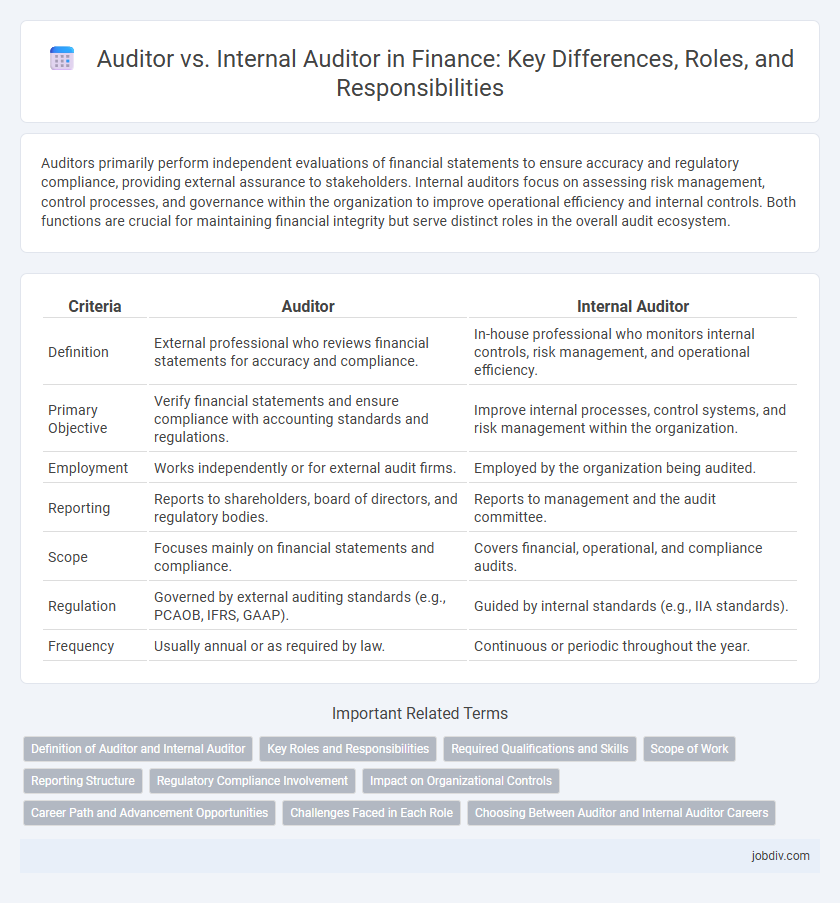

Auditors primarily perform independent evaluations of financial statements to ensure accuracy and regulatory compliance, providing external assurance to stakeholders. Internal auditors focus on assessing risk management, control processes, and governance within the organization to improve operational efficiency and internal controls. Both functions are crucial for maintaining financial integrity but serve distinct roles in the overall audit ecosystem.

Table of Comparison

| Criteria | Auditor | Internal Auditor |

|---|---|---|

| Definition | External professional who reviews financial statements for accuracy and compliance. | In-house professional who monitors internal controls, risk management, and operational efficiency. |

| Primary Objective | Verify financial statements and ensure compliance with accounting standards and regulations. | Improve internal processes, control systems, and risk management within the organization. |

| Employment | Works independently or for external audit firms. | Employed by the organization being audited. |

| Reporting | Reports to shareholders, board of directors, and regulatory bodies. | Reports to management and the audit committee. |

| Scope | Focuses mainly on financial statements and compliance. | Covers financial, operational, and compliance audits. |

| Regulation | Governed by external auditing standards (e.g., PCAOB, IFRS, GAAP). | Guided by internal standards (e.g., IIA standards). |

| Frequency | Usually annual or as required by law. | Continuous or periodic throughout the year. |

Definition of Auditor and Internal Auditor

An auditor is a professional who examines financial statements and records to ensure accuracy, compliance with accounting standards, and to detect any fraud or misstatements. An internal auditor, on the other hand, is employed within an organization to evaluate internal controls, risk management, and governance processes, providing ongoing assurance to management. While external auditors provide independent assessments primarily for external stakeholders, internal auditors focus on improving internal operations and efficiency.

Key Roles and Responsibilities

Auditors typically perform independent evaluations of financial statements to ensure accuracy, compliance with regulations, and detect fraud, while internal auditors focus on assessing internal controls, risk management, and operational efficiency within an organization. External auditors provide assurance to shareholders and regulatory bodies, delivering reports on financial health, whereas internal auditors support management by identifying weaknesses in processes and recommending improvements. Both roles are crucial for maintaining financial integrity but differ in scope, reporting lines, and primary objectives.

Required Qualifications and Skills

Auditors typically require a Certified Public Accountant (CPA) license and expertise in Generally Accepted Auditing Standards (GAAS), with strong analytical, communication, and risk assessment skills. Internal Auditors often hold certifications like Certified Internal Auditor (CIA) and emphasize knowledge in internal controls, compliance, and operational auditing, alongside skills in critical thinking and organizational awareness. Both roles demand proficiency in financial reporting, data analysis, and regulatory frameworks to ensure accuracy and accountability.

Scope of Work

Auditors primarily perform external evaluations of financial statements to ensure compliance with accounting standards and regulatory requirements. Internal auditors focus on assessing and improving internal controls, risk management, and governance processes within an organization. The scope of work for internal auditors is continuous and operational, whereas external auditors have a periodic and statutory examination scope.

Reporting Structure

Auditors typically report to external stakeholders such as shareholders or regulatory bodies, ensuring independent verification of a company's financial statements. Internal auditors report directly to the organization's board of directors or audit committee, providing ongoing assessments of risk management and internal controls. This distinction in reporting structure emphasizes external auditors' objectivity versus internal auditors' role in operational improvement.

Regulatory Compliance Involvement

Auditors primarily focus on regulatory compliance by examining financial statements to ensure adherence to external laws and standards such as GAAP or IFRS. Internal auditors concentrate on evaluating the effectiveness of internal controls and risk management processes to ensure ongoing compliance with company policies and regulatory requirements. Both roles are crucial for identifying compliance gaps but serve different purposes within the organizational governance framework.

Impact on Organizational Controls

Auditors, especially external auditors, provide an independent assessment of financial statements, ensuring compliance with accounting standards and regulations, which enhances stakeholder confidence and identifies control weaknesses. Internal auditors continuously evaluate and improve organizational controls by implementing risk management and governance processes tailored to the company's strategic objectives. The combined efforts of both roles strengthen overall control environments, reduce fraud risk, and promote operational efficiency within financial management.

Career Path and Advancement Opportunities

Auditors typically follow a career path that advances from junior auditor roles to senior auditor and audit manager positions, often transitioning into external consulting or chief audit executive roles within public accounting firms. Internal auditors focus on organizational risk management and compliance, with career progression leading to senior internal auditor, internal audit manager, and ultimately roles such as chief audit executive or compliance officer within a corporation. Both career paths offer advancement through specialized certifications like CPA for auditors and CIA for internal auditors, enhancing opportunities in leadership and strategic advisory positions.

Challenges Faced in Each Role

Auditors face challenges in maintaining independence and objectivity while thoroughly evaluating financial statements for compliance and fraud detection. Internal auditors encounter difficulties in balancing their advisory role with enforcing internal controls and risk management within the organization. Both roles require staying updated with evolving regulatory standards and technological advancements to ensure accurate and effective auditing processes.

Choosing Between Auditor and Internal Auditor Careers

Choosing between a career as an external auditor or an internal auditor depends on one's preference for scope and organizational involvement. External auditors focus on verifying financial statements for accuracy and compliance with regulations, often working for public accounting firms or regulatory bodies. Internal auditors, employed within organizations, specialize in risk management, internal controls, and operational efficiency, providing ongoing assurance to management and stakeholders.

Auditor vs Internal Auditor Infographic

jobdiv.com

jobdiv.com