Asset managers make strategic investment decisions to maximize portfolio returns, while fund administrators handle the operational and compliance aspects of funds, including record-keeping and reporting. The asset manager's role centers on market analysis, security selection, and risk management, whereas the fund administrator ensures accurate valuation, investor communication, and regulatory adherence. Choosing a skilled asset manager combined with a reliable fund administrator is critical for achieving investment goals and maintaining regulatory compliance.

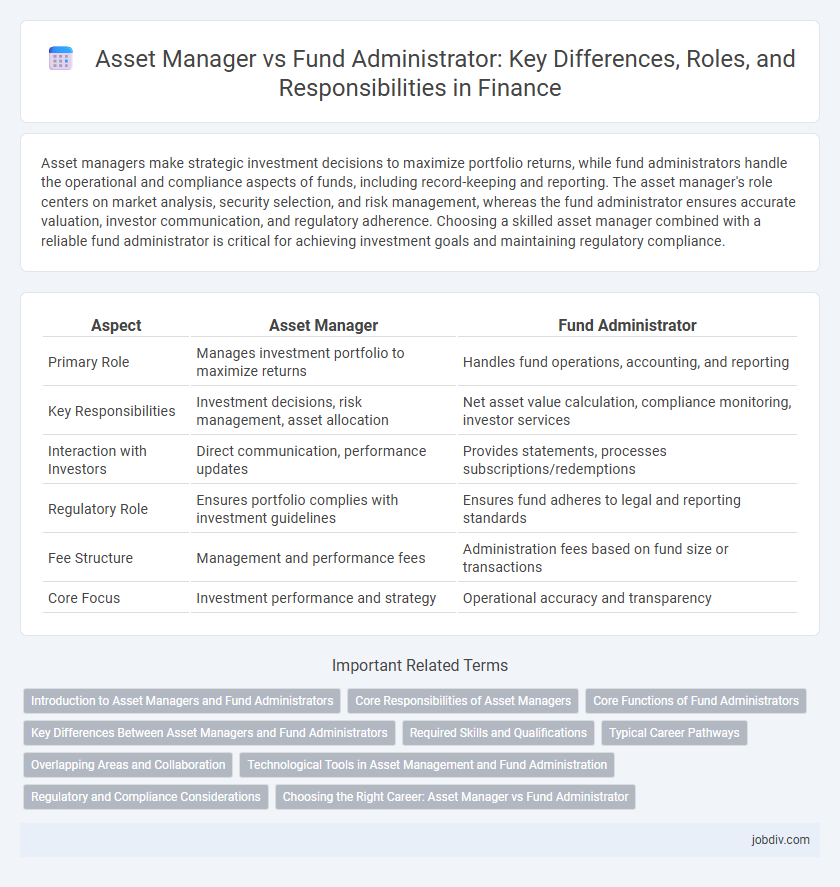

Table of Comparison

| Aspect | Asset Manager | Fund Administrator |

|---|---|---|

| Primary Role | Manages investment portfolio to maximize returns | Handles fund operations, accounting, and reporting |

| Key Responsibilities | Investment decisions, risk management, asset allocation | Net asset value calculation, compliance monitoring, investor services |

| Interaction with Investors | Direct communication, performance updates | Provides statements, processes subscriptions/redemptions |

| Regulatory Role | Ensures portfolio complies with investment guidelines | Ensures fund adheres to legal and reporting standards |

| Fee Structure | Management and performance fees | Administration fees based on fund size or transactions |

| Core Focus | Investment performance and strategy | Operational accuracy and transparency |

Introduction to Asset Managers and Fund Administrators

Asset managers oversee investment portfolios, making strategic decisions to maximize returns based on market analysis and client objectives. Fund administrators handle the back-office operations of investment funds, including accounting, valuation, compliance, and reporting to ensure regulatory adherence and operational efficiency. Both play critical roles in the investment management ecosystem, with asset managers focusing on investment performance and fund administrators on operational integrity.

Core Responsibilities of Asset Managers

Asset managers focus on portfolio construction, investment strategy development, and risk management to maximize returns for clients. They conduct market analysis, select securities, and make buy or sell decisions aligned with client objectives and regulatory compliance. Asset managers also monitor asset performance and adjust allocations to meet evolving market conditions and investment goals.

Core Functions of Fund Administrators

Fund administrators are responsible for critical operational functions such as net asset value (NAV) calculation, investor reporting, and regulatory compliance monitoring. They manage accounting, fund performance tracking, and liquidity management to ensure transparency and accuracy for investors. Unlike asset managers, who focus on investment decisions and portfolio management, fund administrators provide essential back-office support to facilitate smooth fund operations.

Key Differences Between Asset Managers and Fund Administrators

Asset managers focus on making investment decisions, managing portfolios, and achieving returns for clients by selecting and trading assets, while fund administrators provide operational support such as accounting, compliance monitoring, and reporting services. Asset managers are primarily responsible for the strategic growth and risk management of investment funds, whereas fund administrators ensure the accurate valuation, regulatory adherence, and investor communications necessary for fund integrity. The distinction lies in asset managers' active investment role versus fund administrators' critical back-office functions that enable smooth fund operation.

Required Skills and Qualifications

Asset managers require strong analytical skills, expertise in portfolio management, and deep knowledge of market trends to make strategic investment decisions. Fund administrators need proficiency in financial reporting, compliance, and operational processes, along with attention to detail for accurate fund accounting. Both roles demand a solid understanding of regulatory frameworks, but asset managers prioritize investment acumen while fund administrators emphasize operational efficiency.

Typical Career Pathways

Asset managers typically begin their careers in financial analysis or portfolio management, progressing to roles such as senior portfolio manager or chief investment officer. Fund administrators often start as fund accountants or compliance analysts, advancing to positions like fund operations manager or director of fund administration. Both career paths require strong knowledge of financial regulations, risk management, and investment products to succeed in their specialized roles.

Overlapping Areas and Collaboration

Asset managers and fund administrators share overlapping areas such as portfolio valuation, compliance monitoring, and investor reporting, ensuring transparency and accuracy in fund operations. Collaboration between these entities enhances risk management and operational efficiency by streamlining data exchange and regulatory adherence. Effective partnership leverages asset managers' investment expertise alongside fund administrators' operational infrastructure to optimize fund performance and investor satisfaction.

Technological Tools in Asset Management and Fund Administration

Technological tools in asset management enhance portfolio analytics, risk management, and algorithmic trading, leveraging AI and big data to optimize investment decisions. Fund administration relies on advanced software for accurate NAV calculation, compliance monitoring, and investor reporting, ensuring regulatory adherence and operational efficiency. Both functions increasingly integrate blockchain and cloud computing to improve transparency, data security, and real-time processing.

Regulatory and Compliance Considerations

Asset managers are primarily responsible for investment decisions and ensuring portfolio compliance with regulatory frameworks such as the SEC and MiFID II. Fund administrators manage operational compliance, including NAV calculations, investor reporting, and ensuring adherence to anti-money laundering (AML) regulations and the AIFMD reporting requirements. Both roles require rigorous regulatory oversight, but asset managers focus on investment compliance while fund administrators emphasize fund operational and investor regulatory obligations.

Choosing the Right Career: Asset Manager vs Fund Administrator

Asset managers focus on investment strategies, portfolio management, and client relationship building, making it ideal for professionals interested in market analysis and decision-making. Fund administrators specialize in compliance, reporting, and operational accuracy, offering a career path suited for detail-oriented individuals with strong organizational skills. Choosing between these roles depends on whether one prefers dynamic investment decisions or structured administrative processes within the finance industry.

Asset Manager vs Fund Administrator Infographic

jobdiv.com

jobdiv.com