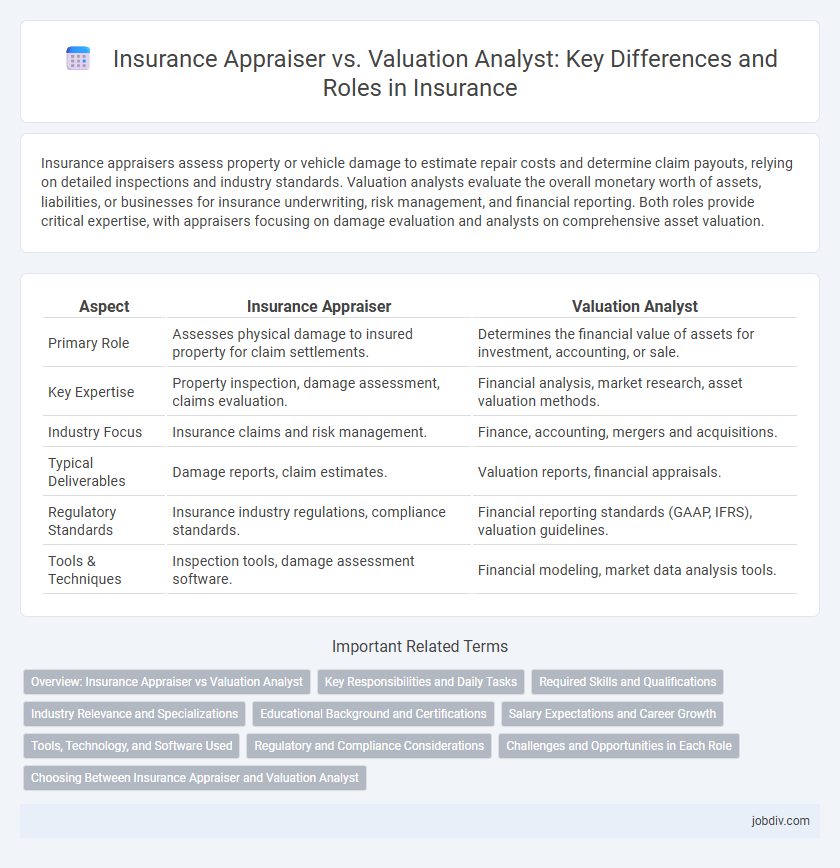

Insurance appraisers assess property or vehicle damage to estimate repair costs and determine claim payouts, relying on detailed inspections and industry standards. Valuation analysts evaluate the overall monetary worth of assets, liabilities, or businesses for insurance underwriting, risk management, and financial reporting. Both roles provide critical expertise, with appraisers focusing on damage evaluation and analysts on comprehensive asset valuation.

Table of Comparison

| Aspect | Insurance Appraiser | Valuation Analyst |

|---|---|---|

| Primary Role | Assesses physical damage to insured property for claim settlements. | Determines the financial value of assets for investment, accounting, or sale. |

| Key Expertise | Property inspection, damage assessment, claims evaluation. | Financial analysis, market research, asset valuation methods. |

| Industry Focus | Insurance claims and risk management. | Finance, accounting, mergers and acquisitions. |

| Typical Deliverables | Damage reports, claim estimates. | Valuation reports, financial appraisals. |

| Regulatory Standards | Insurance industry regulations, compliance standards. | Financial reporting standards (GAAP, IFRS), valuation guidelines. |

| Tools & Techniques | Inspection tools, damage assessment software. | Financial modeling, market data analysis tools. |

Overview: Insurance Appraiser vs Valuation Analyst

Insurance appraisers assess physical damage to insured property, providing detailed reports to determine claim settlements accurately. Valuation analysts specialize in evaluating the financial worth of assets, businesses, or insurance portfolios to support underwriting, pricing, and risk assessment. Both roles require analytical expertise but differ in focus, with appraisers emphasizing property conditions and valuation analysts concentrating on financial metrics.

Key Responsibilities and Daily Tasks

Insurance appraisers primarily assess property damage and vehicle losses to determine repair costs and claim settlements, often conducting on-site inspections and photographing damages. Valuation analysts focus on evaluating the financial worth of assets, including businesses or real estate, by analyzing market trends, financial statements, and comparable sales data. Both roles support insurance underwriting and claim processing but differ in their emphasis on physical damage assessment versus financial valuation.

Required Skills and Qualifications

Insurance appraisers require strong investigative skills, detailed knowledge of insurance policies, and expertise in assessing property damage for accurate claim settlements. Valuation analysts must possess advanced analytical abilities, proficiency in financial modeling, and an in-depth understanding of market trends to determine asset value. Both roles demand excellent communication skills and relevant certifications such as Certified Insurance Appraiser (CIA) or Accredited Senior Appraiser (ASA).

Industry Relevance and Specializations

Insurance appraisers specialize in assessing property damage to determine claim values, playing a critical role in insurance claims processing and risk management. Valuation analysts focus on evaluating financial assets and liabilities to provide accurate market value estimations for underwriting and investment decisions within the insurance industry. Both professionals contribute to mitigating financial loss and ensuring fair claim settlements, with appraisers concentrating on physical asset assessment and valuation analysts on financial asset appraisal.

Educational Background and Certifications

Insurance appraisers typically possess a background in insurance, finance, or business administration and often hold certifications such as the Associate in Claims (AIC) or Certified Insurance Appraiser (CIA). Valuation analysts usually have degrees in finance, economics, or accounting, with professional credentials like the Chartered Financial Analyst (CFA) or Accredited Senior Appraiser (ASA) highlighting their expertise. Both roles require specialized knowledge, but insurance appraisers focus on property damage assessment while valuation analysts emphasize asset valuation through advanced financial analysis.

Salary Expectations and Career Growth

Insurance appraisers typically earn an annual salary ranging from $45,000 to $70,000, with opportunities for growth through certifications and specialization in property or casualty claims. Valuation analysts in the insurance sector often command higher salaries, averaging between $60,000 and $90,000, driven by expertise in financial modeling and risk assessment. Career growth for valuation analysts tends to be faster, with paths leading to senior financial roles or risk management positions, whereas insurance appraisers may progress into supervisory or claims management roles.

Tools, Technology, and Software Used

Insurance appraisers primarily use specialized inspection software, digital cameras, and mobile apps to document damages and assess claims on-site, enabling real-time data capture and streamlined reporting. Valuation analysts rely heavily on advanced data analytics platforms, valuation modeling software, and proprietary algorithms to interpret market trends, perform risk assessments, and generate accurate asset valuations. Integration of AI-driven tools and cloud-based systems is increasingly common in both roles, enhancing efficiency, accuracy, and collaboration across insurance claim processes.

Regulatory and Compliance Considerations

Insurance appraisers must adhere to state-specific licensing requirements and follow established regulatory frameworks to ensure accurate property damage assessments compliant with industry standards. Valuation analysts, operating under financial regulations such as GAAP or IFRS, focus on compliance with accounting principles and valuation guidelines mandated by bodies like the SEC or FASB. Both roles require meticulous documentation and adherence to legal and ethical standards to mitigate risks and maintain regulatory compliance in insurance claims and financial reporting.

Challenges and Opportunities in Each Role

Insurance appraisers face challenges in accurately assessing physical damages and estimating repair costs under tight deadlines, while opportunities lie in leveraging advanced imaging technology and AI for improved damage detection. Valuation analysts encounter complexities in interpreting market trends and policy terms to determine accurate asset values, with opportunities emerging from integrating big data analytics and machine learning for enhanced risk assessment. Both roles demand a deep understanding of insurance principles, yet appraisers focus on tangible asset evaluation, whereas valuation analysts emphasize financial valuation and forecasting.

Choosing Between Insurance Appraiser and Valuation Analyst

Choosing between an insurance appraiser and a valuation analyst depends on the specific insurance claim or policy requirement. Insurance appraisers specialize in assessing property damage and estimating repair costs for claims accuracy, while valuation analysts focus on determining the financial value of assets or businesses for underwriting and risk assessment. Selecting the appropriate expert ensures precise evaluations that align with policy terms and regulatory standards.

Insurance Appraiser vs Valuation Analyst Infographic

jobdiv.com

jobdiv.com