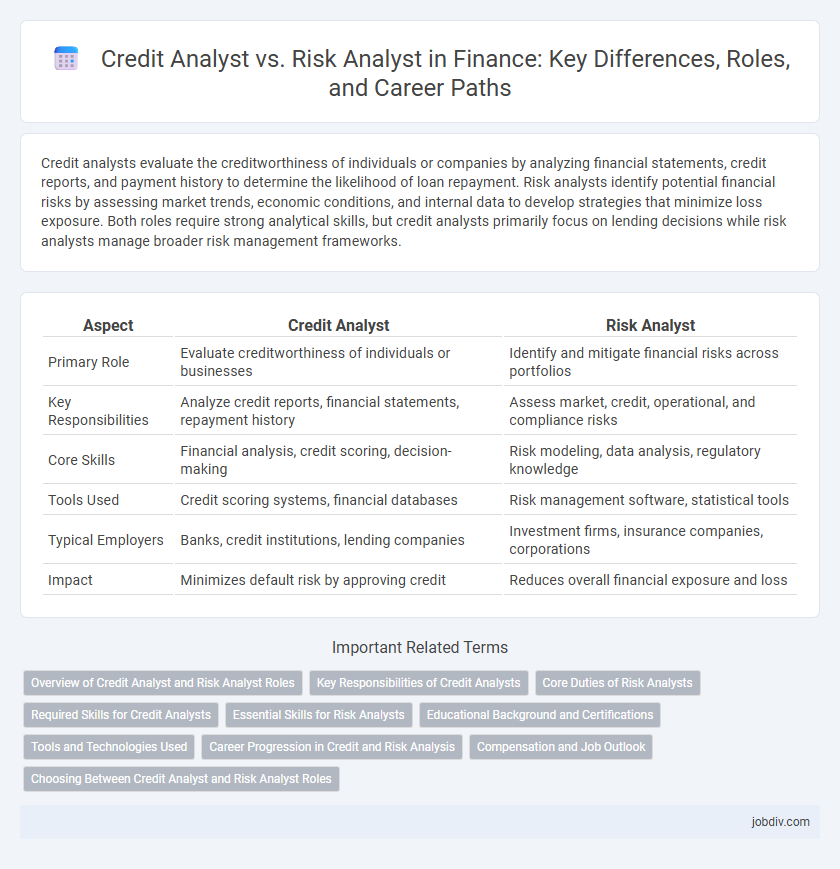

Credit analysts evaluate the creditworthiness of individuals or companies by analyzing financial statements, credit reports, and payment history to determine the likelihood of loan repayment. Risk analysts identify potential financial risks by assessing market trends, economic conditions, and internal data to develop strategies that minimize loss exposure. Both roles require strong analytical skills, but credit analysts primarily focus on lending decisions while risk analysts manage broader risk management frameworks.

Table of Comparison

| Aspect | Credit Analyst | Risk Analyst |

|---|---|---|

| Primary Role | Evaluate creditworthiness of individuals or businesses | Identify and mitigate financial risks across portfolios |

| Key Responsibilities | Analyze credit reports, financial statements, repayment history | Assess market, credit, operational, and compliance risks |

| Core Skills | Financial analysis, credit scoring, decision-making | Risk modeling, data analysis, regulatory knowledge |

| Tools Used | Credit scoring systems, financial databases | Risk management software, statistical tools |

| Typical Employers | Banks, credit institutions, lending companies | Investment firms, insurance companies, corporations |

| Impact | Minimizes default risk by approving credit | Reduces overall financial exposure and loss |

Overview of Credit Analyst and Risk Analyst Roles

Credit analysts evaluate the creditworthiness of individuals or businesses by analyzing financial statements, credit reports, and market conditions to assess the likelihood of loan repayment. Risk analysts identify, measure, and manage financial risks within an organization by employing quantitative models and qualitative assessments to minimize potential losses. Both roles are critical in maintaining financial stability, with credit analysts focusing on lending decisions and risk analysts overseeing broader risk management strategies.

Key Responsibilities of Credit Analysts

Credit analysts primarily evaluate the creditworthiness of individuals or businesses by analyzing financial statements, credit data, and payment history to determine lending risks. They prepare detailed credit reports and recommendations to support loan approval decisions, ensuring compliance with regulatory standards. Monitoring existing credit accounts for signs of risk or default and advising on credit limits are essential responsibilities to mitigate potential losses.

Core Duties of Risk Analysts

Risk Analysts primarily assess potential financial risks by analyzing market trends, credit data, and economic conditions to inform decision-making processes. They develop risk mitigation strategies and financial models to minimize losses and ensure regulatory compliance. Their core duties include monitoring portfolios, conducting stress tests, and providing actionable insights to safeguard organizational assets.

Required Skills for Credit Analysts

Credit Analysts must possess strong analytical skills, proficiency in financial statement analysis, and expertise in assessing creditworthiness through quantitative modeling and qualitative evaluation. They require knowledge of accounting principles, borrower risk factors, and regulatory compliance to make informed lending decisions. Effective communication skills are essential for preparing detailed reports and presenting credit risk assessments to stakeholders.

Essential Skills for Risk Analysts

Risk analysts require strong quantitative skills, proficiency in statistical software, and deep knowledge of financial markets to assess potential threats accurately. Expertise in credit risk modeling, regulatory compliance, and data analysis ensures effective identification and mitigation of financial risks. Communication skills and attention to detail are essential for presenting risk assessments and recommending strategic risk management solutions.

Educational Background and Certifications

Credit Analysts typically hold degrees in finance, accounting, or economics, emphasizing skills in financial statement analysis and credit assessment. Risk Analysts often pursue education in finance, statistics, or risk management, with advanced knowledge in quantitative methods and risk modeling. Professional certifications such as the Chartered Financial Analyst (CFA) and Certified Credit Risk Analyst (CCRA) benefit Credit Analysts, while Risk Analysts commonly obtain certifications like Financial Risk Manager (FRM) and Professional Risk Manager (PRM) for enhanced expertise.

Tools and Technologies Used

Credit analysts primarily utilize financial modeling software, credit scoring systems, and databases such as Moody's or S&P Capital IQ to assess borrower creditworthiness. Risk analysts rely heavily on advanced risk management platforms like SAS Risk, Palisade @RISK, and Monte Carlo simulation tools to quantify and mitigate potential financial risks. Both roles leverage Excel and Python for data analysis, but risk analysts often employ more sophisticated predictive analytics and stress-testing technologies to evaluate complex risk scenarios.

Career Progression in Credit and Risk Analysis

Credit analysts typically advance by mastering financial statement analysis and credit scoring models, evolving into senior credit analysts or credit portfolio managers who oversee lending strategy and client risk. Risk analysts progress by deepening expertise in quantitative risk modeling, regulatory compliance, and enterprise risk management, often moving into roles such as risk managers or chief risk officers. Both career paths demand proficiency in data analysis and decision-making but diverge as credit analysts focus on borrower evaluation while risk analysts address broader financial and operational risks.

Compensation and Job Outlook

Credit Analysts earn an average annual salary of $70,000, while Risk Analysts typically see slightly higher compensation around $75,000 due to growing demand in financial risk management. The job outlook for Credit Analysts is projected to grow by 5% over the next decade, reflecting steady banking sector needs, whereas Risk Analysts are expected to experience a stronger growth rate of 8% driven by increasing regulatory requirements and market volatility. Higher compensation and faster job growth make Risk Analysis a competitive career choice within finance.

Choosing Between Credit Analyst and Risk Analyst Roles

Choosing between credit analyst and risk analyst roles depends on your expertise and career goals within finance. Credit analysts focus on evaluating creditworthiness by analyzing financial statements, credit reports, and repayment histories to determine loan eligibility and credit limits. Risk analysts assess broader financial risks, including market, operational, and credit risks, using quantitative models and risk management strategies to minimize potential losses for organizations.

Credit Analyst vs Risk Analyst Infographic

jobdiv.com

jobdiv.com