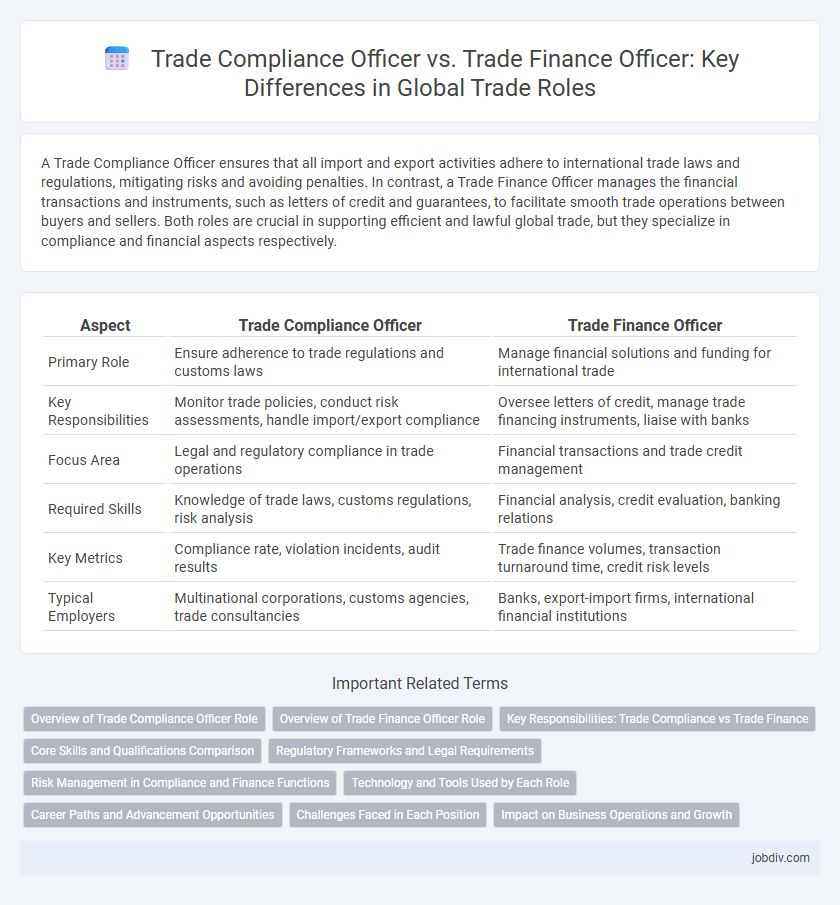

A Trade Compliance Officer ensures that all import and export activities adhere to international trade laws and regulations, mitigating risks and avoiding penalties. In contrast, a Trade Finance Officer manages the financial transactions and instruments, such as letters of credit and guarantees, to facilitate smooth trade operations between buyers and sellers. Both roles are crucial in supporting efficient and lawful global trade, but they specialize in compliance and financial aspects respectively.

Table of Comparison

| Aspect | Trade Compliance Officer | Trade Finance Officer |

|---|---|---|

| Primary Role | Ensure adherence to trade regulations and customs laws | Manage financial solutions and funding for international trade |

| Key Responsibilities | Monitor trade policies, conduct risk assessments, handle import/export compliance | Oversee letters of credit, manage trade financing instruments, liaise with banks |

| Focus Area | Legal and regulatory compliance in trade operations | Financial transactions and trade credit management |

| Required Skills | Knowledge of trade laws, customs regulations, risk analysis | Financial analysis, credit evaluation, banking relations |

| Key Metrics | Compliance rate, violation incidents, audit results | Trade finance volumes, transaction turnaround time, credit risk levels |

| Typical Employers | Multinational corporations, customs agencies, trade consultancies | Banks, export-import firms, international financial institutions |

Overview of Trade Compliance Officer Role

Trade Compliance Officers ensure adherence to international trade laws, export controls, and customs regulations, mitigating risks of fines and shipment delays. They conduct audits, implement compliance programs, and liaise with regulatory bodies to maintain lawful trade activities. This role demands detailed knowledge of trade agreements, sanctions lists, and tariff classifications to ensure seamless global operations.

Overview of Trade Finance Officer Role

A Trade Finance Officer manages financial aspects of international trade, including letters of credit, payment terms, and risk assessment to ensure smooth transactions between importers and exporters. This role requires expertise in banking procedures, trade regulations, and currency exchange to facilitate secure and compliant trade flows. Trade Finance Officers collaborate closely with banks, clients, and regulatory bodies to optimize cash flow and mitigate financial risks in global trade operations.

Key Responsibilities: Trade Compliance vs Trade Finance

Trade Compliance Officers ensure adherence to international trade laws, customs regulations, and company policies to mitigate risks of fines and sanctions, while conducting audits and managing import/export documentation accuracy. Trade Finance Officers focus on facilitating global transactions by managing letters of credit, payment guarantees, and risk assessments to secure timely and compliant financial flows between buyers and sellers in cross-border trade. Both roles require expertise in trade regulations, but Trade Compliance emphasizes legal conformity, and Trade Finance prioritizes financial instruments and transaction security.

Core Skills and Qualifications Comparison

Trade Compliance Officers excel in regulatory knowledge, risk management, and adherence to international trade laws, requiring certifications like CTF and strong analytical abilities. Trade Finance Officers specialize in financial instruments, credit analysis, and transaction structuring, often holding qualifications such as CFA or ACIB and demonstrating expertise in banking operations. Both roles demand attention to detail, cross-functional communication skills, and proficiency in trade-related software, but differ primarily in legal versus financial focus within global trade processes.

Regulatory Frameworks and Legal Requirements

A Trade Compliance Officer ensures adherence to international trade regulations, customs laws, and sanctions programs, minimizing risks related to legal violations and penalties. In contrast, a Trade Finance Officer manages financial instruments and transactions to support global trade, focusing on compliance with banking regulations and anti-money laundering laws. Both roles require deep knowledge of regulatory frameworks, but the Compliance Officer concentrates on legal trade standards, while the Finance Officer emphasizes financial regulatory requirements.

Risk Management in Compliance and Finance Functions

Trade Compliance Officers prioritize risk management by ensuring adherence to international trade laws, regulations, and sanctions, mitigating potential penalties and reputational damage. Trade Finance Officers manage financial risks associated with cross-border transactions, including credit risk, currency fluctuations, and payment assurances to secure liquidity and minimize financial exposure. Both roles collaboratively strengthen organizational risk frameworks, but Trade Compliance emphasizes regulatory alignment whereas Trade Finance concentrates on transactional and credit risk mitigation.

Technology and Tools Used by Each Role

Trade Compliance Officers leverage regulatory software like Amber Road and SAP GTS to ensure adherence to international trade laws and automate customs documentation processes. Trade Finance Officers utilize financial platforms such as SWIFT, Bolero, and Trade Finance Manager to manage letters of credit, guarantee transactions, and monitor payment risks. Both roles integrate ERP systems like Oracle and Microsoft Dynamics to facilitate data consolidation, but their toolkits diverge based on compliance verification versus financial risk management functions.

Career Paths and Advancement Opportunities

Trade Compliance Officers specialize in ensuring that all import and export activities adhere to international laws and regulations, often progressing to roles such as Compliance Manager or Global Trade Director. Trade Finance Officers focus on managing financial instruments like letters of credit and risk assessment, with career advancement toward positions like Finance Manager or Treasury Head. Both paths offer opportunities to develop expertise in global markets, but compliance careers tend to emphasize regulatory knowledge, while trade finance careers highlight financial strategy and risk management.

Challenges Faced in Each Position

Trade Compliance Officers face challenges such as navigating complex international regulations, ensuring adherence to evolving customs laws, and mitigating risks related to sanctions and export controls. Trade Finance Officers encounter difficulties in managing credit risks, securing financing for cross-border transactions, and maintaining compliance with anti-money laundering (AML) standards. Both roles require specialized knowledge to address the unique regulatory and financial obstacles inherent in global trade operations.

Impact on Business Operations and Growth

Trade Compliance Officers ensure adherence to international trade regulations, minimizing legal risks and preventing costly penalties, which safeguards business continuity and supports long-term growth. Trade Finance Officers facilitate financing solutions for importers and exporters, optimizing cash flow and enabling efficient transaction execution, directly impacting operational liquidity and scalability. Both roles drive business performance, with compliance officers focusing on risk mitigation and finance officers enhancing financial efficiency in global trade operations.

Trade Compliance Officer vs Trade Finance Officer Infographic

jobdiv.com

jobdiv.com