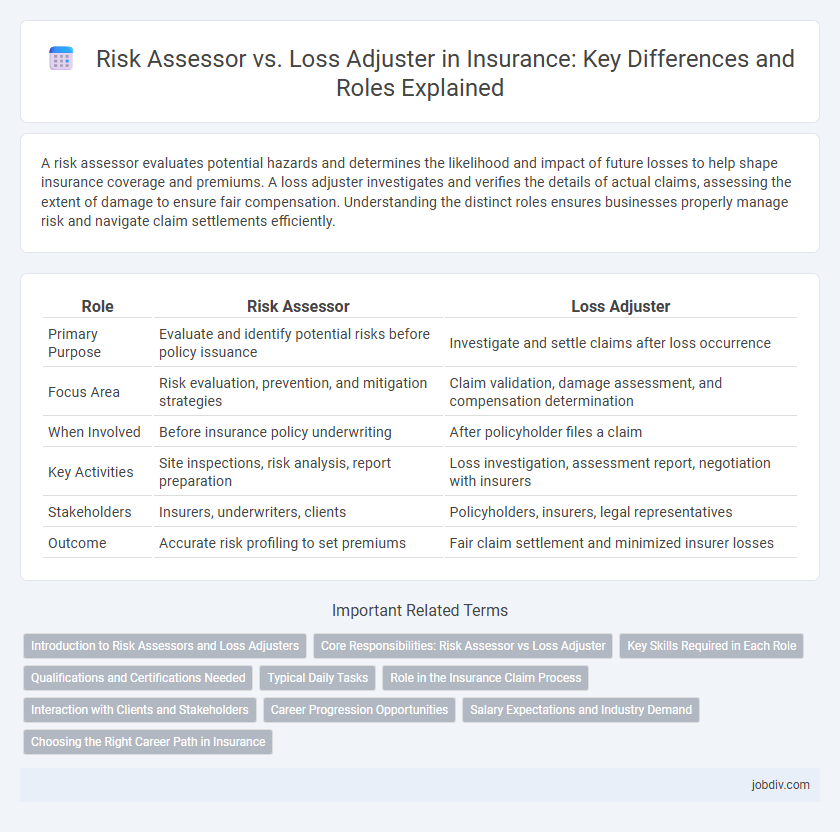

A risk assessor evaluates potential hazards and determines the likelihood and impact of future losses to help shape insurance coverage and premiums. A loss adjuster investigates and verifies the details of actual claims, assessing the extent of damage to ensure fair compensation. Understanding the distinct roles ensures businesses properly manage risk and navigate claim settlements efficiently.

Table of Comparison

| Role | Risk Assessor | Loss Adjuster |

|---|---|---|

| Primary Purpose | Evaluate and identify potential risks before policy issuance | Investigate and settle claims after loss occurrence |

| Focus Area | Risk evaluation, prevention, and mitigation strategies | Claim validation, damage assessment, and compensation determination |

| When Involved | Before insurance policy underwriting | After policyholder files a claim |

| Key Activities | Site inspections, risk analysis, report preparation | Loss investigation, assessment report, negotiation with insurers |

| Stakeholders | Insurers, underwriters, clients | Policyholders, insurers, legal representatives |

| Outcome | Accurate risk profiling to set premiums | Fair claim settlement and minimized insurer losses |

Introduction to Risk Assessors and Loss Adjusters

Risk assessors specialize in identifying, analyzing, and evaluating potential risks that could impact insured assets or individuals, using data-driven methods to mitigate exposure before a loss occurs. Loss adjusters investigate and quantify the extent of damage or loss after an insured event, working closely with insurers and policyholders to settle claims fairly and accurately. Both roles are crucial in the insurance industry, ensuring proactive risk management and effective claims resolution.

Core Responsibilities: Risk Assessor vs Loss Adjuster

Risk assessors evaluate potential hazards and risks associated with individuals, properties, or businesses to determine insurance eligibility and premium rates, using detailed inspections and data analysis. Loss adjusters investigate insurance claims by assessing the extent of damage or loss, verifying policy coverage, and negotiating settlements between insurers and policyholders. Both roles require expertise in risk evaluation, but risk assessors focus on prevention and underwriting, while loss adjusters concentrate on post-loss investigation and claim resolution.

Key Skills Required in Each Role

Risk assessors excel in analytical skills, risk evaluation, and predictive modeling to identify potential hazards and determine insurance coverage needs. Loss adjusters possess strong investigative abilities, negotiation expertise, and detailed knowledge of claims processes to accurately assess damage and settle claims fairly. Both roles demand excellent communication skills, but risk assessors prioritize foresight and prevention, while loss adjusters focus on resolution and compensation.

Qualifications and Certifications Needed

Risk assessors typically require qualifications in risk management, finance, or insurance, often holding certifications such as Certified Risk Manager (CRM) or Associate in Risk Management (ARM). Loss adjusters usually need a background in insurance claims, law, or finance, with industry-recognized certifications like Accredited Claims Adjuster (ACA) or Chartered Loss Adjuster (CLA). Both roles demand strong analytical skills and a thorough understanding of insurance policies, but their certifications reflect specialized expertise in risk evaluation or claims settlement.

Typical Daily Tasks

Risk assessors analyze potential hazards by examining property conditions, reviewing safety protocols, and evaluating risk factors to recommend preventive measures. Loss adjusters investigate insurance claims by inspecting damages, interviewing policyholders and witnesses, and determining claim validity and settlement amounts. Both roles require detailed documentation and strong communication with clients and insurance companies to support informed decision-making.

Role in the Insurance Claim Process

Risk assessors evaluate potential hazards and determine the level of risk before insurance policies are issued, influencing premium calculations and coverage limits. Loss adjusters investigate and verify the extent of damage or loss after a claim is filed, ensuring accurate claim settlements in accordance with policy terms. Both roles are critical in balancing risk management with fair claims resolution in the insurance claim process.

Interaction with Clients and Stakeholders

Risk assessors engage with clients primarily during the policy underwriting phase to evaluate potential hazards and advise on risk mitigation strategies, ensuring accurate premium calculations. Loss adjusters interact directly with claimants and other stakeholders post-incident to investigate and validate claims, facilitating fair settlement processes. Both roles require strong communication skills to manage expectations and foster trust between insurers and insured parties.

Career Progression Opportunities

Risk assessors typically begin their careers by evaluating potential hazards and underwriting insurance policies, gaining expertise in risk analysis and decision-making. Progressing to senior roles often involves specialization in complex risk modeling or transitioning into loss adjuster positions, where skills in claims investigation and settlement negotiation are crucial. Loss adjusters advance by handling high-value or disputed claims, eventually moving into managerial roles overseeing claims teams or consulting on risk mitigation strategies.

Salary Expectations and Industry Demand

Risk assessors in insurance typically earn between $60,000 and $90,000 annually, reflecting strong industry demand for their expertise in evaluating potential hazards and underwriting policies. Loss adjusters command salaries ranging from $55,000 to $85,000, with a growing need driven by increasing claims complexity and regulatory changes. Both roles are essential, but risk assessors may see higher salary growth due to their proactive role in risk mitigation and compliance.

Choosing the Right Career Path in Insurance

Risk assessors analyze potential hazards and evaluate the likelihood and impact of insurance claims to help companies set appropriate premiums and policies. Loss adjusters investigate and verify claims after incidents occur, determining the extent of the insurer's liability and ensuring fair settlements. Choosing between these roles depends on whether you prefer proactive risk management or reactive claims evaluation within the insurance sector.

Risk Assessor vs Loss Adjuster Infographic

jobdiv.com

jobdiv.com