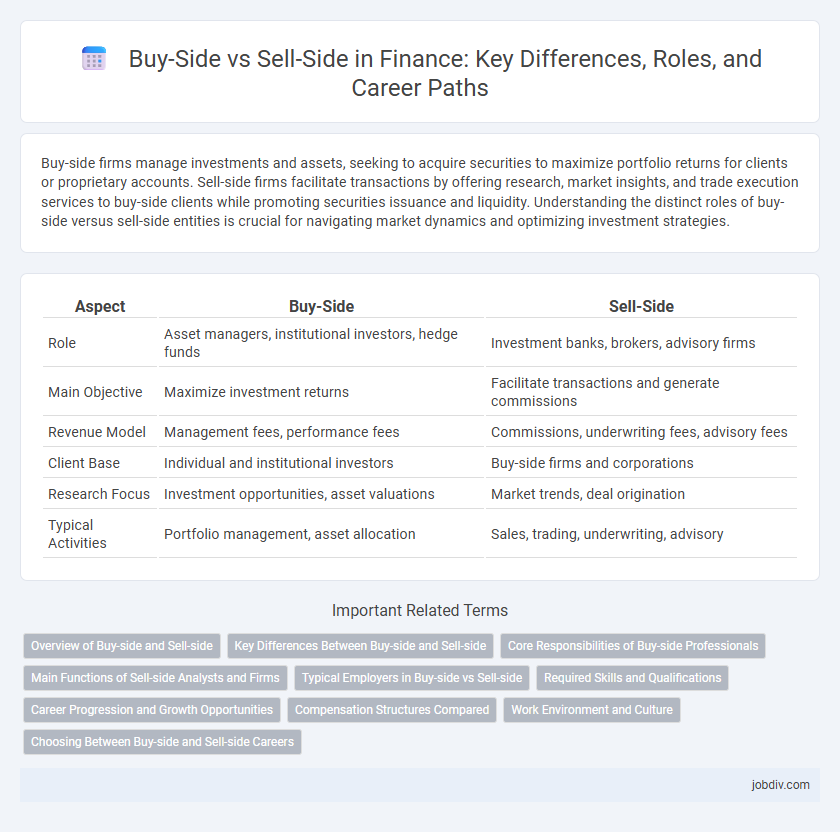

Buy-side firms manage investments and assets, seeking to acquire securities to maximize portfolio returns for clients or proprietary accounts. Sell-side firms facilitate transactions by offering research, market insights, and trade execution services to buy-side clients while promoting securities issuance and liquidity. Understanding the distinct roles of buy-side versus sell-side entities is crucial for navigating market dynamics and optimizing investment strategies.

Table of Comparison

| Aspect | Buy-Side | Sell-Side |

|---|---|---|

| Role | Asset managers, institutional investors, hedge funds | Investment banks, brokers, advisory firms |

| Main Objective | Maximize investment returns | Facilitate transactions and generate commissions |

| Revenue Model | Management fees, performance fees | Commissions, underwriting fees, advisory fees |

| Client Base | Individual and institutional investors | Buy-side firms and corporations |

| Research Focus | Investment opportunities, asset valuations | Market trends, deal origination |

| Typical Activities | Portfolio management, asset allocation | Sales, trading, underwriting, advisory |

Overview of Buy-side and Sell-side

Buy-side firms, including mutual funds, pension funds, and hedge funds, focus on asset management and investing capital to generate returns for clients or shareholders. Sell-side entities, such as investment banks and brokerage firms, provide advisory services, market making, and facilitate securities transactions to support buy-side activities. The interaction between buy-side and sell-side drives market liquidity, price discovery, and efficient capital allocation.

Key Differences Between Buy-side and Sell-side

Buy-side firms, including asset managers, mutual funds, and hedge funds, focus on investment decisions and portfolio management to generate returns for clients, while sell-side firms such as investment banks and brokerage houses provide market liquidity, research, and facilitate transactions. Buy-side entities emphasize long-term value creation through asset allocation and security selection, whereas sell-side firms specialize in underwriting, market making, and advisory services. The primary key difference lies in buy-side's role as investors seeking assets to purchase and sell-side's function as intermediaries enabling market transactions.

Core Responsibilities of Buy-side Professionals

Buy-side professionals focus on asset management, portfolio construction, and investment research to maximize returns for institutional clients such as pension funds, mutual funds, and hedge funds. They analyze market trends, evaluate securities, and execute trades to manage risk while achieving clients' financial objectives. Their core responsibilities include conducting due diligence, selecting high-potential investments, and monitoring portfolio performance to ensure alignment with investment strategies.

Main Functions of Sell-side Analysts and Firms

Sell-side analysts primarily produce research reports and market forecasts to support investment decisions made by buy-side clients. Sell-side firms facilitate liquidity by underwriting new securities issues, executing trades, and providing brokerage services to institutional and retail investors. Their main functions also include market making, advising on mergers and acquisitions, and delivering investment recommendations that drive trading volume.

Typical Employers in Buy-side vs Sell-side

Buy-side firms typically include asset management companies, hedge funds, mutual funds, pension funds, and private equity firms, all focused on investing capital to generate returns. Sell-side employers consist primarily of investment banks, brokerage firms, and advisory services that facilitate the buying and selling of securities and provide research and market-making services. The distinction lies in buy-side entities managing portfolios and making investment decisions, while sell-side firms serve as intermediaries and advisors in financial markets.

Required Skills and Qualifications

Buy-side professionals require strong analytical skills, expertise in portfolio management, and deep knowledge of market trends to make informed investment decisions. Sell-side roles demand proficiency in financial modeling, client relationship management, and thorough understanding of regulatory frameworks to support asset sales and advisory services. Both sides benefit from advanced degrees in finance or economics and relevant certifications such as CFA or CPA.

Career Progression and Growth Opportunities

Buy-side careers in finance typically offer growth through portfolio management, research analysis, and strategic decision-making roles, with potential to advance into senior investment positions or fund management. Sell-side professionals often progress from analyst roles to associate, vice president, and managing director positions, focusing on client relationships, deal execution, and market-making activities. The buy-side emphasizes long-term value creation and deep asset expertise, while the sell-side prioritizes transaction volume and advisory services, shaping distinct career trajectories and skill sets.

Compensation Structures Compared

Buy-side compensation structures primarily emphasize performance-based bonuses tied to portfolio returns and long-term capital gains, aligning incentives with investment success. Sell-side compensation often combines base salaries with commission-based earnings linked to transaction volume and deal execution, incentivizing deal flow and client relationships. Understanding these distinct pay models helps clarify motivational drivers and risk tolerance differences between asset managers and investment bankers.

Work Environment and Culture

Buy-side firms prioritize collaborative, long-term decision-making environments focused on portfolio management and research, fostering a culture of thorough analysis and client relationship building. Sell-side firms emphasize fast-paced, transaction-driven settings where sales, trading, and investment banking professionals operate under performance pressure to execute deals and generate market liquidity. The work culture on the buy-side typically values discretion and strategic patience, while the sell-side embodies competitiveness and real-time market responsiveness.

Choosing Between Buy-side and Sell-side Careers

Choosing between buy-side and sell-side careers hinges on your preferred role in financial markets: buy-side professionals manage investment portfolios aiming for high returns, while sell-side experts focus on facilitating market transactions and providing advisory services. Buy-side roles include asset management, hedge funds, and private equity, emphasizing research and long-term value creation; sell-side careers involve investment banking, brokerage, and equity research, prioritizing client relationships and deal execution. Evaluating factors such as work-life balance, compensation structures, and career growth opportunities is crucial when deciding between buy-side and sell-side paths.

Buy-side vs Sell-side Infographic

jobdiv.com

jobdiv.com