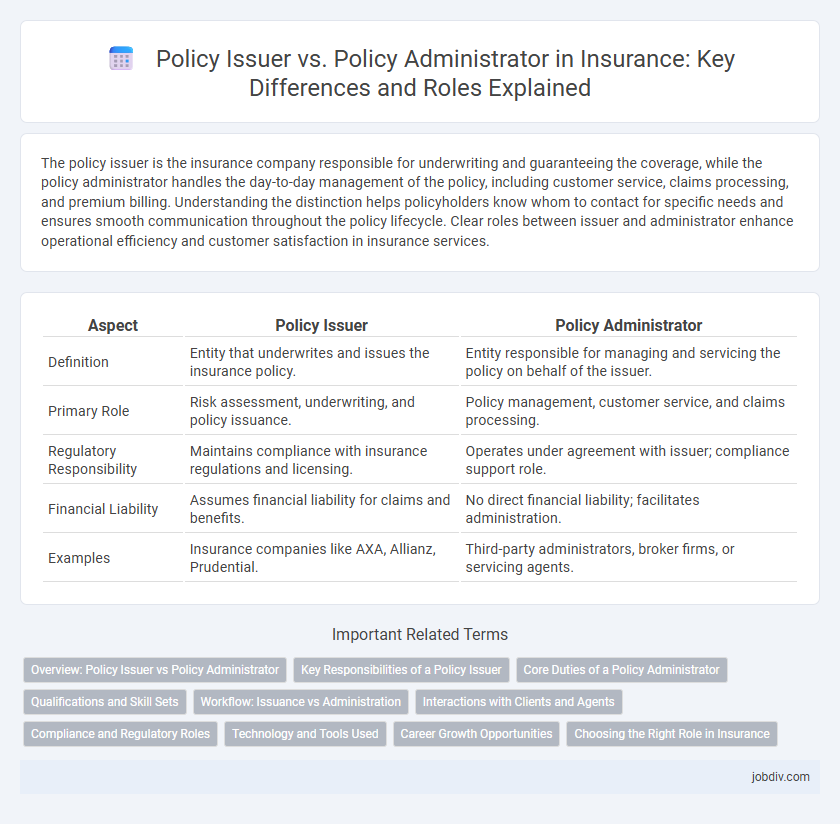

The policy issuer is the insurance company responsible for underwriting and guaranteeing the coverage, while the policy administrator handles the day-to-day management of the policy, including customer service, claims processing, and premium billing. Understanding the distinction helps policyholders know whom to contact for specific needs and ensures smooth communication throughout the policy lifecycle. Clear roles between issuer and administrator enhance operational efficiency and customer satisfaction in insurance services.

Table of Comparison

| Aspect | Policy Issuer | Policy Administrator |

|---|---|---|

| Definition | Entity that underwrites and issues the insurance policy. | Entity responsible for managing and servicing the policy on behalf of the issuer. |

| Primary Role | Risk assessment, underwriting, and policy issuance. | Policy management, customer service, and claims processing. |

| Regulatory Responsibility | Maintains compliance with insurance regulations and licensing. | Operates under agreement with issuer; compliance support role. |

| Financial Liability | Assumes financial liability for claims and benefits. | No direct financial liability; facilitates administration. |

| Examples | Insurance companies like AXA, Allianz, Prudential. | Third-party administrators, broker firms, or servicing agents. |

Overview: Policy Issuer vs Policy Administrator

The policy issuer is the insurance company responsible for underwriting and issuing the insurance contract, bearing the financial risk and legal obligations. The policy administrator manages day-to-day operations such as premium collection, claims processing, and customer service, acting as the intermediary between the policyholder and issuer. Clear distinction between these roles enhances operational efficiency and ensures compliance within the insurance lifecycle.

Key Responsibilities of a Policy Issuer

A Policy Issuer in insurance is responsible for underwriting policies, assessing risk, and determining premiums to ensure financial viability. They issue official policy documents and guarantee the terms, coverage, and conditions of the insurance contract. Key responsibilities also include compliance with regulatory standards and maintaining accurate policy records for audit and claims purposes.

Core Duties of a Policy Administrator

A Policy Administrator manages the day-to-day operations of insurance policies, including processing applications, maintaining policy records, handling premium collections, and addressing customer inquiries. They ensure compliance with regulatory standards and facilitate policy changes or renewals, acting as the primary point of contact between policyholders and the insurance company. Unlike the Policy Issuer, who underwrites and issues policies, the administrator's core duties focus on ongoing policy management and service delivery.

Qualifications and Skill Sets

Policy issuers typically require strong underwriting expertise, regulatory knowledge, and risk assessment skills to design and authorize insurance coverage. Policy administrators focus on claims processing, customer service, data management, and compliance monitoring to ensure effective policy maintenance and support. Both roles demand proficiency in insurance regulations, attention to detail, and effective communication to optimize policy lifecycle management.

Workflow: Issuance vs Administration

The policy issuer initiates the insurance contract by underwriting and issuing the policy, ensuring compliance with regulatory requirements and setting the terms and conditions. The policy administrator manages ongoing tasks such as premium collection, policy changes, claims processing, and renewals, maintaining accurate records throughout the policy lifecycle. Efficient workflow between issuance and administration enhances customer experience and operational accuracy in insurance management.

Interactions with Clients and Agents

Policy issuers are responsible for underwriting, issuing, and managing the official insurance contracts, ensuring legal compliance and risk assessment, while policy administrators handle day-to-day client interactions such as processing claims, policy changes, and premium payments. Effective collaboration between policy issuers and administrators improves customer satisfaction by providing seamless communication channels for agents and policyholders to resolve inquiries and update coverage details promptly. Insurance agents rely on clear protocols from both entities to facilitate accurate information flow and maintain transparency throughout the policy lifecycle.

Compliance and Regulatory Roles

The policy issuer holds primary responsibility for ensuring compliance with insurance regulations and maintaining the legal integrity of the insurance contract. The policy administrator manages day-to-day policy operations and customer service while adhering to regulatory standards set by the issuer and governing bodies. Regulatory roles require clear delineation of authority to prevent compliance breaches and maintain transparent reporting to insurance regulators.

Technology and Tools Used

Policy issuers utilize advanced underwriting software and automated risk assessment tools to streamline policy creation and ensure accurate coverage terms. Policy administrators rely on integrated policy management systems and customer relationship management (CRM) platforms to handle policy servicing, claims processing, and renewals efficiently. The synergy of artificial intelligence and cloud-based technology enhances both policy issuance and administration by improving data accuracy, reducing processing time, and enabling real-time updates.

Career Growth Opportunities

Policy issuers often hold strategic roles in insurance companies, managing underwriting and risk assessment, which can lead to advancement into executive positions like Chief Underwriting Officer. Policy administrators typically focus on the operational side, handling policy documentation and customer service, offering career growth in compliance management and client relations. Both paths provide distinct opportunities; policy issuers tend to progress toward leadership in product development while administrators can advance to senior roles in claims and policy operations.

Choosing the Right Role in Insurance

Choosing between a policy issuer and a policy administrator is crucial for insurance management, as the policy issuer underwrites and guarantees the coverage, while the policy administrator handles day-to-day operations such as premium collection and claims processing. Insurance providers benefit from clearly defining these roles to ensure regulatory compliance and enhance customer service efficiency. Selecting the appropriate role improves risk management and streamlines policy lifecycle administration for both insurers and policyholders.

Policy Issuer vs Policy Administrator Infographic

jobdiv.com

jobdiv.com