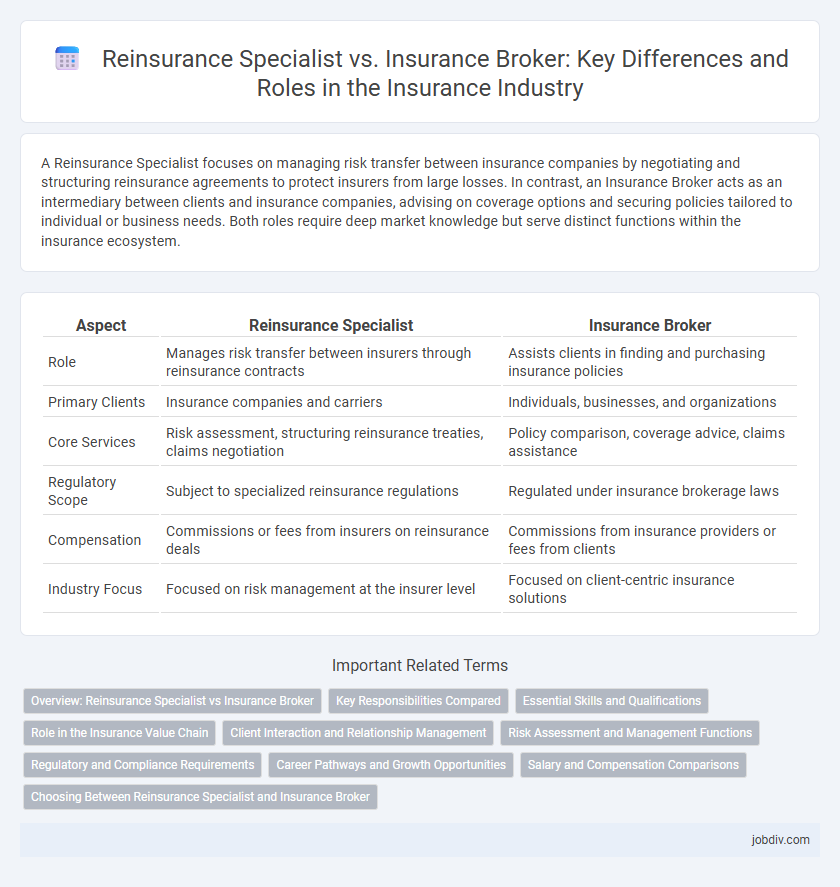

A Reinsurance Specialist focuses on managing risk transfer between insurance companies by negotiating and structuring reinsurance agreements to protect insurers from large losses. In contrast, an Insurance Broker acts as an intermediary between clients and insurance companies, advising on coverage options and securing policies tailored to individual or business needs. Both roles require deep market knowledge but serve distinct functions within the insurance ecosystem.

Table of Comparison

| Aspect | Reinsurance Specialist | Insurance Broker |

|---|---|---|

| Role | Manages risk transfer between insurers through reinsurance contracts | Assists clients in finding and purchasing insurance policies |

| Primary Clients | Insurance companies and carriers | Individuals, businesses, and organizations |

| Core Services | Risk assessment, structuring reinsurance treaties, claims negotiation | Policy comparison, coverage advice, claims assistance |

| Regulatory Scope | Subject to specialized reinsurance regulations | Regulated under insurance brokerage laws |

| Compensation | Commissions or fees from insurers on reinsurance deals | Commissions from insurance providers or fees from clients |

| Industry Focus | Focused on risk management at the insurer level | Focused on client-centric insurance solutions |

Overview: Reinsurance Specialist vs Insurance Broker

A Reinsurance Specialist manages risk transfer between insurance companies by negotiating and structuring reinsurance treaties to protect insurers from significant losses. An Insurance Broker acts as an intermediary between clients and insurance providers, helping individuals or businesses find and purchase the most suitable insurance policies. While both roles optimize risk management, the Reinsurance Specialist operates within the insurance industry framework, whereas the Insurance Broker serves the end client directly.

Key Responsibilities Compared

Reinsurance specialists negotiate and manage risk transfer agreements between insurance companies to optimize portfolio risk and capital efficiency. Insurance brokers act as intermediaries, connecting clients with suitable insurance policies, providing advice, and facilitating policy underwriting and claims. Both roles require deep market knowledge but differ as reinsurance specialists focus on insurer-to-insurer contracts, while brokers primarily serve policyholders' needs.

Essential Skills and Qualifications

A Reinsurance Specialist requires advanced expertise in risk assessment, contract negotiation, and financial analysis to structure and secure reinsurance agreements effectively. In contrast, an Insurance Broker must excel in customer relationship management, policy advisory, and regulatory compliance to tailor insurance solutions to client needs. Both roles demand strong analytical abilities, but reinsurance specialists emphasize technical knowledge of underwriting and actuarial concepts, while brokers focus on sales and communication skills.

Role in the Insurance Value Chain

A Reinsurance Specialist plays a critical role in the insurance value chain by assessing and transferring risk from primary insurers to reinsurers, ensuring financial stability and capacity for the insurer. Insurance Brokers act as intermediaries between clients and insurers, facilitating the purchase of insurance policies by advising on coverage options and negotiating terms. While Reinsurance Specialists focus on risk management at the insurer level, Insurance Brokers concentrate on client needs and market access.

Client Interaction and Relationship Management

Reinsurance specialists primarily manage relationships with insurance companies, negotiating terms to optimize risk transfer rather than interacting directly with individual clients. Insurance brokers focus extensively on client interaction, advising policyholders on coverage options and maintaining ongoing communications to tailor insurance solutions. Effective relationship management in reinsurance centers on industry partnerships, while brokers prioritize personalized client service and trust-building.

Risk Assessment and Management Functions

Reinsurance specialists focus on evaluating and mitigating risks by transferring portions of insurance liabilities to other insurers, ensuring financial stability for primary insurers. Insurance brokers prioritize assessing client risk profiles and finding suitable insurance policies, facilitating risk management by matching coverage to specific client needs. Both roles involve critical risk assessment but differ in scope, with reinsurance specialists managing risk at an institutional level and brokers addressing individual or organizational risk exposure.

Regulatory and Compliance Requirements

Reinsurance specialists navigate complex regulatory frameworks specific to treaty and facultative reinsurance, ensuring compliance with capital adequacy and risk transfer rules established by bodies like the National Association of Insurance Commissioners (NAIC) and Solvency II. Insurance brokers must adhere to licensing requirements, anti-money laundering (AML) regulations, and disclosure obligations under authorities such as the Financial Conduct Authority (FCA) or state insurance departments. Both roles demand continuous compliance monitoring but differ in their regulatory scope, with reinsurance specialists focused on insurer solvency and risk management, while brokers emphasize consumer protection and transactional transparency.

Career Pathways and Growth Opportunities

Reinsurance specialists primarily focus on managing risk transfer between insurance companies and reinsurers, offering specialized knowledge in underwriting, risk assessment, and treaty negotiation that often leads to senior actuarial or risk management roles. Insurance brokers serve as intermediaries between clients and insurance providers, developing expertise in client relations, policy structuring, and market analysis, which can propel careers into sales leadership or consultancy. Both career paths offer substantial growth opportunities, with reinsurance specialists typically advancing in technical and analytical domains, while insurance brokers excel in client-facing and strategic business development positions.

Salary and Compensation Comparisons

Reinsurance specialists typically earn higher salaries than insurance brokers due to their specialized knowledge in risk transfer and large-scale policy negotiations, with average annual compensation ranging from $90,000 to $140,000. Insurance brokers, whose roles focus on client acquisition and policy sales, have a wider salary range, generally between $50,000 and $100,000, often supplemented by commissions and bonuses based on sales performance. Compensation for both roles varies significantly by experience, geographic location, and the size of the employer, with reinsurance specialists benefiting from more stable base salaries and brokers relying more heavily on variable income components.

Choosing Between Reinsurance Specialist and Insurance Broker

Choosing between a reinsurance specialist and an insurance broker depends on the complexity and scale of risk management needs. A reinsurance specialist focuses on managing risk transfer between insurance companies, offering expertise in large-scale or high-risk portfolios, while an insurance broker primarily serves clients by finding and negotiating insurance policies tailored to individual or business needs. For entities seeking to mitigate significant underwriting risks, engaging a reinsurance specialist provides strategic financial protection, whereas brokers are ideal for personalized policy acquisition and claims support.

Reinsurance Specialist vs Insurance Broker Infographic

jobdiv.com

jobdiv.com