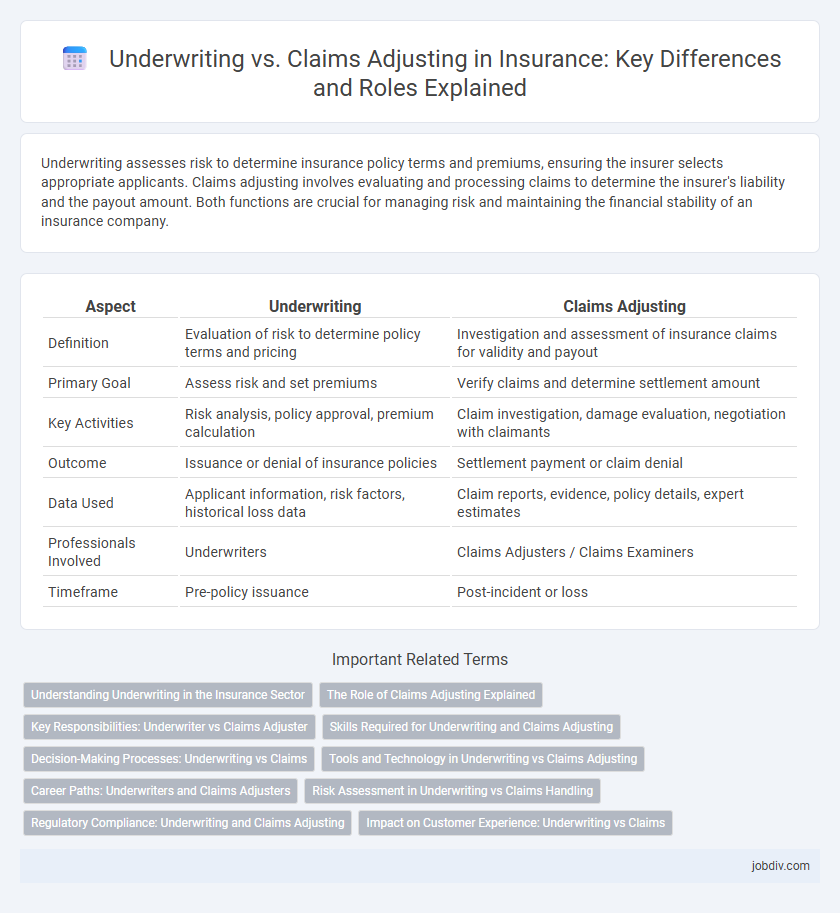

Underwriting assesses risk to determine insurance policy terms and premiums, ensuring the insurer selects appropriate applicants. Claims adjusting involves evaluating and processing claims to determine the insurer's liability and the payout amount. Both functions are crucial for managing risk and maintaining the financial stability of an insurance company.

Table of Comparison

| Aspect | Underwriting | Claims Adjusting |

|---|---|---|

| Definition | Evaluation of risk to determine policy terms and pricing | Investigation and assessment of insurance claims for validity and payout |

| Primary Goal | Assess risk and set premiums | Verify claims and determine settlement amount |

| Key Activities | Risk analysis, policy approval, premium calculation | Claim investigation, damage evaluation, negotiation with claimants |

| Outcome | Issuance or denial of insurance policies | Settlement payment or claim denial |

| Data Used | Applicant information, risk factors, historical loss data | Claim reports, evidence, policy details, expert estimates |

| Professionals Involved | Underwriters | Claims Adjusters / Claims Examiners |

| Timeframe | Pre-policy issuance | Post-incident or loss |

Understanding Underwriting in the Insurance Sector

Underwriting in the insurance sector involves evaluating risks and determining suitable premiums based on factors like applicant health, age, and coverage type, ensuring profitability and regulatory compliance. This process employs data analytics, actuarial science, and risk assessment models to predict potential losses and set policy terms accurately. Effective underwriting minimizes claim occurrences by selecting appropriate risks and establishes the financial stability of insurance providers.

The Role of Claims Adjusting Explained

Claims adjusting involves assessing insurance claims to determine the extent of the insurer's liability based on policy terms and factual evidence. Skilled claims adjusters gather documentation, inspect damages, interview witnesses, and negotiate settlements to ensure fair and accurate compensation. This role helps prevent fraud and controls claim costs, directly impacting an insurer's financial stability and customer satisfaction.

Key Responsibilities: Underwriter vs Claims Adjuster

Underwriters evaluate insurance applications, assessing risk factors and determining policy terms and premiums based on data analysis and risk tolerance levels. Claims adjusters investigate insurance claims by verifying coverage, assessing damages, and negotiating settlements to ensure accurate and fair compensation. Both roles require strong analytical skills but focus on different stages of the insurance lifecycle--underwriting on policy approval and pricing, claims adjusting on claim validation and resolution.

Skills Required for Underwriting and Claims Adjusting

Underwriting requires strong analytical skills, risk assessment capabilities, and attention to detail to evaluate insurance applications and determine policy terms. Claims adjusting demands expert investigative skills, negotiation proficiency, and thorough knowledge of policy language to accurately assess and settle claims. Both roles require strong communication skills and a solid understanding of insurance regulations and industry standards.

Decision-Making Processes: Underwriting vs Claims

Underwriting decision-making involves risk assessment, evaluating applications, and setting policy terms based on statistical data and applicant information to determine insurance eligibility and premium pricing. Claims adjusting focuses on investigating reported losses, verifying coverage, and estimating claim payouts by analyzing evidence and policy conditions to ensure accurate and fair settlements. Both processes require critical evaluation skills but differ as underwriters assess potential risk before policy issuance while claims adjusters resolve actual losses post-incident.

Tools and Technology in Underwriting vs Claims Adjusting

Underwriting employs predictive analytics, artificial intelligence, and automated risk assessment platforms to evaluate applicant profiles and determine policy terms efficiently. Claims adjusting relies heavily on digital inspection tools, mobile apps for real-time damage assessment, and AI-driven fraud detection systems to process claims accurately and swiftly. Both disciplines leverage cloud-based data management and machine learning models but apply these technologies to distinct phases of the insurance lifecycle.

Career Paths: Underwriters and Claims Adjusters

Underwriters assess risk and determine insurance policy terms to minimize company exposure, requiring strong analytical skills and attention to detail. Claims Adjusters investigate insurance claims, evaluate damages, and negotiate settlements, demanding excellent communication and decision-making abilities. Both career paths offer specialized roles in risk management and customer service, with opportunities for advancement in insurance companies and related financial sectors.

Risk Assessment in Underwriting vs Claims Handling

Underwriting involves a comprehensive risk assessment process where insurers evaluate applicant information, financial history, and potential hazards to determine policy terms and pricing. Claims adjusting centers on claims handling by investigating incidents, verifying coverage, and assessing damage to settle claims fairly and efficiently. Risk evaluation in underwriting aims to prevent losses, while claims handling addresses loss resolution after an event occurs.

Regulatory Compliance: Underwriting and Claims Adjusting

Underwriting ensures regulatory compliance by thoroughly evaluating risks and adhering to insurance laws, guidelines, and policy terms before issuing coverage. Claims adjusting maintains compliance by accurately assessing claims, verifying policyholder information, and following industry regulations during the claims settlement process. Both functions require detailed documentation and consistent audit trails to meet state and federal insurance regulatory standards.

Impact on Customer Experience: Underwriting vs Claims

Underwriting shapes customer experience by determining policy eligibility, coverage terms, and pricing, which directly affects customer satisfaction and trust at the initial stage. Claims adjusting impacts the post-loss phase by assessing losses, validating claims, and facilitating timely settlements, crucial for customer retention and loyalty. Efficient underwriting reduces application friction while effective claims adjusting ensures a smooth, transparent resolution process, both enhancing overall customer experience.

Underwriting vs Claims Adjusting Infographic

jobdiv.com

jobdiv.com