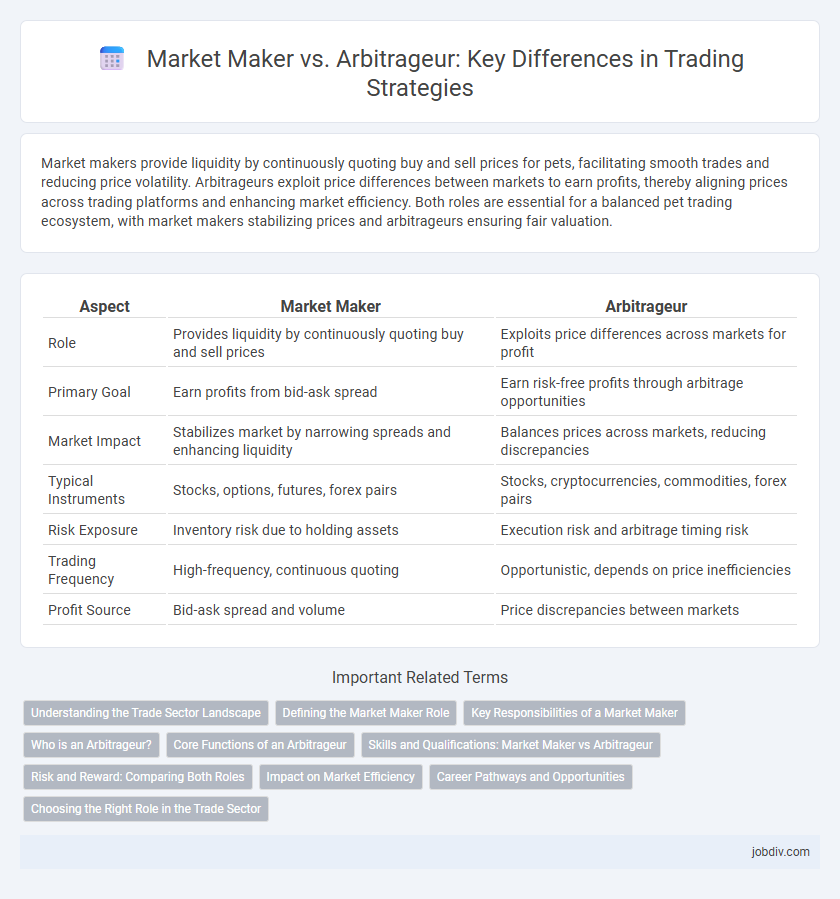

Market makers provide liquidity by continuously quoting buy and sell prices for pets, facilitating smooth trades and reducing price volatility. Arbitrageurs exploit price differences between markets to earn profits, thereby aligning prices across trading platforms and enhancing market efficiency. Both roles are essential for a balanced pet trading ecosystem, with market makers stabilizing prices and arbitrageurs ensuring fair valuation.

Table of Comparison

| Aspect | Market Maker | Arbitrageur |

|---|---|---|

| Role | Provides liquidity by continuously quoting buy and sell prices | Exploits price differences across markets for profit |

| Primary Goal | Earn profits from bid-ask spread | Earn risk-free profits through arbitrage opportunities |

| Market Impact | Stabilizes market by narrowing spreads and enhancing liquidity | Balances prices across markets, reducing discrepancies |

| Typical Instruments | Stocks, options, futures, forex pairs | Stocks, cryptocurrencies, commodities, forex pairs |

| Risk Exposure | Inventory risk due to holding assets | Execution risk and arbitrage timing risk |

| Trading Frequency | High-frequency, continuous quoting | Opportunistic, depends on price inefficiencies |

| Profit Source | Bid-ask spread and volume | Price discrepancies between markets |

Understanding the Trade Sector Landscape

Market makers provide liquidity by continuously quoting buy and sell prices, facilitating smoother transactions and tighter bid-ask spreads in financial markets. Arbitrageurs exploit price discrepancies across different markets or instruments to generate risk-free profits, contributing to price efficiency and market balance. Both roles are critical in maintaining market stability and ensuring efficient capital allocation within the trade sector landscape.

Defining the Market Maker Role

A market maker provides liquidity to financial markets by continuously quoting buy and sell prices, facilitating smooth and efficient trading. By maintaining bid-ask spreads, market makers ensure that traders can execute orders promptly without significant price gaps or delays. Their role is crucial in minimizing market volatility and enhancing overall market stability.

Key Responsibilities of a Market Maker

Market makers provide liquidity by continuously quoting buy and sell prices for financial instruments, ensuring smooth market operations. They manage inventory risk by balancing their holdings to facilitate trades without significant price impact. Their role stabilizes markets, reduces spreads, and improves price discovery for traders and investors.

Who is an Arbitrageur?

An arbitrageur is a trader who exploits price discrepancies of the same asset across different markets or exchanges to generate risk-free profits. By simultaneously buying low in one market and selling high in another, arbitrageurs help enhance market efficiency and liquidity. Their actions reduce price imbalances and contribute to narrowing spreads, ultimately stabilizing the trading environment.

Core Functions of an Arbitrageur

Arbitrageurs specialize in exploiting price discrepancies across different markets to generate risk-free profits by simultaneously buying low in one market and selling high in another. Their core functions include maintaining market efficiency, reducing price gaps, and providing liquidity by swiftly correcting mispricings. These activities help balance supply and demand, ensuring fair market valuations while minimizing arbitrage opportunities over time.

Skills and Qualifications: Market Maker vs Arbitrageur

Market makers require strong skills in risk management, real-time market analysis, and high-frequency trading algorithms to provide liquidity and maintain tight bid-ask spreads. Arbitrageurs excel in identifying price discrepancies across different markets or instruments, demanding expertise in quantitative analysis, rapid execution, and a deep understanding of market microstructures. Both roles necessitate advanced knowledge of financial instruments, robust technical proficiency, and the ability to operate under high-pressure environments.

Risk and Reward: Comparing Both Roles

Market makers assume continuous risk by providing liquidity and holding inventory, earning profits primarily from the bid-ask spread but facing potential losses during volatile market conditions. Arbitrageurs engage in low-risk strategies that exploit price discrepancies across different markets or instruments, aiming for small, consistent returns with minimal exposure to market fluctuations. The reward for market makers is higher during periods of significant trading volume, while arbitrageurs benefit from rapid execution and access to diverse markets to capitalize on fleeting opportunities.

Impact on Market Efficiency

Market makers enhance market efficiency by providing liquidity and narrowing bid-ask spreads, which facilitates smoother trading and price discovery. Arbitrageurs improve efficiency by exploiting price discrepancies across different markets, aligning prices closer to their intrinsic value. Both roles contribute to reduced volatility and more accurate market pricing, benefiting overall market stability.

Career Pathways and Opportunities

Market makers and arbitrageurs offer distinct career pathways within trading, with market makers specializing in providing liquidity and ensuring market efficiency by continuously quoting buy and sell prices. Arbitrageurs focus on exploiting price discrepancies across different markets or instruments to generate risk-free profits, requiring strong analytical skills and real-time data analysis expertise. Both roles offer opportunities in proprietary trading firms, hedge funds, and financial institutions, with market makers often advancing toward risk management and trading desk leadership, while arbitrageurs may evolve into quantitative strategists or portfolio managers.

Choosing the Right Role in the Trade Sector

Market makers provide liquidity by continuously quoting buy and sell prices, benefiting from the bid-ask spread, while arbitrageurs exploit price inefficiencies across different markets for risk-free profits. Selecting the right role depends on factors such as capital allocation, risk tolerance, and market knowledge, with market makers requiring constant market engagement and arbitrageurs relying on rapid execution and sophisticated algorithms. Traders should assess their strategic goals, technological resources, and regulatory environment to optimize performance in either capacity within the trade sector.

Market Maker vs Arbitrageur Infographic

jobdiv.com

jobdiv.com