Personal lines insurance safeguards individuals and families by covering risks related to homes, automobiles, and personal possessions, offering tailored protection for everyday life. Commercial lines insurance focuses on businesses, providing coverage for property, liability, workers' compensation, and commercial vehicles to mitigate risks associated with professional operations. Understanding the distinct needs of each category ensures appropriate risk management and financial security for both personal and business environments.

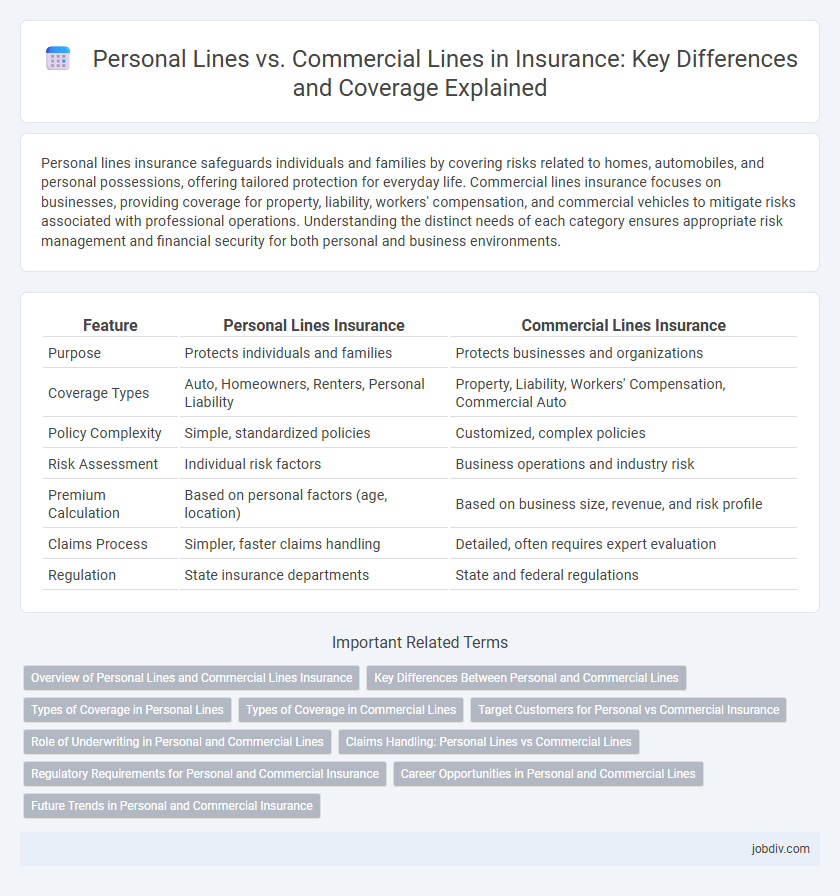

Table of Comparison

| Feature | Personal Lines Insurance | Commercial Lines Insurance |

|---|---|---|

| Purpose | Protects individuals and families | Protects businesses and organizations |

| Coverage Types | Auto, Homeowners, Renters, Personal Liability | Property, Liability, Workers' Compensation, Commercial Auto |

| Policy Complexity | Simple, standardized policies | Customized, complex policies |

| Risk Assessment | Individual risk factors | Business operations and industry risk |

| Premium Calculation | Based on personal factors (age, location) | Based on business size, revenue, and risk profile |

| Claims Process | Simpler, faster claims handling | Detailed, often requires expert evaluation |

| Regulation | State insurance departments | State and federal regulations |

Overview of Personal Lines and Commercial Lines Insurance

Personal lines insurance covers policies designed for individual consumers, protecting against risks like auto, home, renters, and personal liability, tailored to personal use and family needs. Commercial lines insurance addresses the coverage requirements of businesses, including property, liability, workers' compensation, and commercial auto insurance, focusing on mitigating risks associated with business operations and assets. Both types provide essential financial protection but cater to different policyholders and risk exposures.

Key Differences Between Personal and Commercial Lines

Personal lines insurance primarily covers individual risks such as home, auto, and renters insurance, tailored to protect personal assets and liabilities. Commercial lines insurance addresses business-related risks, offering coverage for properties, liabilities, workers' compensation, and business interruption specific to company operations. Key differences include policy complexity, underwriting criteria, and risk assessment, with commercial lines requiring more detailed evaluations due to higher exposure and business-specific needs.

Types of Coverage in Personal Lines

Personal Lines insurance primarily includes coverage types such as auto, homeowners, renters, and personal umbrella policies designed to protect individuals and families from financial loss. These policies typically cover risks like property damage, liability, theft, and personal injury specific to everyday life and personal assets. Personal Lines differ from Commercial Lines, which focus on business assets, liability, and operational risks.

Types of Coverage in Commercial Lines

Commercial lines insurance encompasses diverse coverage types tailored for businesses, including general liability, property insurance, workers' compensation, and commercial auto policies. Specialized coverage such as professional liability, product liability, and business interruption insurance address specific risks faced by commercial enterprises. These policies protect business assets, ensure legal compliance, and manage operational risks distinct from personal lines insurance.

Target Customers for Personal vs Commercial Insurance

Personal lines insurance targets individual consumers seeking coverage for risks related to their personal lives, such as auto, home, and renters insurance. Commercial lines insurance serves businesses and organizations requiring protection for property, liability, and employees, including policies like general liability, workers' compensation, and commercial property insurance. Understanding the distinct needs of personal versus commercial customers enables insurers to tailor products and risk management strategies effectively.

Role of Underwriting in Personal and Commercial Lines

Underwriting in personal lines insurance primarily evaluates individual risk factors such as age, health, and property condition to tailor policies for homeowners, auto, and personal liability coverage. In commercial lines, underwriting involves assessing complex business risks including financial stability, industry type, operational hazards, and regulatory compliance, which impact larger-scale insurance solutions like liability, property, and workers' compensation. The depth and scope of risk analysis in commercial underwriting demand advanced expertise to structure policies that protect both the business assets and employee interests effectively.

Claims Handling: Personal Lines vs Commercial Lines

Claims handling in personal lines insurance involves straightforward processes focused on individual policyholders, typically covering auto, home, and renters insurance with standardized claim procedures for quicker settlements. Commercial lines claims handling is more complex, dealing with diverse business risks such as liability, property damage, and workers' compensation, requiring specialized expertise and tailored investigation. Efficient management in commercial claims often demands detailed risk assessments, collaboration with legal and risk management teams, and customized resolution strategies to minimize business interruption.

Regulatory Requirements for Personal and Commercial Insurance

Personal lines insurance, covering individuals and families, typically adhere to state-specific regulatory requirements emphasizing consumer protection, clear policy language, and coverage limitations. Commercial lines insurance, designed for businesses, face more complex regulations including risk management standards, liability exposures, and compliance with industry-specific laws such as OSHA and environmental regulations. Both sectors must ensure adherence to licensing, claims handling procedures, and financial solvency standards mandated by insurance regulators like the NAIC.

Career Opportunities in Personal and Commercial Lines

Career opportunities in personal lines insurance focus on underwriting, claims adjusting, and customer service for individual policies like auto, home, and life insurance. Commercial lines careers involve managing complex risks for businesses, including liability, property, and workers' compensation insurance, often requiring specialized knowledge of industry-specific exposures. Growth in both sectors is driven by evolving regulatory environments and increased demand for tailored risk management solutions.

Future Trends in Personal and Commercial Insurance

Future trends in personal lines insurance include increased adoption of telematics and AI-driven risk assessments, enhancing personalized premium pricing and claims management. Commercial lines are evolving with a focus on cyber liability coverage and integrating IoT technologies to mitigate operational risks in complex supply chains. Both sectors demonstrate a growing emphasis on sustainability and data analytics to improve underwriting accuracy and customer experience.

Personal Lines vs Commercial Lines Infographic

jobdiv.com

jobdiv.com