FP&A focuses on forward-looking financial planning, budgeting, and forecasting to support strategic decision-making and business growth, while controllership emphasizes accurate financial reporting, compliance, and internal controls to ensure fiscal integrity. FP&A professionals analyze trends and financial models to guide management on optimal resource allocation, whereas controllers oversee accounting operations and regulatory adherence. Both functions are critical for organizational financial health but serve distinct roles in managing performance and safeguarding assets.

Table of Comparison

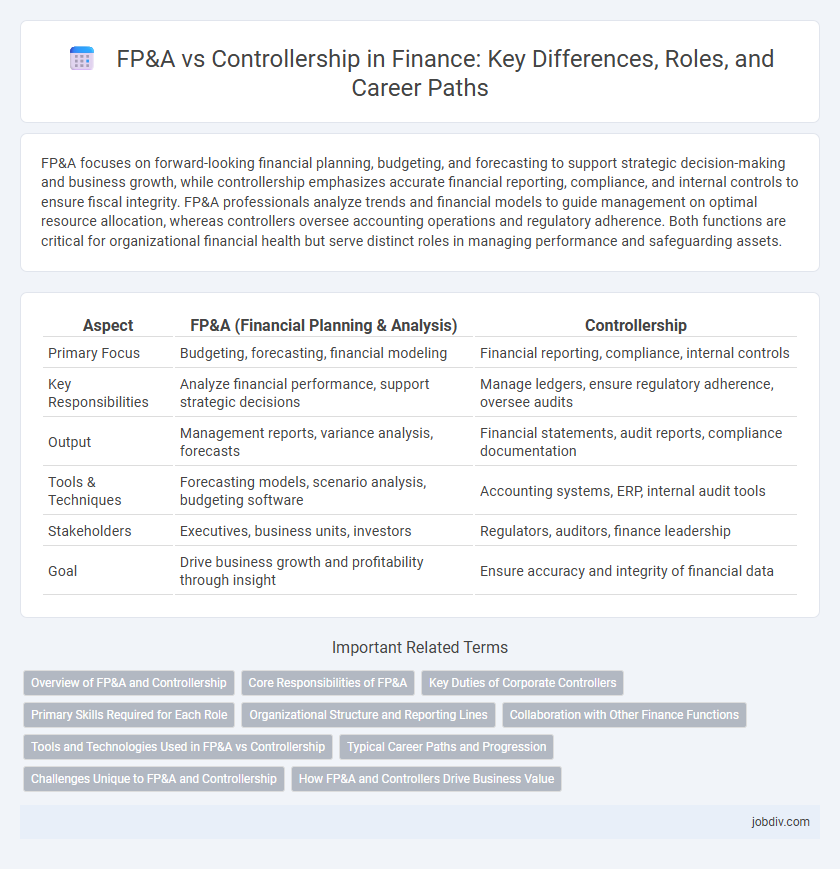

| Aspect | FP&A (Financial Planning & Analysis) | Controllership |

|---|---|---|

| Primary Focus | Budgeting, forecasting, financial modeling | Financial reporting, compliance, internal controls |

| Key Responsibilities | Analyze financial performance, support strategic decisions | Manage ledgers, ensure regulatory adherence, oversee audits |

| Output | Management reports, variance analysis, forecasts | Financial statements, audit reports, compliance documentation |

| Tools & Techniques | Forecasting models, scenario analysis, budgeting software | Accounting systems, ERP, internal audit tools |

| Stakeholders | Executives, business units, investors | Regulators, auditors, finance leadership |

| Goal | Drive business growth and profitability through insight | Ensure accuracy and integrity of financial data |

Overview of FP&A and Controllership

FP&A (Financial Planning and Analysis) focuses on budgeting, forecasting, and strategic financial modeling to support decision-making and growth initiatives. Controllership centers on financial reporting, compliance, and internal controls to ensure accuracy and integrity in accounting processes. Both functions play crucial roles in maintaining financial health, with FP&A driving forward-looking insights and Controllership managing historical accuracy.

Core Responsibilities of FP&A

Financial Planning & Analysis (FP&A) primarily focuses on forecasting, budgeting, and analyzing financial performance to support strategic decision-making. Core responsibilities include variance analysis, financial modeling, and identifying trends to optimize resource allocation and drive business growth. FP&A teams collaborate closely with management to provide actionable insights that enhance profitability and long-term planning.

Key Duties of Corporate Controllers

Corporate Controllers oversee financial reporting accuracy, ensuring compliance with accounting standards and internal controls. They manage month-end close processes, balance sheet reconciliations, and financial statement preparation to provide reliable data for stakeholders. Controllers also coordinate audits and enforce corporate governance policies to mitigate risks and maintain fiscal integrity.

Primary Skills Required for Each Role

FP&A professionals require strong financial modeling, forecasting, and strategic analysis skills to drive business planning and decision-making. Controllership demands expertise in accounting principles, regulatory compliance, internal controls, and financial reporting accuracy. Both roles benefit from advanced proficiency in ERP systems and data analytics tools for effective financial management.

Organizational Structure and Reporting Lines

In finance, FP&A (Financial Planning & Analysis) typically operates under the CFO with a focus on forecasting, budgeting, and strategic analysis, driving decision-making processes. Controllership, often positioned within the finance department but distinct from FP&A, is responsible for accounting, compliance, and financial reporting, ensuring accuracy and adherence to regulations. Organizationally, FP&A functions as a forward-looking advisory unit, while controllership maintains historical financial integrity, each reporting through separate but complementary lines to the CFO.

Collaboration with Other Finance Functions

Collaboration between FP&A and Controllership is essential for accurate budgeting, forecasting, and financial reporting, ensuring alignment of financial strategy with operational execution. FP&A provides forward-looking analysis and scenario planning, while Controllership guarantees compliance, internal controls, and timely recordkeeping. This synergy enhances decision-making efficiency and drives better financial performance across the organization.

Tools and Technologies Used in FP&A vs Controllership

FP&A professionals leverage advanced predictive analytics, AI-driven planning software like Adaptive Insights, and real-time data visualization tools to enhance budgeting and forecasting accuracy. Controllership relies heavily on ERP systems such as SAP and Oracle, alongside compliance-focused financial consolidation and reporting solutions to ensure regulatory adherence and internal controls. Both domains increasingly integrate cloud-based platforms to improve data accessibility, collaboration, and streamline financial close processes.

Typical Career Paths and Progression

FP&A professionals typically advance from financial analysts to senior analysts, FP&A managers, and ultimately finance directors or VPs of finance, emphasizing strategic planning and forecasting skills. Controllership career paths often start as accounting staff or junior controllers, progressing to senior controller roles and then to controller or chief accounting officer positions, with a strong focus on compliance and financial reporting. Both tracks offer opportunities to transition into CFO roles, but FP&A emphasizes forward-looking decision support while controllership centers on accurate financial stewardship.

Challenges Unique to FP&A and Controllership

FP&A faces challenges such as accurately forecasting in volatile markets and integrating complex data analytics to support strategic decision-making. Controllership uniquely struggles with maintaining compliance across evolving regulatory frameworks and ensuring robust internal controls to prevent financial discrepancies. Both functions must navigate the balance between speed and accuracy while managing cross-departmental collaboration and technology integration.

How FP&A and Controllers Drive Business Value

FP&A teams drive business value by delivering forward-looking financial analysis, budget forecasting, and strategic insights that enable data-driven decision-making and resource optimization. Controllers ensure business value through accurate financial reporting, compliance adherence, and internal controls that safeguard assets and maintain operational integrity. Together, FP&A and Controllership create a comprehensive financial management framework that supports sustainable growth and risk mitigation.

FP&A vs Controllership Infographic

jobdiv.com

jobdiv.com