities | Risk analysis, policy development, compliance monitoring, loss prevention. | Claims investigation, evaluation, negotiation, and claim resolution. |

| Primary Goal | Reduce exposure and financial impact of risks on the organization. | Ensure accurate and timely claims payments to policyholders. |

| Required Skills | Risk assessment, analytical skills, regulatory knowledge, strategic planning. | Claims processing, customer service, negotiation, legal knowledge. |

| Typical Industries | Insurance firms, corporate risk departments, financial services. | Insurance companies, healthcare, automotive, property sectors. |

Overview of Risk Manager and Claims Manager Roles

Risk Managers identify, assess, and mitigate potential risks to protect an organization's assets and ensure regulatory compliance, often developing risk management strategies and policies. Claims Managers oversee the claims process, ensuring accurate assessment, timely settlement, and compliance with insurance policies while managing relationships with claimants and adjusters. Both roles are essential in the insurance industry but focus on different aspects of risk and loss management to minimize financial impact.

Key Responsibilities Comparison

Risk Managers identify, assess, and mitigate potential risks to minimize financial losses and ensure regulatory compliance, focusing on proactive strategies and risk prevention. Claims Managers oversee the processing, investigation, and settlement of insurance claims, ensuring timely and accurate resolution while managing claim-related expenses. Both roles require strong analytical skills, but Risk Managers emphasize risk assessment and reduction, whereas Claims Managers concentrate on claims handling and customer service.

Required Skills and Competencies

Risk Managers require strong analytical skills, expertise in risk assessment methodologies, and proficiency in regulatory compliance to identify and mitigate potential threats to the organization. Claims Managers need excellent negotiation abilities, detailed knowledge of claims processing, and strong communication skills to efficiently handle claims lifecycle and resolve disputes. Both roles demand leadership, decision-making capabilities, and a thorough understanding of insurance policies and industry standards.

Educational and Certification Requirements

Risk Managers typically require a bachelor's degree in risk management, finance, or business administration, with many pursuing professional certifications such as the Certified Risk Manager (CRM) or Associate in Risk Management (ARM) to demonstrate expertise in identifying and mitigating risks. Claims Managers often hold degrees in insurance, business, or law and benefit from certifications like the Chartered Property Casualty Underwriter (CPCU) or Associate in Claims (AIC) to enhance skills in claims investigation and settlement negotiation. Both roles emphasize continuous education through industry seminars, workshops, and relevant certification renewals to stay current with regulatory changes and best practices.

Daily Workflow and Core Activities

Risk Managers focus on identifying, assessing, and mitigating potential risks by analyzing data and implementing strategies to minimize losses, while Claims Managers handle the end-to-end claims process including investigation, evaluation, and settlement of insurance claims. Daily workflows for Risk Managers involve risk assessments, compliance reviews, and coordination with underwriting teams, whereas Claims Managers prioritize claim intake, documentation verification, and negotiation with claimants and service providers. Both roles demand strong analytical skills, but Risk Managers emphasize proactive risk control, whereas Claims Managers concentrate on reactive claims resolution.

Career Progression Opportunities

A Risk Manager typically advances by deepening expertise in risk assessment, regulatory compliance, and enterprise risk management, with potential progression to Chief Risk Officer or Director of Risk roles. Claims Managers often move towards senior claims executive positions, specializing in claims strategy, litigation management, and customer relations, leading to roles like Claims Director or Vice President of Claims. Career growth in both paths depends on industry experience, leadership skills, and specialized certifications such as CPCU or ARM.

Impact on Insurance Company Performance

Risk Managers play a crucial role in enhancing insurance company performance by identifying, assessing, and mitigating potential risks, which reduces the frequency and severity of claims. Claims Managers directly impact financial outcomes by efficiently handling claims processing, ensuring accurate payouts, and controlling claim-related costs. Together, these roles optimize risk exposure and claims expenditure, improving overall profitability and stability for insurance companies.

Collaboration with Other Departments

Risk Managers collaborate closely with underwriting, finance, and compliance teams to identify and mitigate potential exposures before they materialize. Claims Managers work in tandem with legal, customer service, and adjuster departments to ensure efficient claim processing and resolution. Effective communication between Risk and Claims Managers enhances overall risk assessment and supports seamless operational workflows across departments.

Challenges Faced in Each Role

Risk Managers face challenges in identifying emerging risks, ensuring compliance with regulatory changes, and implementing effective risk mitigation strategies across diverse business operations. Claims Managers encounter difficulties in managing high claim volumes, detecting fraudulent claims, and maintaining customer satisfaction while controlling claim settlement costs. Both roles require balancing operational efficiency with strategic decision-making to protect organizational assets and reputation.

Salary and Job Outlook in the Insurance Sector

Risk Managers in the insurance sector typically earn higher salaries, with median annual earnings around $120,000, compared to Claims Managers whose median salary is approximately $75,000. The job outlook for Risk Managers is robust, driven by increasing demand for risk assessment and mitigation in complex insurance portfolios, while Claims Managers face steady growth due to ongoing claims processing needs. Both roles require strong analytical skills, but Risk Managers benefit from a broader scope in strategic risk planning, leading to higher compensation and career advancement opportunities.

Risk Manager vs Claims Manager Infographic

jobdiv.com

jobdiv.com