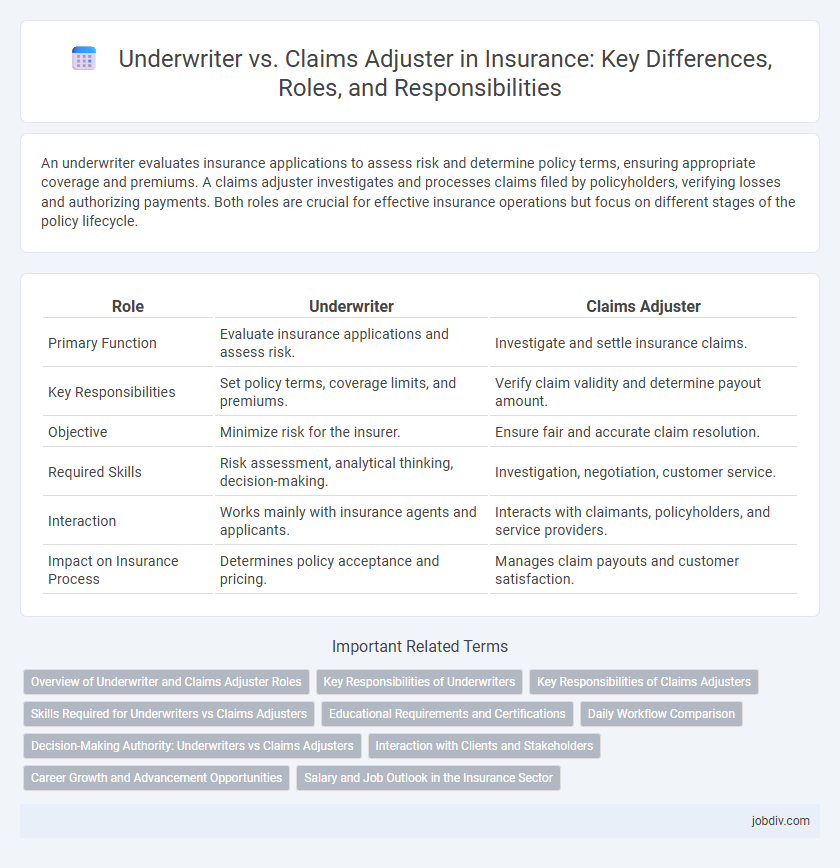

An underwriter evaluates insurance applications to assess risk and determine policy terms, ensuring appropriate coverage and premiums. A claims adjuster investigates and processes claims filed by policyholders, verifying losses and authorizing payments. Both roles are crucial for effective insurance operations but focus on different stages of the policy lifecycle.

Table of Comparison

| Role | Underwriter | Claims Adjuster |

|---|---|---|

| Primary Function | Evaluate insurance applications and assess risk. | Investigate and settle insurance claims. |

| Key Responsibilities | Set policy terms, coverage limits, and premiums. | Verify claim validity and determine payout amount. |

| Objective | Minimize risk for the insurer. | Ensure fair and accurate claim resolution. |

| Required Skills | Risk assessment, analytical thinking, decision-making. | Investigation, negotiation, customer service. |

| Interaction | Works mainly with insurance agents and applicants. | Interacts with claimants, policyholders, and service providers. |

| Impact on Insurance Process | Determines policy acceptance and pricing. | Manages claim payouts and customer satisfaction. |

Overview of Underwriter and Claims Adjuster Roles

Underwriters evaluate insurance applications to assess risks and determine appropriate premiums, ensuring profitability and compliance with company policies. Claims adjusters investigate and verify insurance claims to establish liability and authorize proper settlements. Both roles are essential in managing insurance risk and maintaining financial stability within insurance companies.

Key Responsibilities of Underwriters

Underwriters evaluate insurance applications to assess risk and determine appropriate coverage terms and premiums using statistical data and risk factors. They analyze financial documents, medical histories, and property appraisals to make informed decisions that minimize potential losses for the insurer. Effective risk assessment and policy approval by underwriters ensure the insurer's profitability and compliance with regulatory standards.

Key Responsibilities of Claims Adjusters

Claims adjusters investigate insurance claims by evaluating damage, reviewing policy terms, and interviewing claimants to determine the validity and extent of the claim. They negotiate settlements with policyholders and third parties, ensuring fair compensation while preventing fraud. Accurate documentation and communication with insurers, legal teams, and customers are crucial for claim resolution and maintaining company compliance.

Skills Required for Underwriters vs Claims Adjusters

Underwriters require strong analytical skills to assess risk, proficiency in financial evaluation, and expertise in policy guidelines to determine coverage terms accurately. Claims adjusters need keen investigative abilities, excellent negotiation skills, and empathy to evaluate claims fairly and resolve disputes effectively. Both roles demand attention to detail and critical thinking but differ in emphasis on risk assessment versus claim resolution.

Educational Requirements and Certifications

Underwriters typically require a bachelor's degree in finance, business, or a related field, alongside certifications such as the Chartered Property Casualty Underwriter (CPCU) to enhance their expertise. Claims adjusters often need a high school diploma or associate degree, with many pursuing state-specific adjuster licenses and certifications like the Associate in Claims (AIC) designation to improve their skills. Both roles benefit from ongoing professional education to stay current with industry regulations and standards.

Daily Workflow Comparison

Underwriters evaluate risks by analyzing applications, financial data, and industry trends to determine policy terms and premiums, often collaborating with agents to refine coverage options. Claims adjusters investigate reported losses, inspect damage, interview claimants and witnesses, and assess liability to process claims efficiently while preventing fraud. Both roles require meticulous documentation and communication, but underwriters prioritize risk assessment and policy approval, whereas claims adjusters focus on verifying claims and facilitating settlements.

Decision-Making Authority: Underwriters vs Claims Adjusters

Underwriters possess decision-making authority focused on assessing risk and determining policy eligibility, coverage limits, and premium pricing before a policy is issued. Claims adjusters hold authority to evaluate and validate claims, establish liability, and approve or deny claim payments after an incident occurs. The distinction lies in underwriters shaping the terms of insurance contracts, while claims adjusters enforce and implement those terms during the claims process.

Interaction with Clients and Stakeholders

Underwriters primarily engage with insurance agents and brokers to assess risk and determine policy terms, ensuring accurate coverage tailored to client needs. Claims adjusters interact directly with policyholders, medical providers, and repair services to evaluate and process claims efficiently while maintaining clear communication. Both roles require strong interpersonal skills to manage expectations and facilitate smooth client and stakeholder experiences throughout the insurance lifecycle.

Career Growth and Advancement Opportunities

Underwriters typically experience career growth through specialization in risk analysis and progression to senior underwriting or management roles, leveraging their expertise in policy evaluation and risk assessment. Claims adjusters advance by developing skills in negotiation, investigation, and legal knowledge, often moving into supervisory positions or claims management. Both careers offer distinct pathways, with underwriters focusing on risk control and pricing, while claims adjusters emphasize resolution and client service, influencing advancement opportunities within insurance companies.

Salary and Job Outlook in the Insurance Sector

Underwriters in the insurance sector typically earn a median salary of around $72,000 annually, with job growth projected at 6% over the next decade. Claims adjusters earn a median salary slightly lower, approximately $67,000 per year, and their job outlook is similarly steady with a 5% growth rate. Both roles are critical in risk assessment and claims processing, reflecting stable career opportunities within the insurance industry.

Underwriter vs Claims Adjuster Infographic

jobdiv.com

jobdiv.com